I was recently asked to give a presentation to an investment committee about my long term view on markets. This post is that presentation.

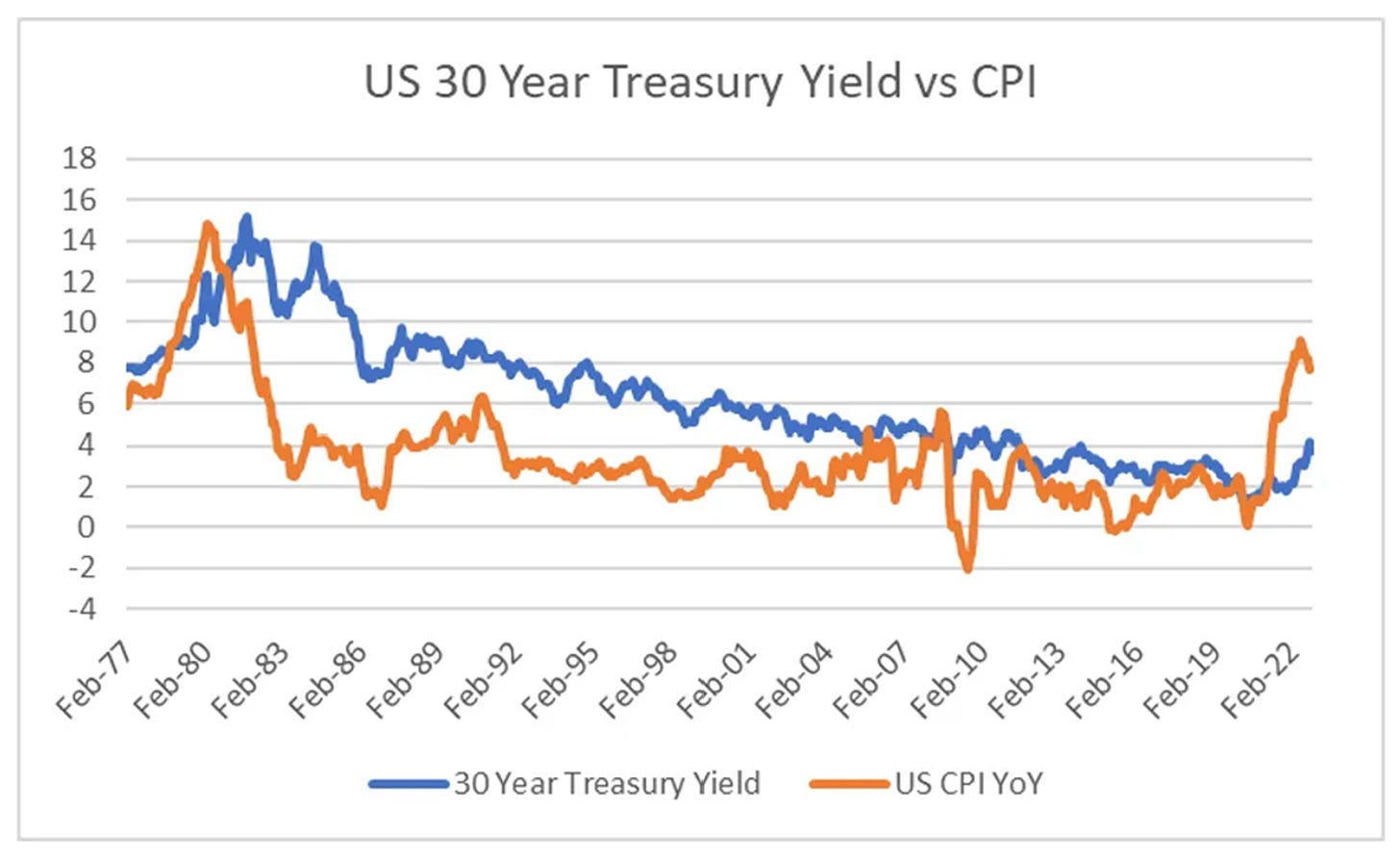

Free market capitalism is the most efficient way to allocate resources. When Thatcher and Reagan were elected all the levers of government move to a pro capital policy, and US inflation collapsed, but long term bond yield lagged well behind inflation for many years. As it was a political change, investors were probably quite worried about a shift back to the left. This meant that bond investors did very well. The corollary of the 1980 is today. We have shifted pro-labour, and inflation is now much higher than expected, but bond investors think we are going to shift back to pro-capital, so are buying bonds at very low yields.

