For a very long time I thought Japan was the centre of the financial universe. In recent years, as China accumulated larger financial reserves, and bigger trading relationships with I wondered if China had supplanted Japan, but ongoing capital controls in China make that unlikely. In my recent two part note “Death of Denial” (the second part is now free to view), I looked back over financial market history from 1990s onwards, and concluded the time to worry about markets was when the BOJ was tightening policy. Using 3m TIBOR as an indicator, any time it has been rising, or even above 0, has been a tricky time in markets.

That is a big call, so lets put some numbers into support this thesis. Japan was for a long time, the biggest holder of US treasuries. China briefly owned more treasuries than Japan, but recent trends has seen Japan become the largest owner of treasuries.

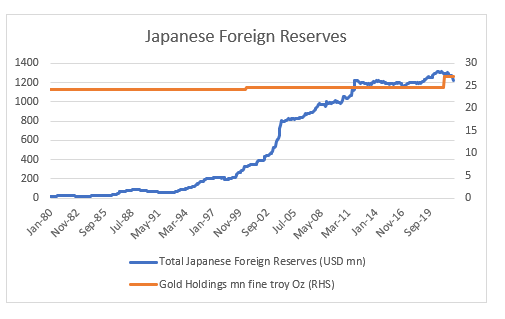

Japanese ownership of US treasuries is also noteworthy, as they have chosen almost exclusively to buy US treasuries, to the exclusion of all other assets, even gold. Currently Japanese holdings of US treasuries make up most of Japanese foreign reserve holdings.

So Japan is the biggest public sector player in treasuries. But what about Japanese private sector investors (we find this by looking at NIIP and subtracting official reserves). Using longer term data, we can see ever since the Japanese bubble economy burst, Japanese private sector net international investment position has grown as percentage of GDP. What is also noticeable is that it spikes before every crash.

So if Japanese private sector investment is the drive of capital flows, what causes them to bring money home? If we look at the GFC and the Euro-Crisis were both preceded by the BOJ reducing its Current Account Balance (balance sheet). Below you can see in 2006, BOJ began to withdraw stimulus. So far in 2022, we have yet to see any stimulus be withdrawn.

What is currently interesting about markets is that the BOJ has historically taken a lead from the US Federal Reserve, which has turned hawkish in recent meetings. The BOJ has refrained from any tightening, as we can see from above. This sets up a fascinating test case to see which central bank is more important, the BOJ or the Federal Reserve. So far I would suggest the BOJ is looking more important.

Share this post