Coming in to 2022, most fund managers probably wanted to be short the USD. NIIP data shows record long positioning, and with the Nasdaq beginning to weaken, a commodities rising, a short USD position made a lot of sense.

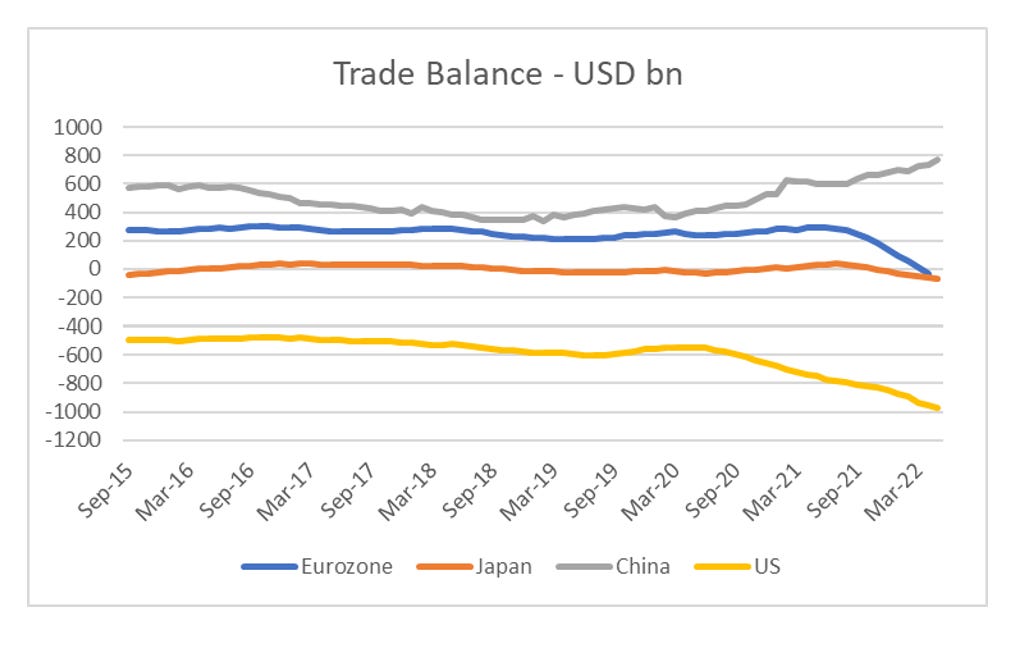

However trade data in 2022, has been very bearish for the Eurozone and for Japan. Both have slipped from trade surplus to deficit in 2022. China has continued to run a large trade surplus, and the US a large trade deficit, but on a relative basis this would imply Euro and Yen weakness.

The reason for such a huge turn in trade surpluses in Japan and Eurozone are not too hard to find. Europe and Japan now pay large multiples to US gas price.

When Japan and Europe went “unconventional” with negative interest rates, it was in my view to counteract the natural appreciation pressure both currencies felt from a surging US trade deficit. With their own trade surpluses gone, the need for negative interest rates has largely disappeared, but both the ECB and BOJ seem slow to react.

There is one problem with this analysis. Arguing that there is a permanent change in terms of trade, would lead me to be very bullish on countries like Australia who are large LNG exporters, and have been reporting record trade surpluses. However the Australian dollar has also been weak (I have talked about it previously - but message me if you want to see the data). So what else is going on? Credit quality is deteriorating, and this affects all “risk” assets - including currency. Korea is a good proxy for Asia, as it has the longest CDS history and is liquid. We find Australian CDS is also moving higher, in line with a stronger USD.