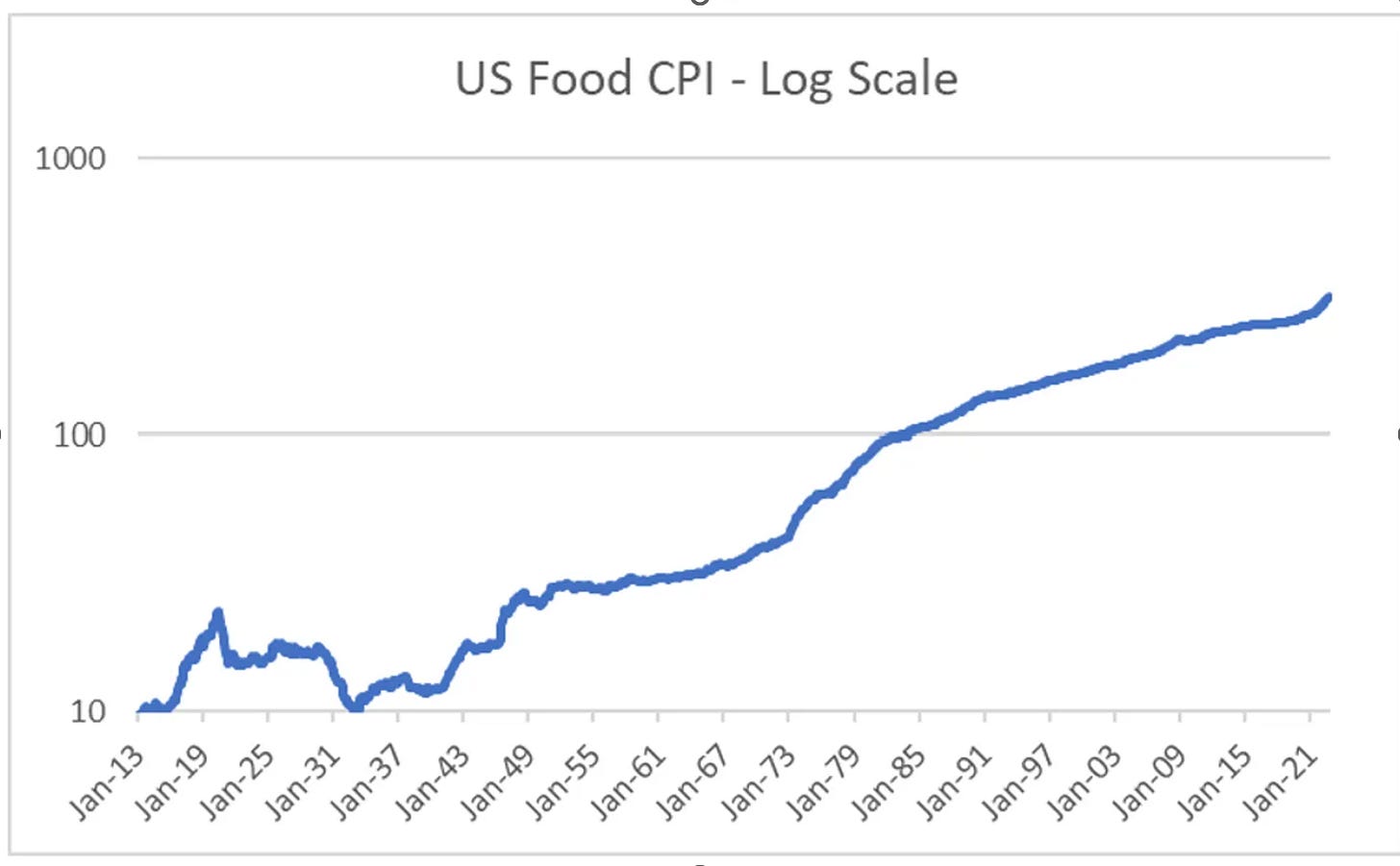

US Food CPI show regime changes more clearly. 1913 to 1939 was classical, where all prices, including wages were allowed to adjust. Then from 1939 we moved to a pro labour environment, focused on rising wages and full employment. 1980 onwards was a shift back to pro-capital. The spike in 2022 show the beginning of pro-labour policies again.

1939 saw FDR bring in a Federal Minimum Wage, which then rose 1000% over 40 years. A very explicit pro-labour policy.

From 1980 today, the Federal minimum wage has risen only 100%. A very explicit pro-capital policy.

Another feature of pro-capital policy is a willingness to devalue the currency. Devaluing favours capital over labour as it basically gives all workers a wage cut. China is pro-labour in my view, as unlike either Japan or Korea, it has maintained its currency at an expensive rate for more than 8 years now. Neither Japan or Korea ever kept their currencies strong for that long.

China has also looked to weaken corporate power and cartels. This can be most clearly seen in its tech sector that has faced strong regulatory oversight. The difference in share price performance to the US is stark.

China moving pro-labour means it has more inflation. This also now means it has higher food prices than the US.

Which now means that China is drawing on world food supplies for the first time. For most of the post WWII period China was an exporter of self sufficient in food. Chinese pork imports were rising before Covid and Ukraine.

Why is this a big deal? Chinese policy change is putting upward pressure on food prices globally. This make pro-capital policies, such as currency devaluation or austerity very unpopular (see Truss government in UK). If current Sunak government continues to push austerity and below inflation pay increases, I suspect it is replaced by a much more left wing government that will pursue pro-labour policies.

Pro-capital policies are deflationary. Greek Bread CPI flatlined for the 10 years, probably for the first time in its modern history after EU led austerity. But with food inflation, austerity is impossible. Other policies need to be implemented.

Other measures of wages show how far they need to rise. Using the US federal minimum wage and the price of a Big Mac, we can see that low end workers have seen real wages collapse. McDonalds, Amazon and Walmart are often signalled out as companies that have full time employees on food stamps. That is they pay below living wage, and rely on the government to keep their workers alive. Politically I see this as unsustainable.

The conclusion is that income growth in the US and the rest of the world has to rise. Looking at US 5 year average income growth, I am reminded of bond yields. Both look to be going higher.

What the end game? Ultimately wage growth drives commodity prices higher, and bond yields higher, and leads to a 1970s outcome.

In a future post, I will talk about how to time this monetise this view. Note, all of this is political based, so I reserve the right to change my view if politics change, but that being said, it looks pretty right to me.