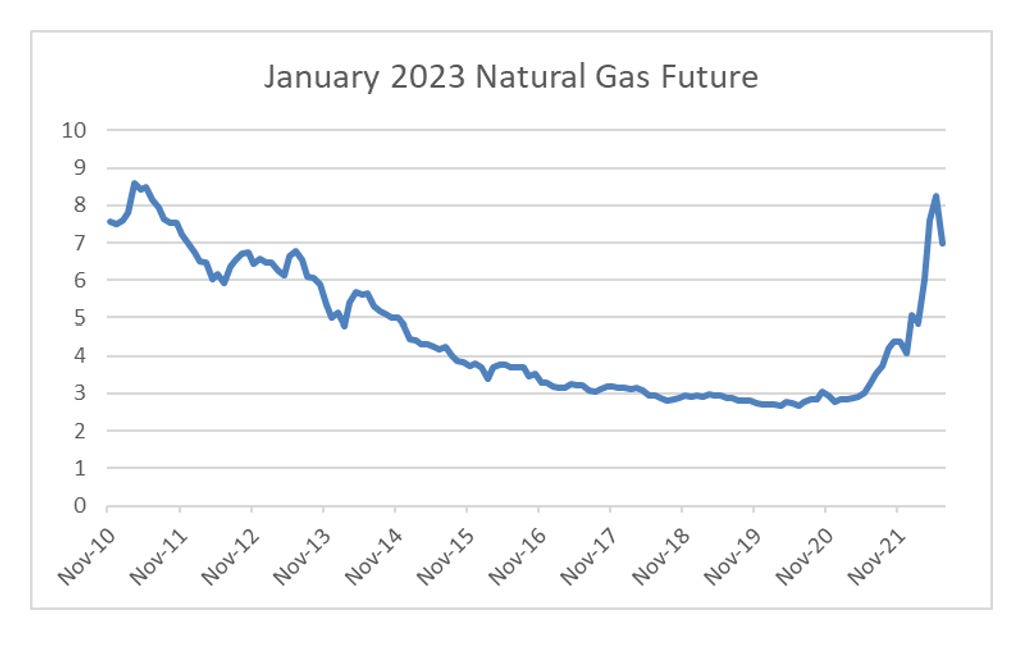

Shale drilling caused the most brutal commodity bear market I have ever seen. Shale drilling for various reasons has its most powerful effect on US natural gas prices. The problem with analysing US natural gas prices is there there is a very strong seasonal effect, with demand spiking in the winter. When you look at spot natural gas prices, there is always a spike in winter, which hides the brutal bear market that natural gas prices has been in since 2010. One way to get around this seasonal problem is to to look at the future market for a single winter in the future. Below I show future market pricing for January 2023 natural gas in the US. In 2010, the market thought it would be USD9 per MMBTU, when then fell to a low of USD2.50 in 2020, and has now spiked back to USD7, after a reaching a peak of USD8.50. Does this recent dip mark the end of the energy bull market?

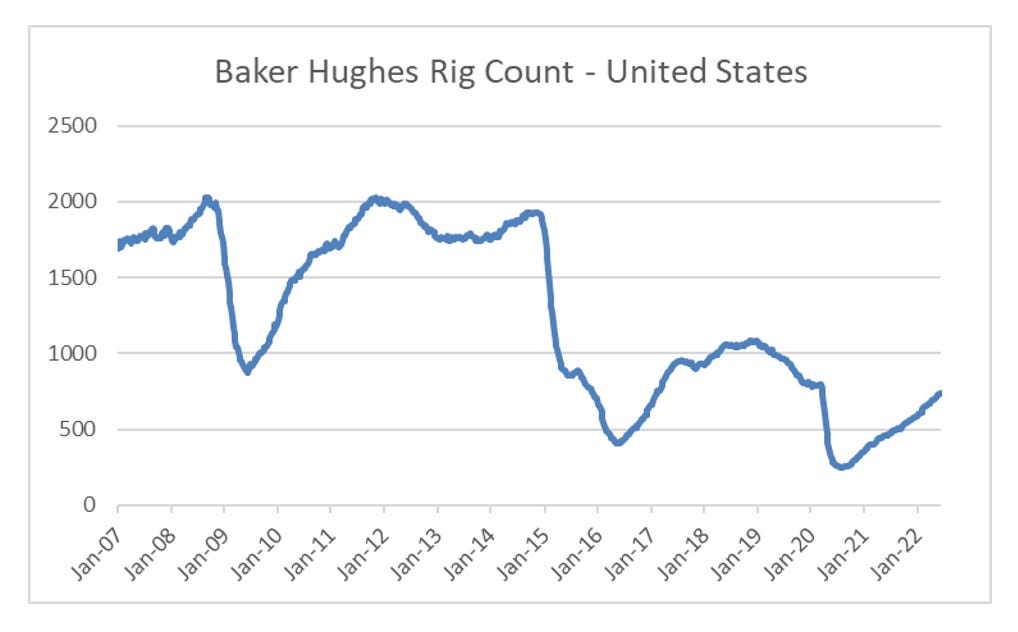

On the bearish side, we can see that drilling activity has recovered in the US.

On the bullish side, “Drilled, Uncompleted Well” (DUC) which is an essence an inventory that drillers can draw upon to ramp production has fallen to very low levels.

Watch with a 7-day free trial

Subscribe to Capital Flows and Asset Markets to watch this video and get 7 days of free access to the full post archives.