I did a lot of short selling when I was managing money. The funny thing about short selling was that most people (or at least my investors) would agree something was a short - but just could not agree on “when”. I thought I had solved this “when” problem, by closely watching movements in currency and bonds (macro assets). In previous posts, when I talk about the 3M process - the fist “M” - Macro was really all about timing moves in the market. The core idea was that asset flows would create and destroy capital markets (hence the title of this substack). The related idea to this was that Japan was the Saudi Arabia of the savings markets, and that Japanese flows into and out of markets would create and then end credit booms. This idea helped explain why the Yen and JGBs rallied during credit crises, as Japanese capital would flow back into Japanese asset markets. The implication was you needed to look at relative investment position of two different nations to see where risk was hiding. We started using net international investment position (NIIP) data to look at where capital flows had gone and could reverse creating a crisis.

This worked well with the Asian Financial Crisis, where Japan had a very positive NIIP, while Korea was very negative in 1998. Note Private sector here means that the holdings of treasuries as foreign reserve assets are stripped out.

This analysis also worked well with the Eurocrisis, where we swapped Germany for Japan. The NIIP of Spain was very negative just before the crisis began.

On the back of this analysis, I then looked for other countries with negative NIIP numbers. China data in 2014 and 2015 was highlighting the risk of asset flows out of China.

Once China risk was realised, the NIIP data has been pointing to a very negative outlook for US assets, with NIIP data extending far past the levels seen during the dot com bust.

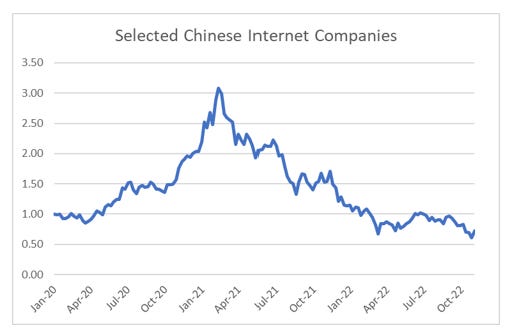

Using the NIIP data, from 2018 onwards I tried to short assets tied to the US, while being long asset that would benefit from a weakening US dollar. This was not a very successful trade, but this was not the reason I gave up on short selling. With a bearish view on the USD driven by NIIP, I was not particularly bearish on Chinese or Emerging Market assets. But one day in early 2021 I read about the Chinese antitrust regulator calling in the 34 biggest internet operators to remind them to comply with existing antitrust laws. Most articles only referred to Alibaba and Tencent, but after 30 minutes work I was able to find the list of all 34 companies from an article dated 14 April.

As you would expect, many of these companies topped out a few months before this meeting, but many fell more than 50% post this meeting, particularly the smaller lesser-known Chinese companies.

For half an hour work I had generated a very successful short theme, that worked far better than a macro model that I have spent more than 15 years developing. What was worse, the implication was that politics trumped economics, which was something that I had explicitly rejected in my macro model. And this is why I stepped away from short selling and managing money. But over the last year, I have tried my best to develop a “political model” of markets, which is starting to pay dividends. So in my next post, I will talk about where my political model says to short.

Share this post