IS THE TECH BULL MARKET DRIVING THE DOLLAR?

Most macro models would predict significant dollar weakness, which has failed to materialise. Perhaps the tech cycle is also a macro variable?

I first took an interest in currency markets during the Asian Financial Crisis. My first observation at the time was that governments and central banks seem to have little control over their exchange rates. Japan constantly tried to weaken its exchange rate and failed. Asian nations tried to maintain pegs to the dollar and failed. The Swiss tried to peg to the Euro and failed. The overwhelming impression was that private capital flows would overwhelm official actions. The twin deficit model, which shows the direction of the US fiscal and current account deficits would imply much greater dollar weakness than we have seen.

Historically we have also come to expect commodity strength to be associated with dollar weakness. This relationship has also broken down.

This unusual scenario of US dollar strength and commodity strength has bled into very unusual macro data. Australia has very rarely run a trade surplus, as usually the Australian dollar adjusts higher to improving commodity prices. However this has not happened this time.

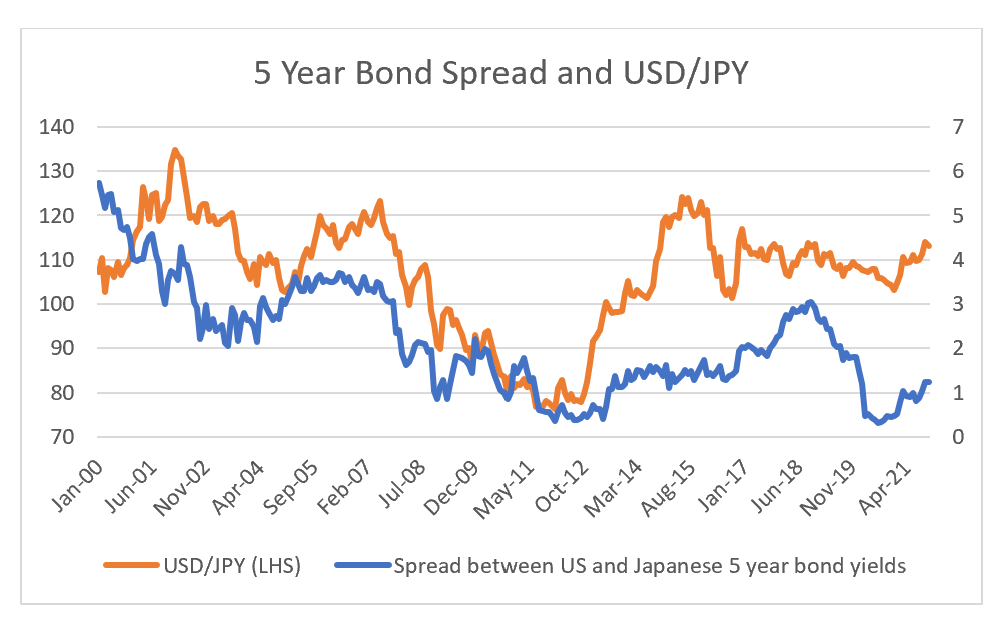

The breakdown in commodity currencies correlation to commodities adds to the breakdown in safe haven currencies reaction to bond yields. The Yen used to move closely with movements in the spread between US and Japanese bond yields. But over the last few years, this relationship has also largely broken down.

So if twin deficits, commodities and bond yields have no effect on currencies anymore, what does? One idea I have is that the bursting of the dot com bubble just happened to coincide with the beginning of a commodity super cycle. That is dollar weakness had far more to do with the bear market in tech, than a bull market in commodities and emerging markets. Its an intriguing idea. One tech sector that is data rich and homogenous across regions is semiconductors. Using data from www.semiconductor.org we can get an idea of changes in the industry as well as regionally. Just looking at sales by region, we can see that Americas has grown sales dramatically since 2010, while Europe and Japan has lagged, in line with equity market performance.

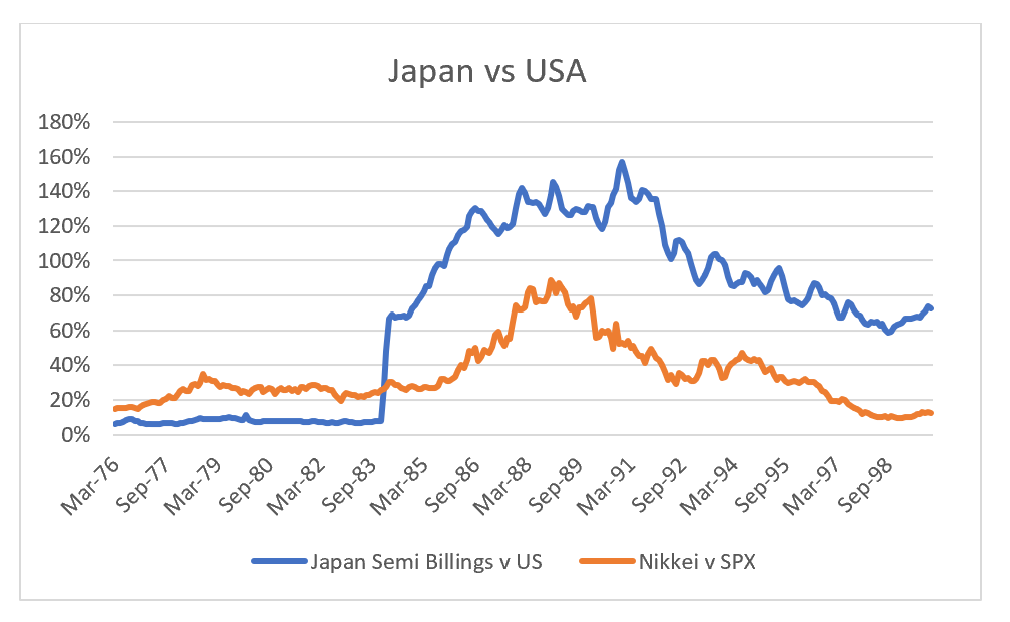

Perhaps more interesting is that Japan began to grow its semiconductor industry in 1980s, and had greater sales than the US for a few years. This coincided with significant outperformance of the Nikkei versus the US.

Asia is now by far the biggest semiconductor market in the world, and China the largest single market. However in contrast to Japan of the 1980s which used indigenous chips, most of China’s semiconductors are made by US companies with facilities in Asia. The below information is taken from the 2021 Semiconductor Industry Association Factbook.

There is something intuitively correct about the leading market in semiconductors also having the leading equity market. Unlike most products, humans continue to consume more semiconductors per capita, a process that is likely to continue with the electric vehicle revolution. In fact the big delta in the semiconductor industry is pricing not volume. Using TSMC quarterly results, we can see that TSMC always grows volume, but from 2001 to 2011 saw falling pricing, and has seen rising pricing since then.

The implication is that a tech bull market drives capital flows to the leading technological nation, which was Japan in the 1980s, and the US in 1990s and now. The first part of the analysis seems to imply that tech driven flows are impervious to changes in commodity prices, fiscal deficits and current account deficits. If that is the case, then macro investors need to also become tech investors.

This implies that if the tech bull market is over for some reason, the Dollar would need to weaken.

What is your opinion on the share of semi contribution to a tech bull market. I mean we have seen a bull market pretty much since more than a decade, and it was mostly led by tech companies, but not only by those were involved in the semi industry or manufacturing of tech supplements of any kind.

Lastly, do you think there is any chance of the tech bull market being in the late cycle or at an inflection point of being soon over?

Appreciate your great work.

Interesting observation.