In recent posts, I have been talking about the private equitization of stock markets. It explains the huge surge in valuations for many stocks, and the changed behaviour we see large parts of markets and macro data (posts explaining this are here, here and here). The good news is that the world has changed, but most investors are unaware of this change, which leaves us with the opportunity to exploit this backward looking bias. First of all, we have to acknowledge that many of the causes of previous bear markets seem to have disappeared. That old favourite, yield curve inversion has smoked bearish investors.

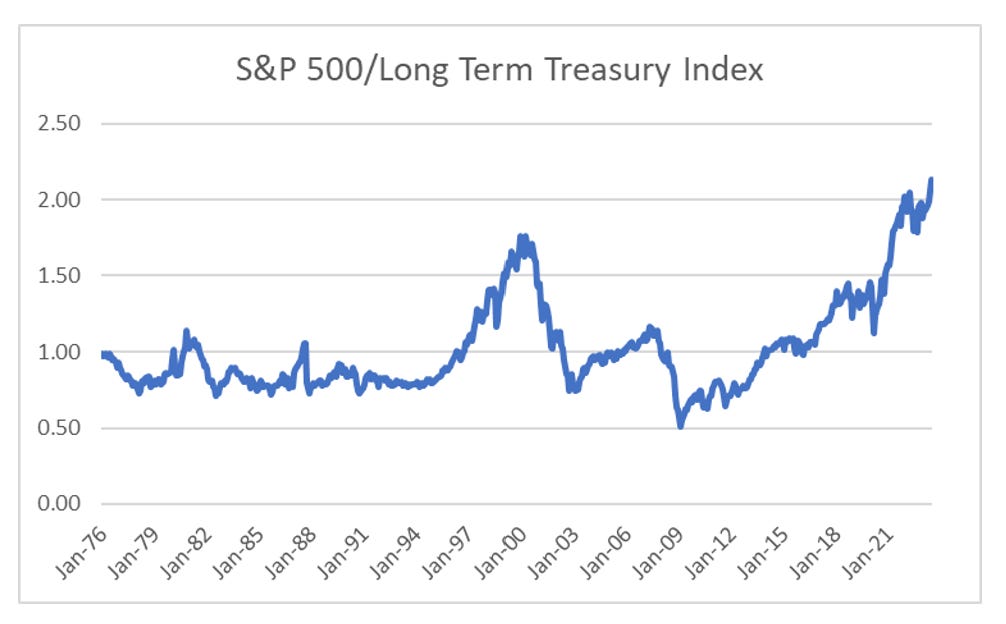

The way I looked at it, when the yield curve inverted, you wanted to be short S&P 500 and long treasuries. We can use a long term treasury return index to show how well that worked historically, and how bad it has been recently. The dot com bubble took out a lot of bearish investors - but what we have today is far in excess of that.

Unlike the dot com bubble, this is a very US centric bubble, although perhaps Japan is joining the party these days, I think we can look back at the excesses in 2000, 2007 and today in a coherent narrative, that at least gives us an idea of if and when this move will end.