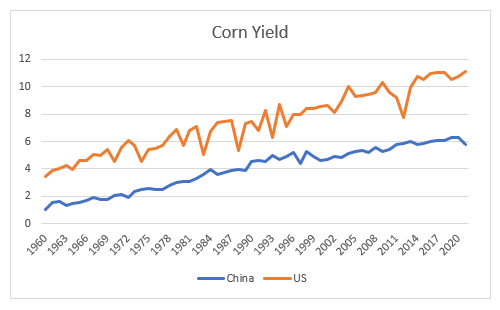

From a purely economic perspective, food inflation should be cyclical. The most obvious reason for this is that demand for food should be relatively stable. Humans tend to eat better food as they get richer, but they do not need more calories. In some richer economies, per capita consumption of meat is falling, which actually implies falling demand on a total grain usage basis. The other factor pointing towards food inflation being cyclical rather than secular is the ongoing increases we see in yield on food production.

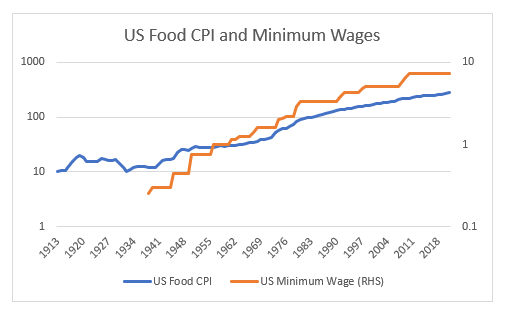

When we look at US Food CPI (we use a log scale, so we can see the scale of change at the beginning of the index) we can see that from 1913 through to 1947 or so food inflation was definitely cyclical. But post-World War II food inflation stabilised before taking off in the 1970s, before stabilising again in from 1990s onwards. My working assumption has been that food inflation and wage inflation are highly correlated, but I am unsure which way causation flows. Looking at the US Federal Minimum wage on a log scale matches US food inflation fairly closely.

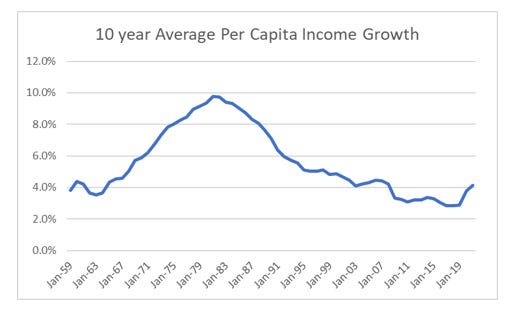

Or to put it another way, when average incomes are growing fast, then price for food can also grow quickly. The corollary of this argument is that suppressing income growth will control inflation. Looking at US average per capita income growth, it matches closely with what you would expect. It is also noticeable that the 10 year average income growth has picked up considerably recently.

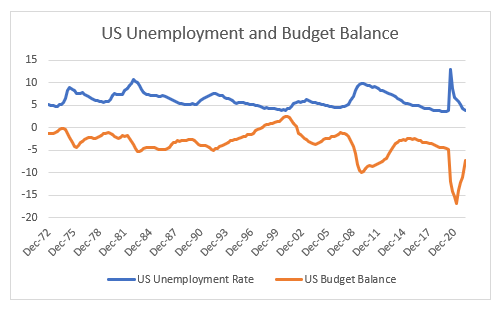

Here is where the argument of whether inflation is cyclical or secular moves away from dry economic analysis to one of political analysis. The question is what do governments need to do to win and maintain power? Both Trump and Biden have focused on government spending policies.

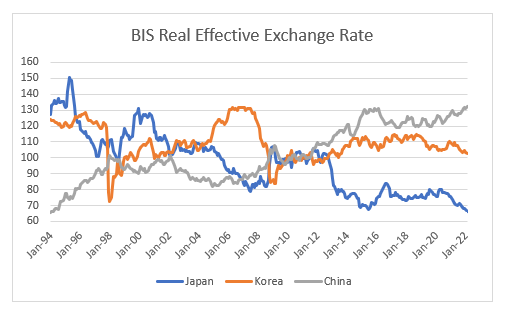

China has already moved to a policy of focusing on rising labour share of GDP, which has involved increasing regulation of big tech, and a focus on high cost of living. It has also led to a big change in currency markets. I had expected China to be similar to Japan and Korea, where the government would seek to devalue the currency to create inflation to reduce levels of debt, and restore export competitiveness. Instead on a BIS Real Effective Exchange Rate Basis it has remained at an “expensive” level far longer than either Japan or Korea ever managed.

UK and US politics are tricky beasts to analyse. But China is perhaps a little easier. Why? Well as long as China chooses to pursue a strong currency policy, its sending a clear signal that it is choosing pro-labour policies. Given it position as the biggest food producer and food consumer this should continue to lead to rising food prices, and I suspect put Western governments under severe pressure to pursue pro-labour policies. The “good news” about this analysis is that if the Chinese Yuan begins to weaken, then we know this theory is busted, but I would suggest as long as the Yuan stays strong, we will see inflation, and upward pressure on bond yields.