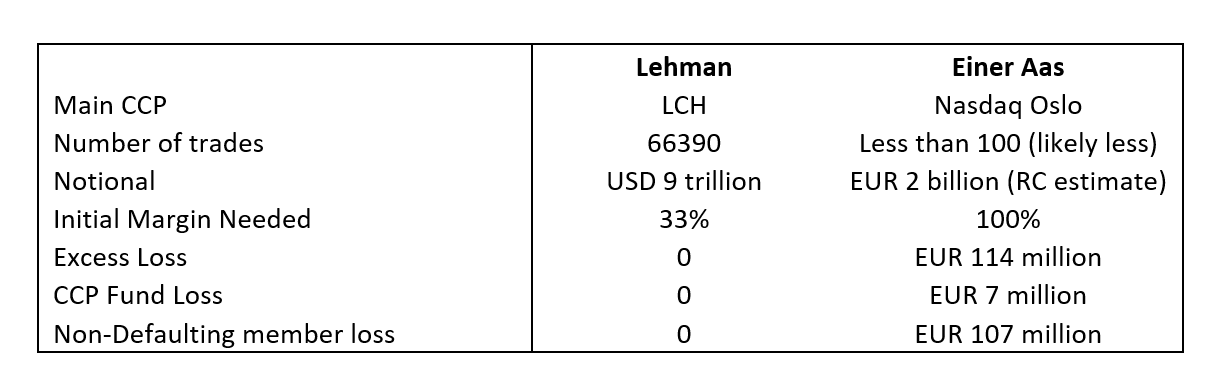

In my previous note, we highlighted the different experience of clearinghouses to two different bankruptcies, Lehman and Einer Aas. Lehman saw no losses at clearinghouses despite being of a much large scale, while Einer Aas required other members to recapitalise the clearinghouse.

The key is that under Lehman, the clearinghouse has plenty of initial margin on hard, while with Einer Aas, initial margin was plainly insufficient. Lehman when bankrupt under the pre-crisis model, while Einer Aas went bankrupt under the new model.

In the pre-crisis model, all banks are in essence acting as a clearinghouse, which requires them to require margin from all counterparties. Bank of America would have been a counterparty to Lehman at the time, and starting in 2007 the CDS of Bank of America began to rise.