The first stage of my investment process now is political. From where I sit, the Democrats did well in the mid-terms - and so pro labour policies will continue to gain traction. In the UK, the face of the unions, Mike Lynch, continues to win the public relation war, and now has the NHS also going out on strike. To my mind, the politics of austerity is dead and buried, and if the current UK government continue to pursue this policy, they are likely heading for a landslide loss. What does that mean? That wage inflation will continue to be strong, and the central banks will need to pursue much more aggressive interest rate increases to keep inflation check. Ultimately, these policies will fail, but more than likely I expect to see financial assets crushed in real terms, or in simpler terms I expect gold to outperform bonds as it did in the 1970s before we see political change again.

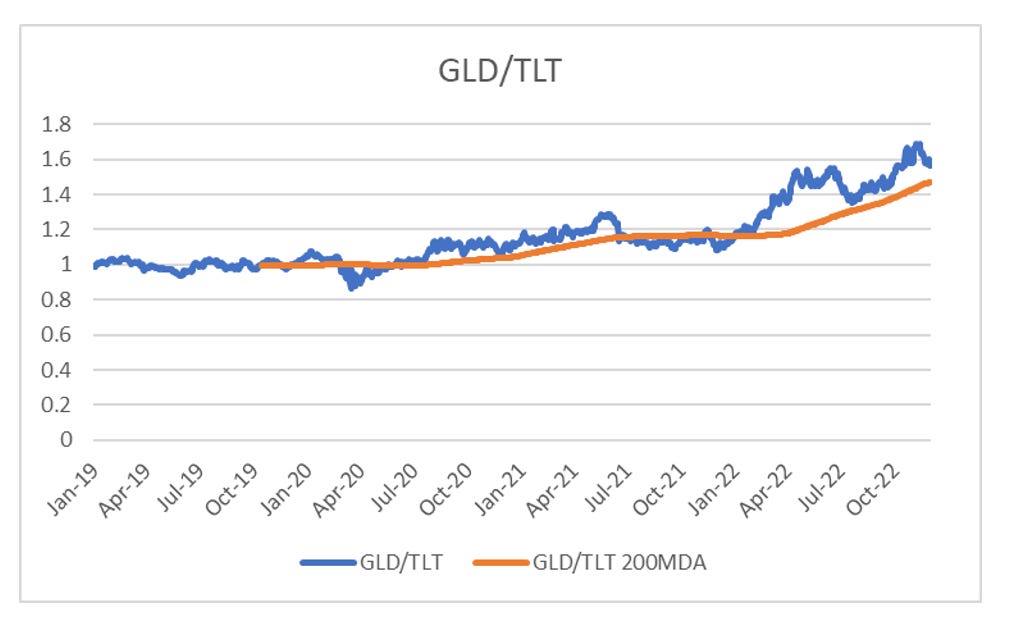

In the last month or so, we have seen a reversal of GLD/TLT. This still looks on trend to me. That is you can either buy GLD or sell TLT here.

The rally in TLT (which is a long-dated treasury ETF) has pushed the yield of the 30-year treasury below that of the 5-year. In my view, the 30-year yield is pulling the 5-year lower. Why buy a 30 year at 3.5% when you can buy a 5 year at 3.7%?

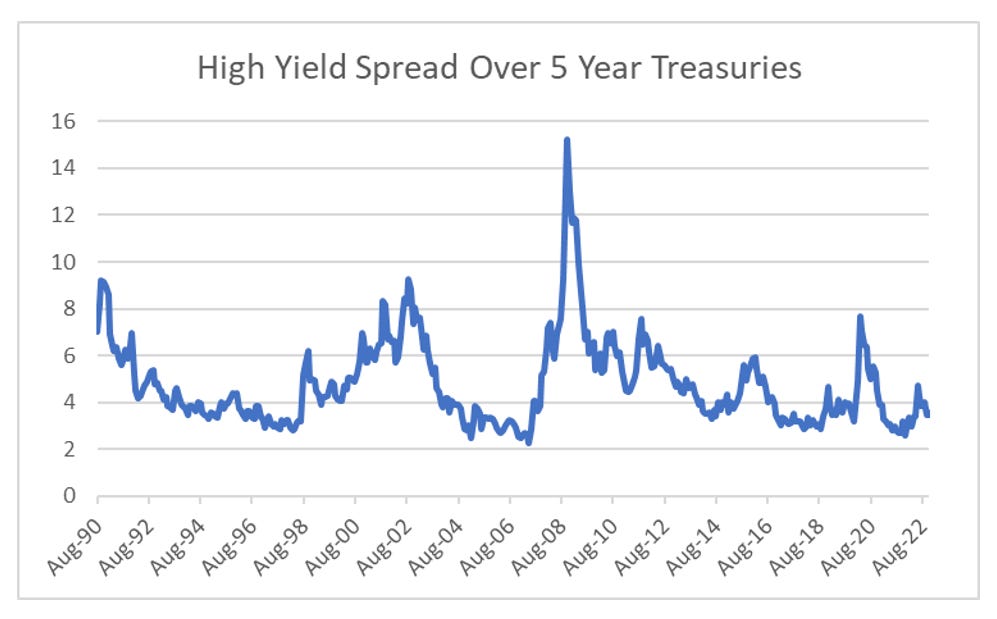

The rally in the 5-year treasury has led to a rally in high yield credit.

All of this has led to the S&P 500 having a nice bounce to recapture 4000.

The rally has been associated with a typical junk bond compression, which have seen the spread of high yield credit over 5-year treasuries from 4.7 in June to 3.4 now. So high yield credit does need further compression to drive more of a rally in the S&P. That is spreads are tight, so if the bond market sold off, high yield credit would likely sell off too.

I think the rally in the 30-year has driven the rally in the 5-year treasury and high yield. As stated above, my political view is that pro-labour policies will continue, so inflation will stay very high. I think investors buying 30-year treasuries at this level are asking for trouble.

Why do I think pro-labour policies are likely to continue? China moved to pro-labour policies, and is now the largest food importer in the world. This is driving food inflation, which has always been the worst type of inflation politically. Unless I see a collapse in food inflation, central banks will be under pressure to keep financial conditions tight.

I think TLT looks a short, which makes me think you should sell the rip.