For a long time I have said the BOJ was the most powerful central bank in the world, and we have prove of it today. Raising interest rates, and reducing QE, has turned Nikkei from an up trending market to bear market very quickly.

A collapsing Nikkei tends to be seen as a indicator of incipient economic doom. But even with the moves today, the Japanese 30 year still seems to be in an uptrend.

As is the relative Japanese bank trade.

The problem with the deflation story is that it that bond yields have already proven themselves to be a policy story more than a macro story. Do you remember when every economist and hedge fund manager was telling you that the unwinding of the Chinese property bubble would be the GFC on steroids. Chinese property developers have gone bust in droves, and property starts in China has collapsed. And yet US bond yields have remained fairly high, and JGBs remain in bear market.

Looking at US policy going forwards, both Trump and Harris I think would like to restore US manufacturing to its former glory. Using non-farm payroll data, we can see how much more employment would need to rise in this sector. The US lost 6mn manufacturing jobs from 2000. Could policy restore this? I think they are going to try - and it will not be deflationary!

Curiously, the number of US government employees has recently risen to new highs, after a long period of stagnation.

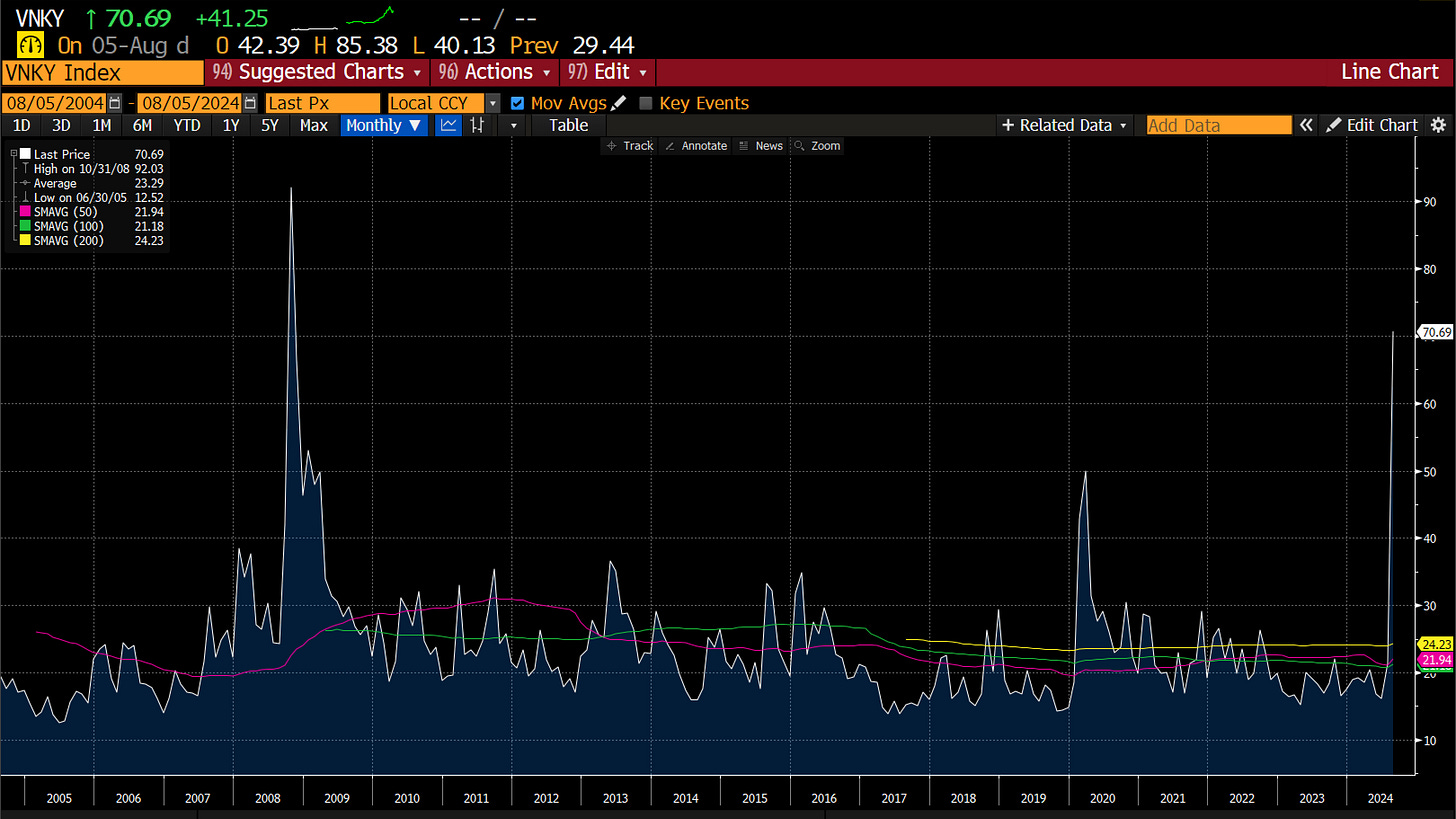

Hopefully this helps you understand where I am coming from. Deflation had little to do with economics, and more to do with government policy. Inflation has little to do with economics and more to do with government policy. For me, policy is inflationary. So why have markets moved so violently? Well I have to go back to the way clearinghouses price risk - which is backward looking. So even though the BOJ has been talking about raising rates, clearinghouses not have anticipated any volatility until it actually happens. Once volatility spikes, THEN they ask for more initial margin, which then causes more volatility and so on so forth. As I pointed out, clearinghouses create more financial volatility, and likely bankruptcy. Their only “benefit” is that governments can bail out market via clearinghouses rather than banks. The Nikkei VIX chart give you a good idea of how bad they are at pricing risk. Nikkei vol trended higher into the GFC, but todays 70 print came from nowhere. Margin call is the answer.

I ask myself, is the political will there to create unemployment to defeat inflation? I don’t think so. The BOJ is reacting to this change very slowly, and leveraged players are going to go to the wall, but I don’t think we are going to see austerity anytime soon. The stupidness of clearinghouses is going to let you get in on inflation trades at good levels I think.

GLD/TLT still looks good to me.