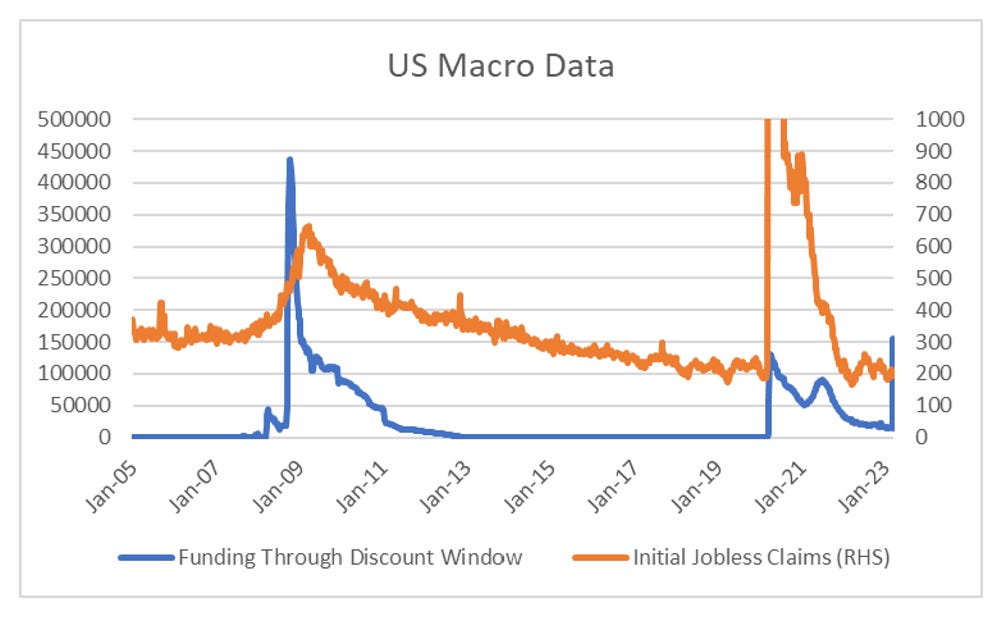

I am a big idea type of guy, and less a detail type of guy. Hopefully you get that from what I have written. The big idea I am trying to get across is that current problems with banks seem to have very little to do with the problems we have seen with banks over the last 15 years or so. One example of this is borrowing from the Federal Reserve discount window and unemployment. Normally you need to see some rise in unemployment to see banks access the discount window - not this time.

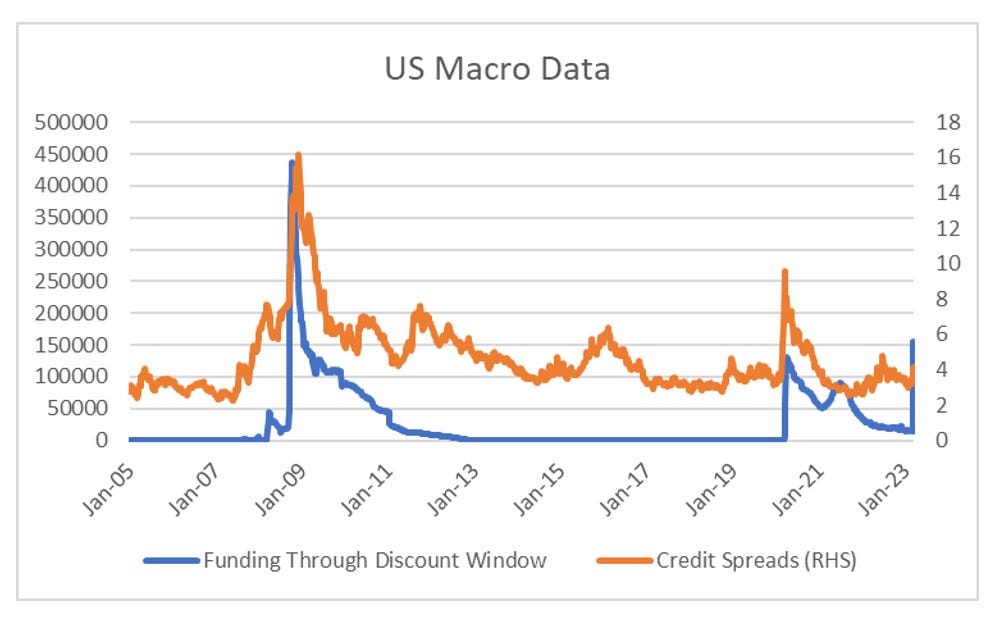

Many people would say employment data is a bit backward looking, which is fair enough. I would expect to see credit spreads widening with increased use of the discount window. I can’t really see it.

So if unemployment is still okay, and credit spreads are okay - why are banks failing. Well for the first time in a long time, deposits at commercial banks in the US are falling.

Your deposit at a bank is in essence a loan. They take that money, and lend long. So when deposits fall, they need to fill the gap with either an equity issuance or going to the discount window. So why are deposits falling? Two reasons, inflation has pushed up the cost of everything so that real wages are falling, and people need savings to pay for things.

The second reason which is really “bizzaro” is that even though inflation is still running at 6%, investors are so convinced that rates will come down again, even corporate bonds are yielding less than the Fed Funds rate. So banks can’t offer deposit rates that are competitive, and still make money.

The truth is probably somewhere in between these two reasons, but an industry that cant make money AND facing funding issues? No wonder there is a crisis. Of course this goes away if the Federal Reserve cuts interest rates - but will they?