Is Bitcoin a buy here? The first things we should note about Bitcoin is that it has traded much more like a speculative asset, than a sure-fire store of wealth. Bitcoin has been incredibly lucrative for early investors. That being said, bitcoin has not reached some of the more aggressive price targets that would put around. Most, but not all, price targets for bitcoin use some version of the stock/flow model popularised by Plan B (@100trillionUSD). In simple terms its compares market value of assets of flow versus stock. Essentially, the less flow, the more value, and as Bitcoin reduces flow over time, its value must rise. Using Plan B models, you get a target of USD700,000 to USD800,000 for bitcoin in 2024 - which would give a market value of USD17 trillion.

If your base case is that bitcoin is going to USD 700,000, then the optimal investment strategy is to buy and hold (hodl). From a technical point of view, bitcoin looks very interesting at the 20 week moving average is nearing the current spot price, making the possibility that we could be near a trend change.

However, for me the behaviour of bitcoin over the last few years indicates it trades at least in the short term as a speculative asset. In that case, you want to look for when speculative long positions have been liquidated, and short positions have been added to make for the optimal entry point. CME provides a history of net positioning in bitcoin. Net positioning was very negative in May of 2020, before a phenomenal rally. Today it is flat.

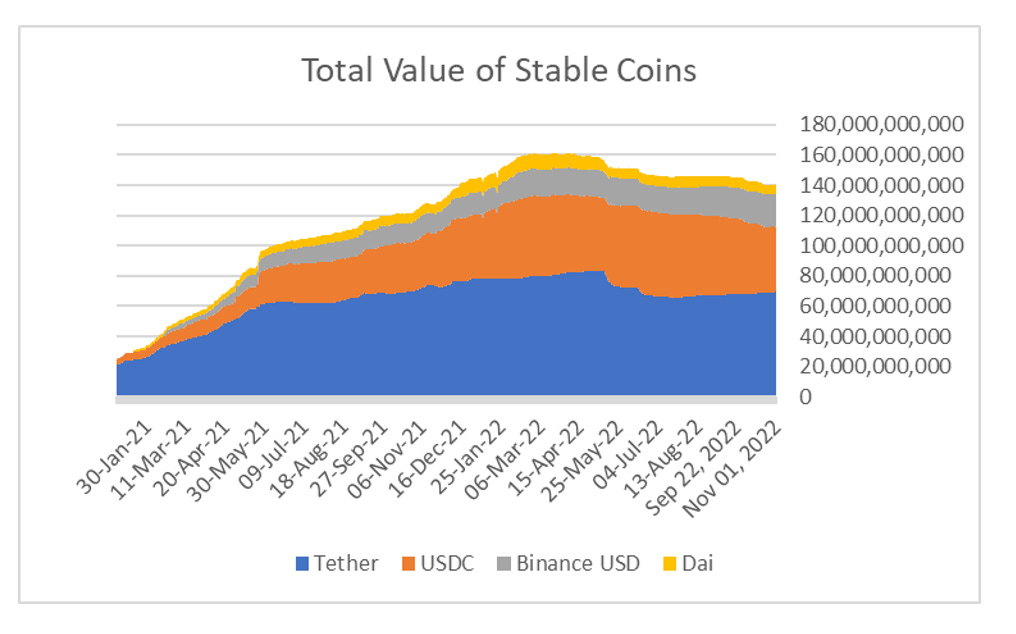

Again, looking at bitcoin as a purely speculative asset, there has been a relationship between inflows into stablecoins and bitcoin. In my view, rising market capitalisation of stable coins is sign of asset flows into the cryptospace (Converting fiat to a stable coin will increase a stablecoin market value). Tether used to dominate the stablecoin space, and we can see that inflows into tether began in early 2020, BEFORE bitcoin rallied substantially.

Unfortunately, there are many more stablecoins these days and tether has been hit by some outflows for various reasons, so we need to look at total stablecoin inflows. We have yet to see a meaningful turn in stablecoin flows.

Ultimately, bitcoin and crypto seem to be children of the pro-capital environment that has existed in the US, particularly since the dot com bubble (that is using rising assets to promote growth - the wealth effect). My view is that politics is moving pro-labour and anti-speculation. Bitcoin looks tempting, but without more negative positioning, it looks like a trap to me.