The fall in oil price this year is that is has been accompanied by a truly historic fall in US oil inventories. As a rule, collapsing inventories are seen as bullish, as they normally have to get replenished, however I am pretty sure the SPR will never be refilled.

In my original note, I wondered where all the oil was going. Using OECD data, which looks at not just crude oil inventory, but product inventory we can see that the sell down in SPR has largely turned up overseas.

While it is easy to characterise the sell down of the SPR as political driven, there are good economic reasons for it. In recent years, the growth of US oil production has led to a fall in net imports, from a peak of 10m barrels a day to around 2m at the moment.

The Strategic Petroleum Reserve (SPR) was built up by the US government so that the US would always have 90 days of net crude oil imports on hand. This is the number that the IEA suggests that all its members hold as oil inventory. The US commercial sector did not hold that much inventory in 1980 to 2010s, so the SPR was needed. However, as us net imports have fallen, the need for the SPR has disappeared. I think it very unlikely the US will ever refill the SPR.

None of the other IEA nations have had a large increase in oil production like the US, so no other nation is in a position to reduce inventories like the US.

As the US is a bigger producer of oil, it needs less strategic reserves is quite obvious. But the problems for the SPR are bigger than that. The SPR is held in storage in Texas and Louisiana. The reason for that is that was where the US imported most of its oil to then distribute to refiners in the midwest and elsewhere. The problem is that the big shale production growth has been located in and around Texas, so very little oil is now imported. This means that it was even when the SPR released oil, there was very little domestic demand for it. As far back as 2016, the Department of Energy realised that the SPR was not practical anymore and had planned to sell oil slowly into the market to generate the capital to modernise the whole SPR system.

In the same report, US SPR Long Term Strategic Review, they also looked at a scenario when Russian oil became unavailable. In this scenario, the plan was to release 1.8 m barrels a day. The reality is that SPR has been selling oil down at a slower rate than this plan, which again this plan showed was likely as there was limited shipping capacity.

In some ways the Russian invasion of Ukraine has done the SPR a favour. It has allowed them to reduce the size of the reserves that was increasingly look like a stranded asset. The reports states that the average purchase price of SPR oil is USD 30 a barrel. The SPR sell down would have generated a USD10bn profit so far. The fall in SPR also completes China’s domination of commodity markets. Japan has the highest reported strategic reserve at 511m barrels, but Chinese reports state that China has achieved 90 days of import coverage, which leads to roughly 1bn barrels of reserves at the current import rate of 12m barrels a day.

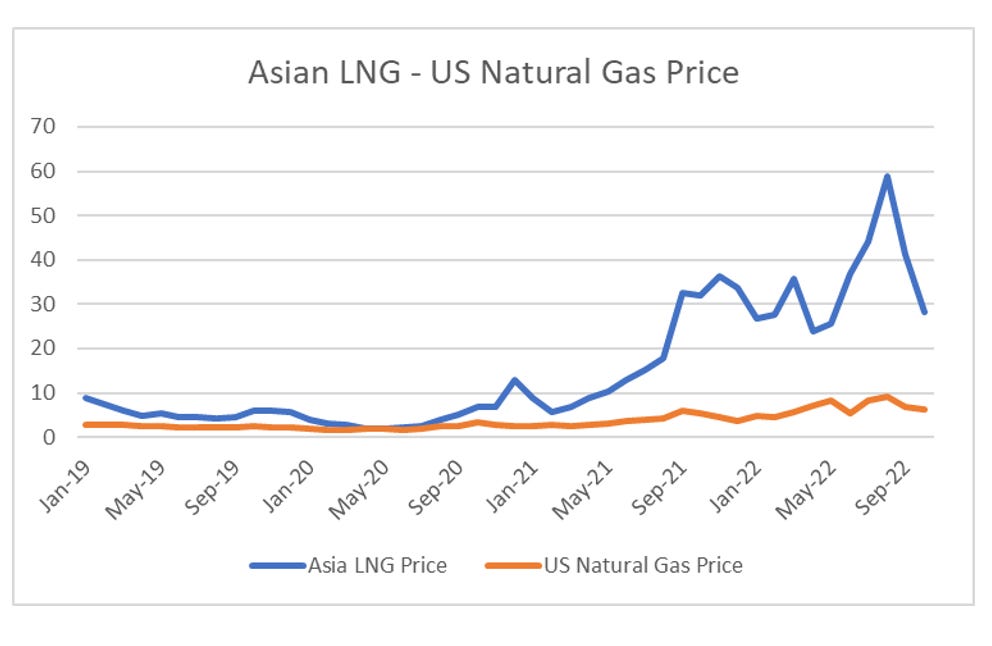

The big take away for me is the SPR number is no longer important. It will keep falling as long as oil prices stay high. The operational minimum is 10% of total capacity, which means 70m barrels, but over time this could fall to zero. It also means that Chinese demand is now much more important to the oil market, particular once the SPR sell off is completed. Unfortunately, good data on Chinese demand is hard to come by. All I know is that when I look at the LNG market in Asia is still indicates that energy supply is tight.

An old rule of thumb has oil should trade 10 times the natural gas price, so current Asian LNG prices imply oil prices of USD 300 a barrel in Asia. But again prices here have been weak this year, although natural gas is a very seasonal market. One energy market that I trust is the US natural gas futures market. It successful highlighted the oversupply of the energy market from 2011 onwards, and correctly foresaw the tightness of market in 2021 and 2022. Current pricing is not showing the weakness that spot oil is showing, which makes me think, that the energy market is still tight.

In conclusion, SPR selling is likely to continue for another 12 to 18 months, as long as they can realise a good price for the oil. This is likely as long as the Russian invasion of Ukraine continues. This could keep a lid on oil prices, but all investors need to start focusing much more on China for directions on the oil market.

Share this post