In a globalised world, I assumed booms and bust were driven by the flow of assets in and out of markets. One easy way of keeping track of these net accumulated flows was to look at net international investment position (NIIP). In pure economic terms, countries that were saving could move money into countries that were spending. Theoretically, NIIP globally should add to zero, but rarely have. In practice, countries that very negative NIIP are (were?) likely to see either currency weakness or asset price weakness, which would bring their NIIP back to balance.

In recent years, the gap between sum of deficit countries and surplus countries has increased dramatically. Until 2017 or so, the difference was around USD 2 trillion, but has grown to nearly USD 8 trillion in recent years.

Where has this gap come from? Well US NIIP deficit has surged, but has not been accompanied by a corresponding increase in NIIP surplus nations. Eurozone NIIP has improved, but nowhere near as large as the increase in the US deficit.

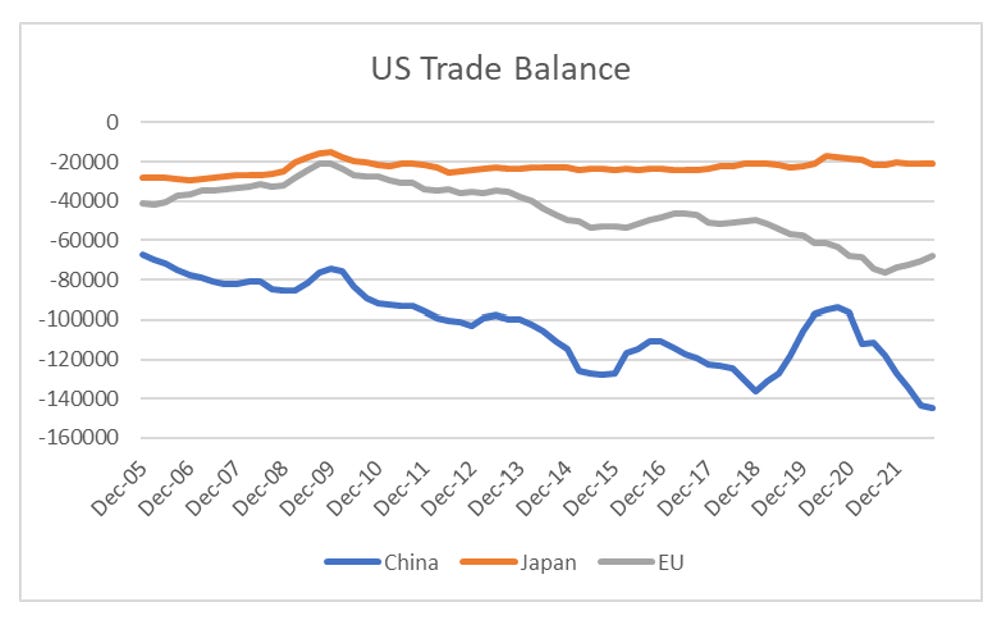

NIIP generally moves with current account surpluses. If a country runs a current account surplus, you are generating surplus capital from exporting more than you are importing. As the US has the biggest increase in NIIP deficit, then we can look at US trade balances to work out who should see a big increase in NIIP surplus. China’s trade surplus with the US dwarfs both the EU and Japan.

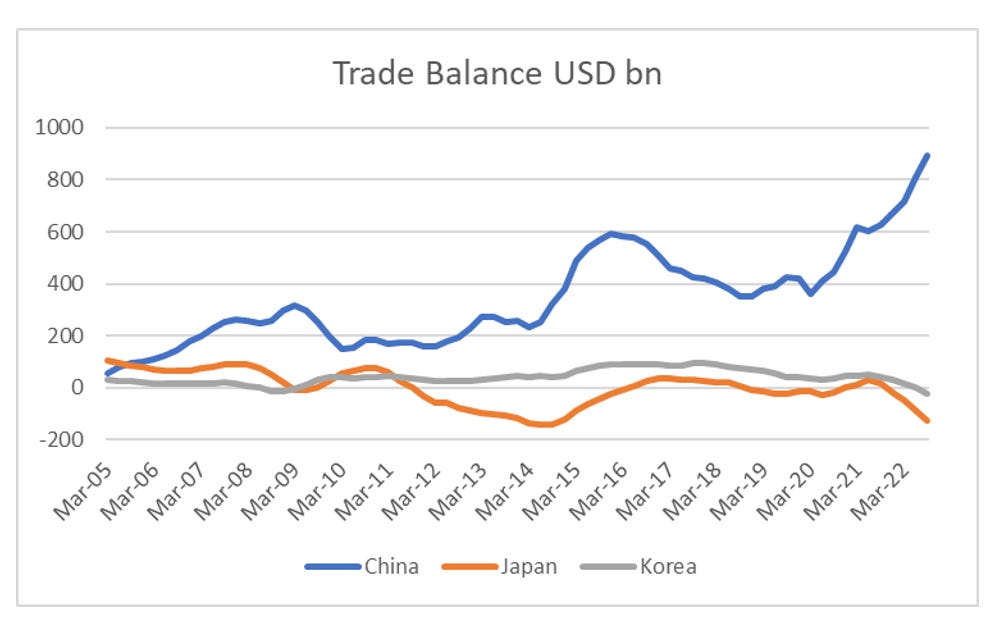

When we look at the top two charts, we see a negligible improvement in Chinese NIIP. Unfortunately, the more we look at China, the less it makes sense. China has a soaring trade surplus, while Japan and Korea have trade deficits.

But when we look at Asian holdings of treasuries, we see that China, Japan and Korea all have declining holdings of treasuries (I am unsure if this is mark to market movements - or actual selling).

The NIIP data suggests huge inflows into US assets. Trade data suggests it should be coming from China, but Chinese NIIP and treasury data does not confirm this. My best guess is that after imposing capital controls in 2015/6, Chinese exporters are no longer bringing capital back to China, but are buying US assets directly. This shows up in US NIIP data, but not in China NIIP data. For years a strong dollar would lead to larger trades surpluses in Asia, would cause more treasury buying supporting the US treasury market. With China either no longer able to, or no longer willing to buy US treasuries, this cycle looks broken. Treasuries look like a short.