Process is the most important thing in the fund management business. If you can create an identifiable process, then you are well on track to generating returns, and also attracting capital. My process worked well until 2016, and I have spend the time since I steeped back from managing capital to work out why it stopped working, and how to fix it.

So what was my process? Well before I gave back capital, I used to call it the three M’s. Macro, Micro and Market. In essence I was looking for investment ideas that were supported by these three individual levels. The elevator pitch would be I was looking for a turning point in the macro, supported by what the businesses were saying (micro) and then pulling the trigger on the trade when the technicals turned in my favour. Below is a screenshot from a presentation to investors.

The problem is that this process stopped working from 2016 onwards. And I could not work out why, as it was a process that I used to win to Eurohedge awards and pick out short themes in a raging bull market. In the end, I could not work out why it didn’t work anymore, so I gave back capital.

With hindsight, I realise that a stressed mind is a very uncreative mind. And in the free time I have had over the last nine months or so, I realise that the key factor I needed was “Motivation”.

So what do I mean by motivation? Motivation is the underlying ideology which underpins the economy. It does not change often, but it does change. After World War II, the “motivation” was for government to act as necessary to create full employment and rising wages. If this required governments to nationalise industries, then this happened. If this required tariffs to protect domestic workers, then this happened. If strong unions were needed, then this happened. If cushy cartels were required, then this happened.

As people became disenchanted with big government and surging inflation in 1970s, the motivation changed to one of market efficiency and small government. From 1980s onwards, the market was trusted to efficiently allocate capital, and governments allowed unemployment to rise, and businesses to go bust.

What is the motivation today? I suggest people are frustrated by over powerful corporates and stagnant real wages. They want government to act against large corporates, and they was income inequality to be reduced. My observation is that all governments are working towards this goal, but some are more advanced than others.

So what does that mean for investing? When China started to crackdown on its tech giants in 2021, many tech investors called China “uninvestible” and then doubled down on non-Chinese tech companies, particularly in the US. However the anti-tech “motivation” seen in China exists everywhere, be it the beefing up the FTC and antitrust in the US, or the implementation of GPDR in Europe. That is what happens in China is not separate to the rest of the world, but a theme that will be seen everywhere. I suspect the stimulus payments that have become so popular in the West may well end up becoming part of China’s policy response as well. That is you should suspect markets will act in a way that favours labour over capital.

The second M - Macro. The trend to labour over capital implies a stronger inflationary environment. Higher wages implies stronger commodity prices, and higher interest rates. We have already seen a breakdown in the relationship between the US dollar, commodity prices and bond yields, which is explained by Motivation above. Typically a strong dollar is associated with weaker commodity prices. Not in 2022. That is commodity strength is not related to currency debasement anymore, but to rising wages.

Likewise, a strong dollar has normally been seen as deflationary, causing long term bond yields to fall, particularly when equities are weak. Not this time.

The third M - Micro. Physical commodities where supply is restricted. Short bonds were wage rates are likely to rise the most. Short corporates that are likely to see rising competition and greater regulation. This is typically where most of the time is spent day-to-day, as motivation and macro, rarely change. And this sort of work I stick behind the paywall!

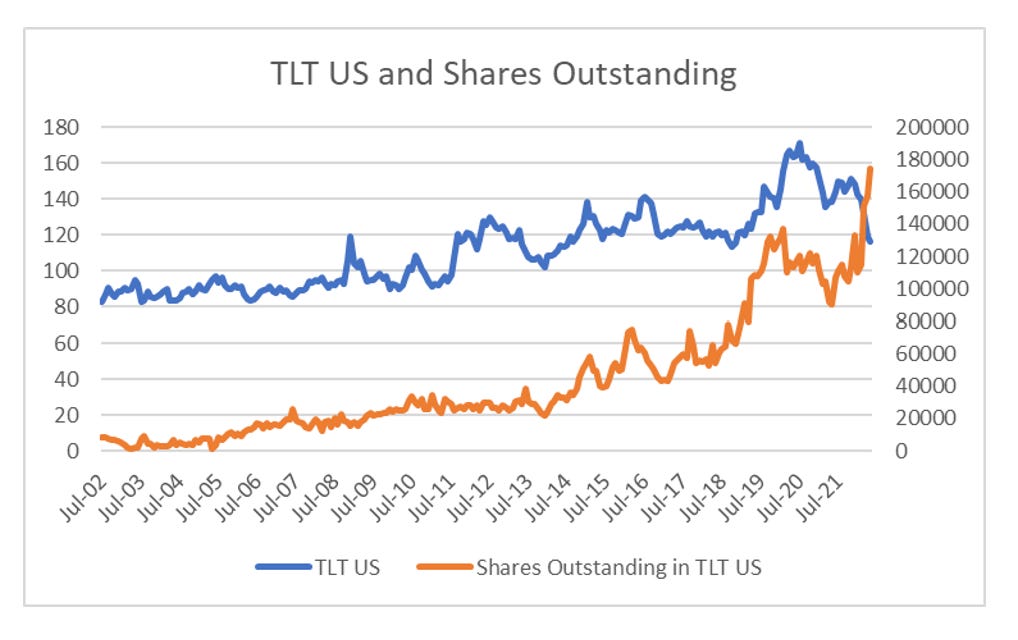

The fourth M - Market. Only invest in trends where the market is already moving and positioning is supportive. Most commodities and bonds markets are confirming my inflationary view. To reduce risk, look for where positioning is long even though the asset is falling and vice versa. A good example of this is 30 Year US Treasuries. TLT US is an ETF that is long 30 year Treasuries, and has performed very poorly this year. However, the shares outstanding in this ETF has risen dramatically even as this has fallen, implying that most investors see this is as a buying opportunity. This suggests to me that TLT US still offers good risk reward as a short.

Hopefully you will have gained some idea of how I look and think about things. I think the 4Ms offer a really good way of thinking about investing, where many different style of investing are incorporated to help clarify decisions and focus capital. I will certainly be using it going forward.