The US auto industry and politics have been intertwined for nearly over 80 years. The Big Three Auto in the US was at the centre of FDR’s push for labour power in 1936. When FDR refused to break a strike at a Ford factory in Michigan, the signal of political support for labour over capital was unmistakeable. Previously all other Presidents had intervened on behalf of the company, and this set the stage for the big three to be unionised.

In 1953, Charlie Wilson, President of General Motors, was nominated to be Secretary of Defence by Eisenhower, and in his confirmation hearing he was asked if he would be conflicted in his new role replied, “For years I have thought what was good for our country is good for General Motors and vice versa”, or more widely remembered as what is good for General Motors is good for the United States. The unionisation of the car industry stabilised the industry which during the Great Depression saw demand and pricing collapse. Prices remained stable in 1950s and 1960s before inflation saw new car prices surge. The question is does the recent surge in new car CPI hail a new political era?

Before we look at what the future holds, let us understand how the pro-labour policies of FDR were unwound. The inflationary 1970s led to move away from protecting labour, and allowing consumers to buy from the cheapest producer available. This in particular helped the Japanese producers who exported from Japan and built a number of factories in the South that were not unionised. The Big Three with their unionised workforces could not compete, and saw market share collapse.

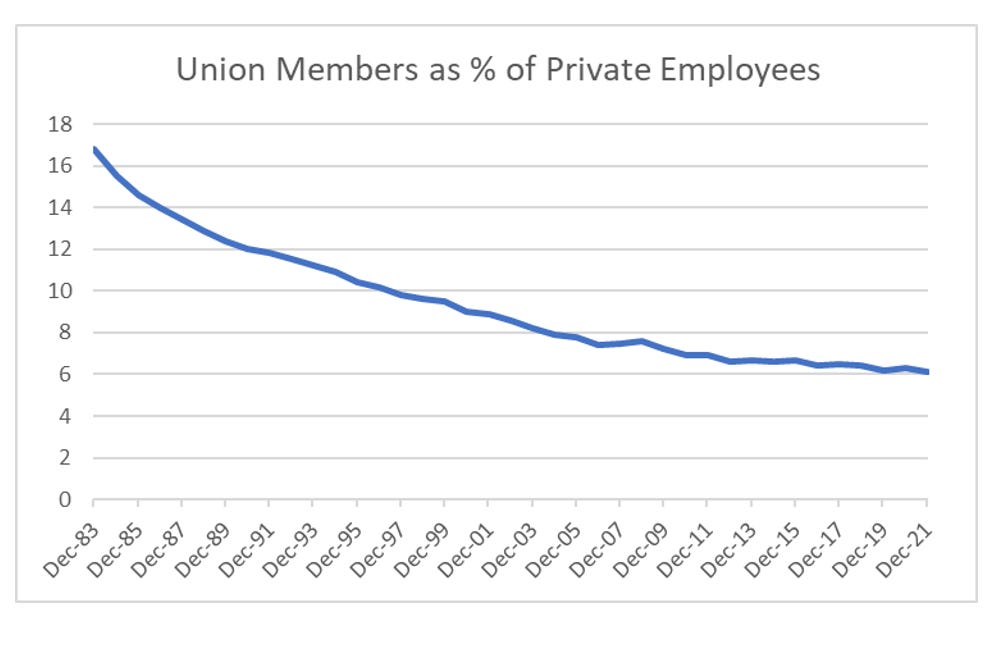

This collapsing market share of the Big 3 has also underpinned an ever declining unionisation rates in the US, which was the likely aim of favouring international producers over domestic producers. A glass half full person sees free trade as being pro-consumer. A glass half empty person sees free trade as being anti-labour. Both are broadly correct.

However, the US lost its long held title of being largest car market in the world to China back in 2009. If autos are a guide to inflation, then what is Chinese policy on auto inflation and on wage inflation in general?

From a pure market economic standpoint, Chinese auto sales peaked in 2017, and since then the industry has been operating on a declining utilisation rate, which would imply that we should see deflation in the auto industry.

In 2019 the Chinese Government acted to curb excess capacity in the auto industry, essentially making it impossible to open a new internal combustion engine factory (electric vehicle factories are still encouraged). The question is whether this increased government intervention is leading to rising car prices like it did in the 1970s in the US. Unfortunately, the Chinese car is not entirely transparent on car pricing. Large Chinese auto makers often control multiple brands, sometimes directly, sometimes as subsidiaries. The cleanest set of numbers I can find are from Great Wall Motors (GWM), a maker of SUVs. Using annual numbers we can see average selling price (ASP) and operating profit per unit. The numbers from 2021 show a jump in ASP, but falling operating profit implying that cost inflation and probably wage inflation is taking hold at least for GWM. To be honest, I am not totally happy with this metric, but it does tally up with other industries that I do have good data for, such as steel and cement, where government policy has had a decidedly FDR style ”inflation creation” bent.

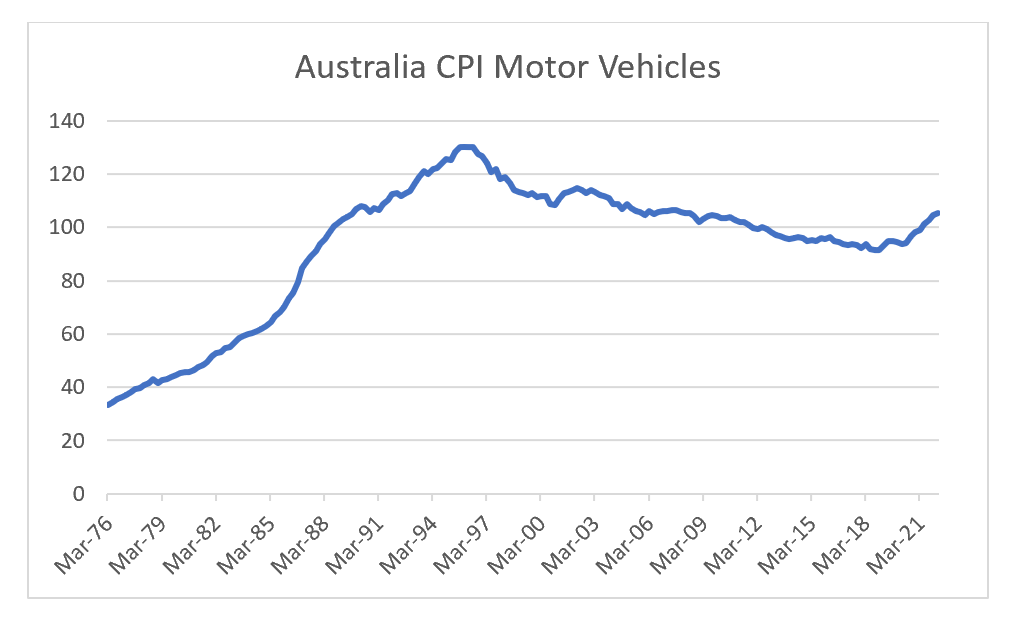

That leaves one last question. Will China export auto inflation to the rest of the world? One market where GWM has an reasonable export presence is Australia. Australia is also noteworthy in that is has no domestic auto factories (the last one closed in 2017) and is entirely dependent on imports. For the first time in 25 years, Australian motor vehicle CPI is turning higher. It should be noted that Japanese car maker are the dominant car companies in Australia.

I originally thought food inflation would be the key product by which China would export its pro-inflation policies, but now it is beginning to look like autos could also be a key transmission area.