Is food inflation any different from other forms of inflation? Economic theory would suggest that every rising productivity in the agricultural sector, combined with the natural boom bust nature of agricultural commodities, should imply food price inflation moves in very different way to broader economic inflation. That is you could have soaring wages, and falling food prices for example. However, when we take a very long term look at US food inflation, we find the deflation of the 1930s, the inflation of 1970s, and the great moderation of 1990s onwards are all apparent in food inflation.

Japanese food inflation also provides pretty good confirmation that food inflation moves with wages. Japanese wages have stagnated since the 1990s, and likewise Japanese food inflation has also been stagnant.

Personally, I am pretty convinced that wages and food inflation move together. The question now is which one drives which? Europe provides some good evidence that wage inflation drives food inflation. Prior to the GFC and the Eurocrisis, Greece, Croatia, and Estonia were all booming, and all saw food inflation rise from 2000 to 2010. However, since 2010, Greek food inflation have been stagnant even as Croatian and Estonian food prices have continued to rise. All are either using the Euro, or have a pegged exchange rate to the Euro.

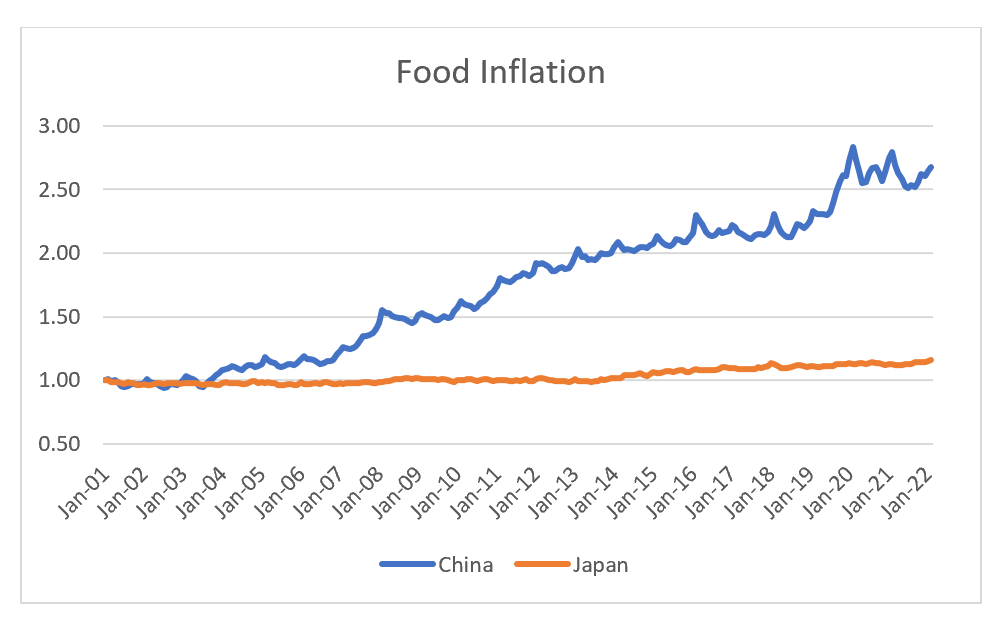

Revisiting the Japanese experience, we can compare the evolution of Chinese and Japanese food inflation since 2001. Intriguingly, Chinese food inflation was under control until 2006, but has been rising since then.

Again, I am fairly convinced that wages and food prices follow each other. This then throws up a conundrum. If Chinese wages are lower than US wages, why are Chinese pork prices higher than US pork prices?

Does this mean Chinese wages need to fall, or US food prices and wages need to rise? Recent data suggests the latter, which means Chinese food prices could become the key driver of global inflation and bond markets.