My view is that we are in a pro-labour political world, and hence unless central banks tighten substantially, inflation will continue to be a problem. It seemed to me that a long gold, short bond (TLT) trade would capture this. If bonds were weak enough, gold would be placid, but if bond yields did not rise enough, then gold would surge. I have been quietly congratulating myself on this trade.

Then the Acid Capitalist, my intellectual nemesis and occasional drinking buddy, Hugh Hendry comes out and tells everyone to buy TLT, I start to get worried. I ask myself the question, is TLT still a short? For those of you not familiar, TLT US is the iShares 20+ Year Treasury Bond ETF. There are two reasons I think TLT is a short. One is that I think interest rates are going to keep rising, and the second there is a liquidity mismatch between TLT and its underlying that will prove a problem at some point. Lets start with the first point. TLT does exactly what it says on the tin - it tracks the performance of bonds with a maturity of 20 years or more. Its a pretty concentrated fund, with the top 10 positions making up well over 50% of the fund.

TLT also does a great job of tracking the performance of long dated bonds - I have taken the 9th largest holding, and tracked is performance against a rebased TLT - and they are identical. The reason that both TLT and 8/44 Treasury is trading below 100 is that the current yield on 30 yield on 30 year treasuries is 3.6%

The iShares website provide a good overview of the details of the TLT, updated on a daily basis. I provide a snapshot below. The key to why TLT is a short for me is that TLT does not hold is bonds to maturity. It sells the bonds at they get closer and closer to a 20 year maturity. What this means is that yield to maturity for the TLT is meaningless. For me the key issues is that it has a low weighted average coupon at 2.45. The lower the coupon, the more likely you are to lose capital on rising interest rates.

The risk owners of TLT run is that 30 year bonds yields rise another 2%, leaving you with a 30% capital loss, that 10 years of 2.45 coupons will not help you with (and with no pull to par).

The buy case for TLT revolves around the inversion of the yield curve, which has since 1980 marked the top of the Fed hiking cycle. In my view, the longer and deeper this inversion goes, the more it makes this cycle look like a 1970s inflation cycle, rather than disinflation cycle we are used to.

My second problem is that TLT is now too big to exit its positions during periods of stress. As we saw with gilts, the clearinghouse system has a way of reinforcing shocks, by asking for more collateral and causing fire sale sell offs.

When Covid struck, the treasury market became particularly illiquid. This fed into a record NAV volatility for TLT. That is the value of TLT moved away from its NAV.

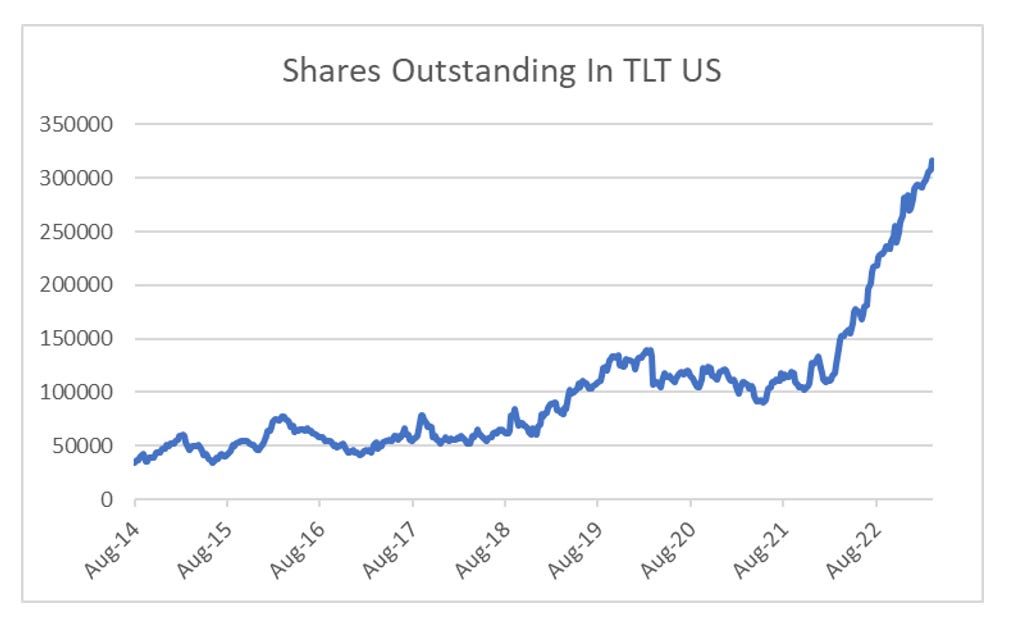

TLT now has 3 times as many shares outstanding than when Covid hit. And this illiquidity occurred during a bond rally, and with deflation pressures at a maximum. How will TLT act in a large inflationary scare, with the Federal Reserve selling treasuries?

TLT largest position is 1.8 2/51 Treasury. Blackrock is the second largest owner after the Federal Reserve. Vanguard is the third largest and Japanese GPIF is 4th largest. Easy to see an environment where all 4 are sellers.

TLT could be a trade, but I think it is still a short.