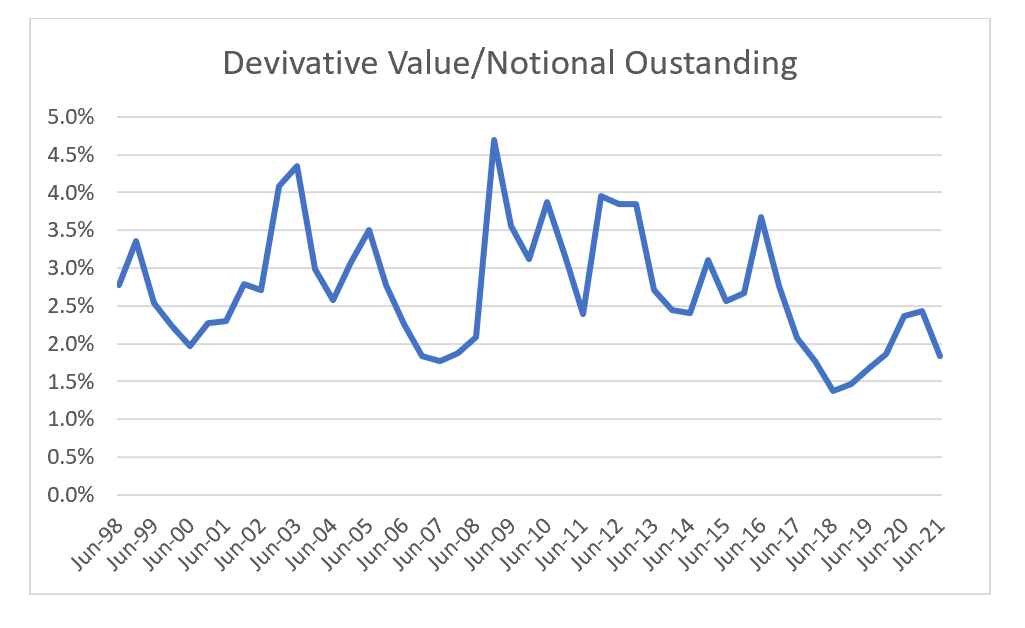

Initial margins are in financial terms very similar to option premiums. The more volatility in the market, the more margin there should be. Using BIS data we can track the notional interest rate derivative value outstanding, and the gross value of those derivatives, gives us something resembling implied volatility. As you would expect in a bull market, the premium value is only 2% of notional, and in a bear market rises up to 4 or 4.5%. Most recent observation is June 2021 at 1.8%. So this basic analysis suggest at least a doubling of initial margins on a cyclical basis.

The problem with this analysis is that it ignores the changes to the clearinghouse system. As pointed out in a previous post, compression trades now are larger volume at LCH alone than total IRD notional outstanding.