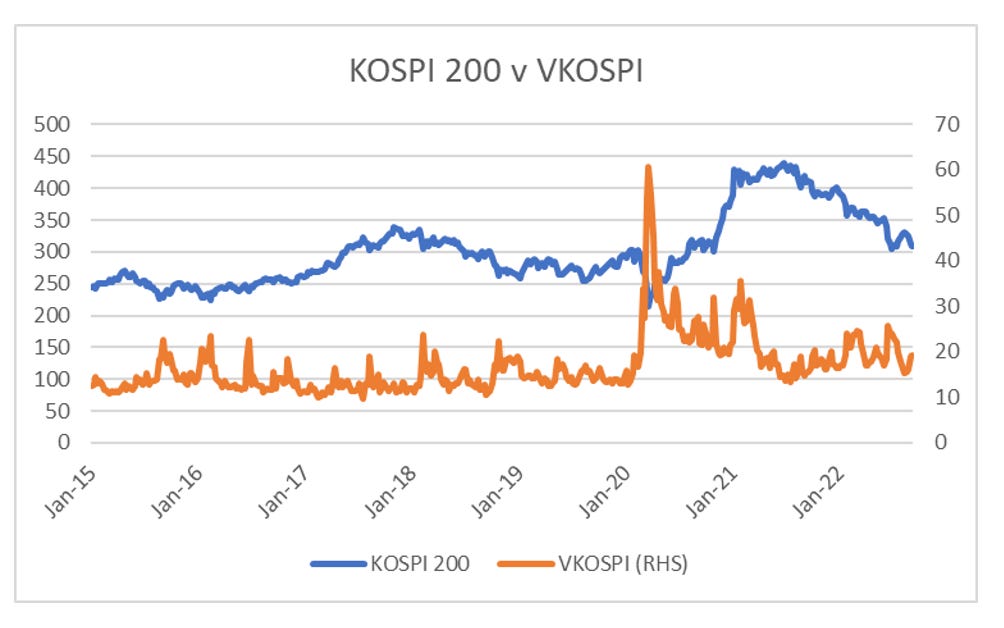

Why have I started writing about autocallables? When I first researched them I realised they create very perverse market behaviour. One of the oddest things about them is that as autocallables approach a lower barrier, it can cause implied market volatility to FALL not rise as you would expect. Why? As an index gets closer to the barrier, the dealers and structurers need to hedge their exposure, and will be selling MORE protection which puts more pressure on the market price of volatility (ie implied volatility). If the autocallable breaks through the barrier, the risk transfers from the dealer to the investor, and suddenly volatility goes through the roof. So one warning sign I look for is an implied volatility that is at odds with market action. Korea is one such market, where the KOSPI 200 is down 27% from its peak, yet VKOSPI is pricing at 16.7 (pricing at close 13/9/2022).

When I look at HSCEI, a market that caused significant autocallable problems in 2015, volatility is also too low. The market is down 47% from its peak in early 2021, and yet VHSCEI is at 29, where a decline of this magnitude would normally see a VHSCEI of closer to 40.

The other area I have learnt to look at is dividend futures. The sell side will often claim that dividend futures are artificially depressed due to autocallable activity. My experience is that typically the dividend futures are correct, and when equity indices and dividend futures diverge, the index is incorrect.