As there is a lot of interest in how clearinghouse work, let me explain in more detail how they price risk. The key point I have been trying to make in my series on clearinghouses is that by moving clearinghouses to the centre of the financial system they misprice risk. with the emphasis on pricing risk on a backward looking basis, rather than a forward looking basis. Bankruptcy tends to happen suddenly in a clearinghouse centre financial system.

To understand how clearinghouses price risk, we now have four overnight bankruptcies/market stresses we can look at. We are going to use the ISDA Standard Initial Margin Model (SIMM) for a proxy of how clearinghouses price risk before and after. We are also only going to look at two metrics from the ISDA SIMM - risk weight and correlation. With risk weight, lower is less risky. With correlation, higher is “better” as it means that hedging with similar products will allow you to reduce initial margin.

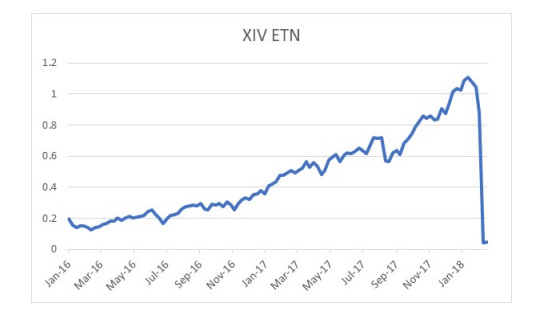

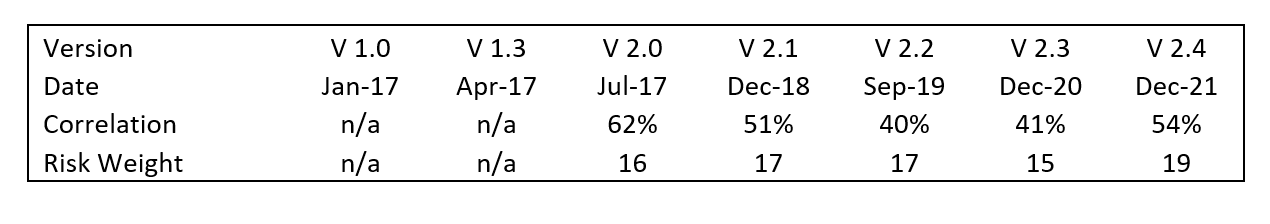

In chronological order, the first one we have in the bankruptcy and liquidation XIV US (the inverse VIX ETF). As a reminder, XIV was essentially bankrupted when VIX doubled overnight. Note that after the XIV blow up, volatility indices saw their correlation offset reduced, and their risk weight increased.

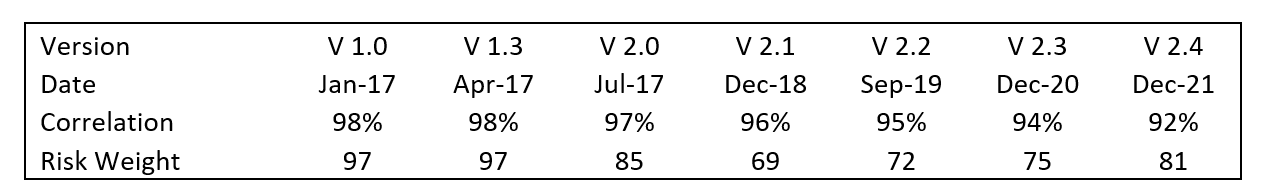

Einar Aas went bankrupt on wrong way spread trade in European power trade. Again note that after Einar Aas was bankrupted correlation for European power was reduced and risk weight was increased

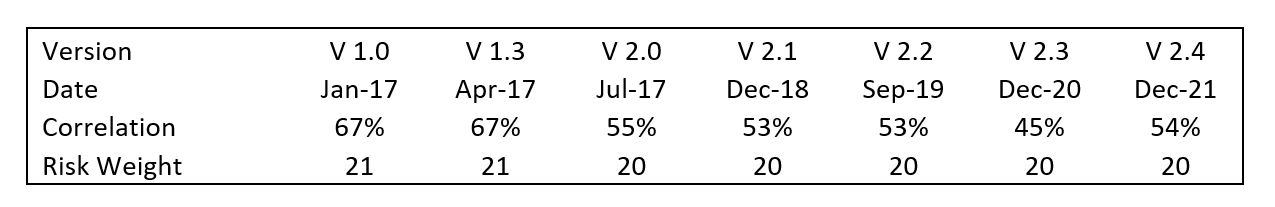

We had the repo rate spike in 2019, which required the Federal Reserve to step into the market. Again we see that after the blow up, correlation offset is reduced and risk weight is increased. You could even wonder if the increase in risk weight in ISDA SIMM V2.2 cause the repo spike? The SIMM was published in early September 2019.

With nickel causing problem today, we will have to wait for the next ISDA SIMM update to see what happens to risk weights in base metals. Correlation will almost certainly reduce and risk weights reduced.

Off the four blows up we have had, all have been contained to some degree (so far). The question we need to ask is that are all four of these episodes tremors before a larger market move, or is this just how the new financial system works, and we need to learn to deal with overnight bankruptcies going forward? Part 2 will try and address this issue.

Share this post