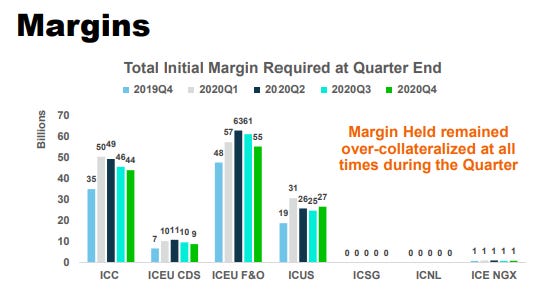

As picked up by Robin Wigglesworth at FT Alphaville, @mechmarkets on Twitter highlighted that Chris Edmonds, the Global Head of Clearing & Risk at Intercontinental Exchange (ICE), was in a position to put a major financial institution into default in March 2020, but chose not to. The CFTC have the YouTube video up, and you can find the link via @mechmarkets . So can we use ICE regulatory disclosure to shed anymore light on this event? ICE manage seven different clearinghouses. As a general rule, the more initial margin at a clearinghouse, the more important it is. Using ICE data, only the ICE Clear Credit (ICC), ICE Clear Europe (ICEU CDS and Futures & Options) and ICE Clear US would be big enough to be a problem.

Financial trouble would be caused by the clearinghouse two ways. Firstly, asking for a large increase in initial margins. If this was the case, then ICC will be the place to look. It had by far the largest increase in initial margin in Q1 2020.

The other way you can get a big problem is that if the market is bifurcated, and requires huge payments from one set of investors to another. This creates outsized variation margin flows. In this case, we should look at ICUO F&O or ICUS.

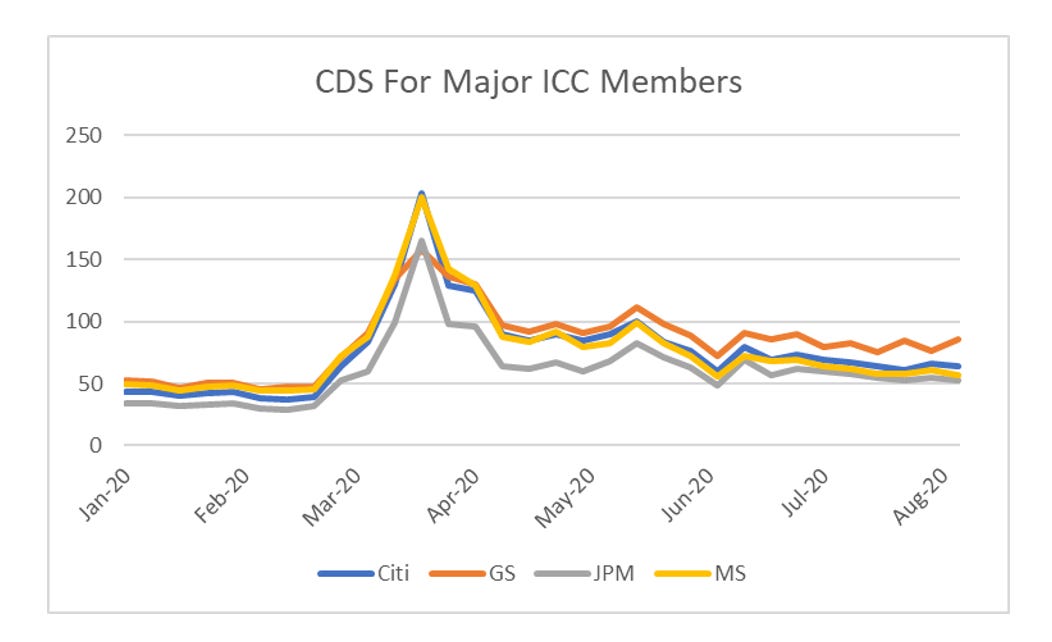

What stands out to me is the very large increase in initial margin relative to the change in variation margin that occurred at ICC. A big shift in initial margin occurs when a good credit it suddenly perceived as bad. All the other ICE clearinghouses saw increases in initial margin as levels lower than the increase in variation margin. Focusing on ICC makes life much easier to work out who would be in trouble. ICC members are made up exclusively of large banks, and as Chris Edmonds states the potential defaulters is in the room, narrows the suspects down to Citi, Goldman Sachs, JP Morgan and Morgan Stanley. ICC seems very likely to be the right place to look, as the Federal Reserves intervention into credit markets allowed this market to rally quickly, and would have allowed any bank that was facing a huge margin call, to get out of trouble. The CDS of these four main banks show exactly how quick the reversal was in 2020. I should point out that which bank was in trouble is a mute point - if any of these banks defaulted, they all would have been in trouble.

What LME and now this disclosure from ICE highlight, is that the clearinghouses will and do bend the rules for their large clients, the banks. The clearinghouse system has mutualised risk, while at the same time placing glorified civil servants at the centre of market pricing. The stated aim of the clearinghouse reform was to make sure no bank was “too big to fail". The end result is that clearinghouses ensure with ad hoc rule changes, “no bank can fail”. Perhaps the real aim of regulatory reform is to remove the power of banks to force another bank into default.

Share this post