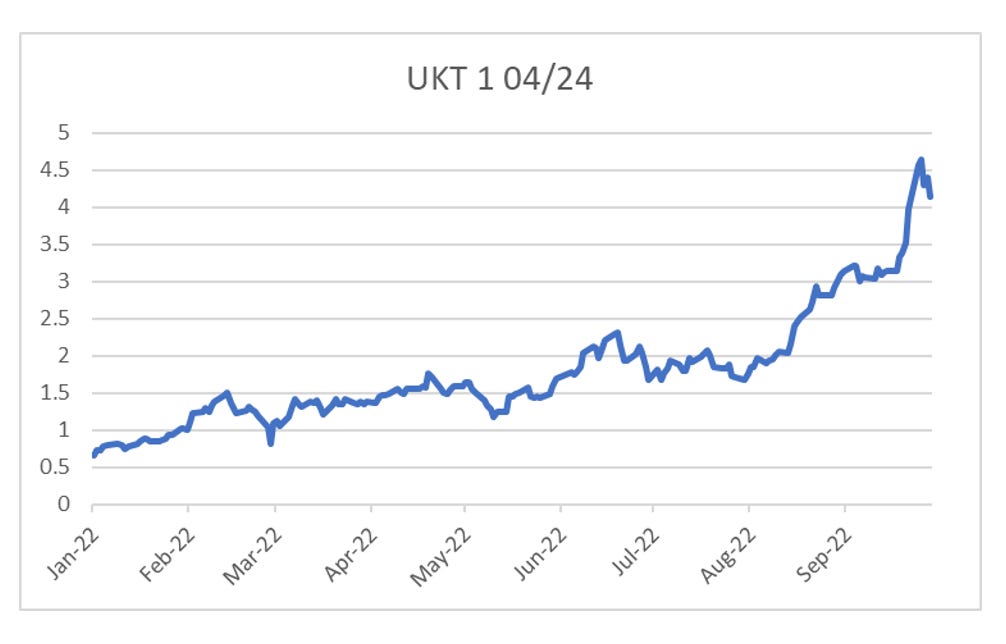

Clearinghouses were meant to reduce risk in the financial system, and reduce the risk of bailouts. In practice, they make market bailouts compulsory. The most recent example is the UK gilt market. As a recap, the UK announced a budget that both increased spending and cut taxes. Markets reacted by dumping the pound, and selling bonds. Investors in long dated gilts have lost well over half their value this year as yields have risen from 1% to nearly 4%.

So far, so standard. Fiscal recklessness causes investors to dump the currency and bonds, and the typical reaction here should be a tightening by the Bank of England to calm nerves. And financial market have reflected that reality in pushing up the yield on 2 year gilt to over 4%.

But then the BOE did something very odd. They restarted QE. That is they announced a program to buy bonds - which is complete at odds with a central bank that is trying to combat inflation. In the end, they did not need to conduct much QE - but they were prompted by fears of “dysfunction” in the long dated (over 20 years) gilt market. So how is it that the long dated gilt market could suffer dysfunction? The same way that the nickel market suffered dysfunction, and numerous other market in recent years - clearinghouses.