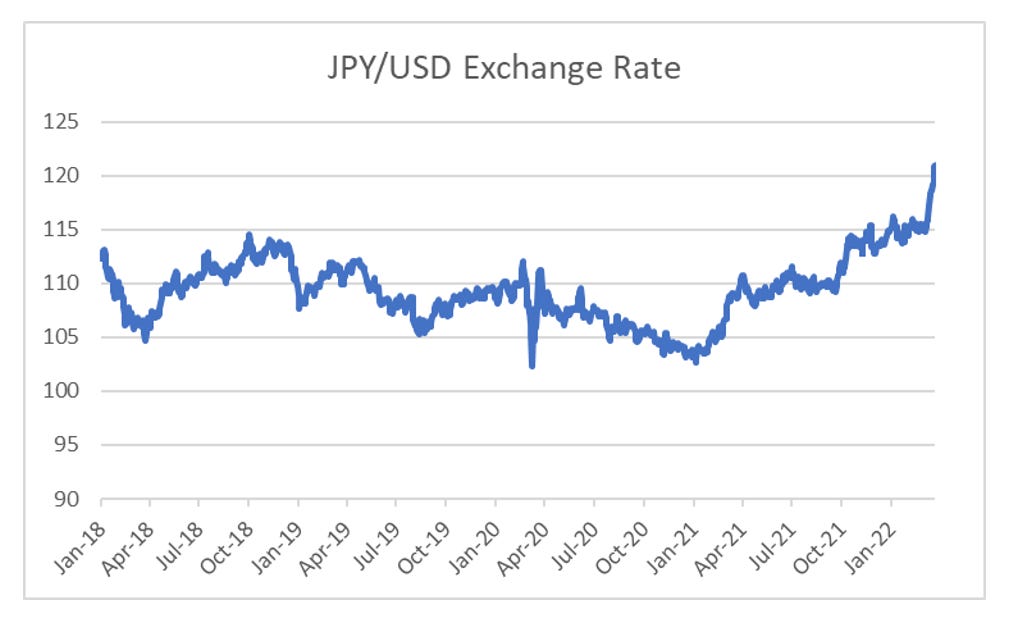

I have always had a hard time getting bearish on yen. Mainly driven by it being so cheap. But despite being cheap and a reputation of being a safe haven, the yen has weakened substantially this year.

While the yen has not rallied during the Ukraine/Russia war, we also see that long dated JGBs have also sold off in 2022. From a macro traders perspective, selling Yen and JGBs are historically considered “risk on” trades.

One big change this year, to every other market sell-off since at least 2007, is that commodity prices have risen, even when the equity market has weakened. So one currency pair that has historically followed commodity prices pretty closely is the AUD/JPY. Australia and Japan are large complimentary trade partners, so improving Australian terms of trade, imply weakening terms of trade for Japan. Looking at AUD/JPY and the terms of trade index suggest the Yen is not that weak compared to the moves in commodities.

This then makes me think more about the Australian Dollar. Australia is a large wheat exporter, large LNG exporter and a large coal exporter. Russian sanctions should surely be a huge boon for the Australian dollar? Using the CRB Raw Industrial index to generate a much longer term graph, and we can see the Australian dollar used to move pretty closely with commodities. Not in 2021 or 2022.

So instead of asking why Yen is so weak, we could ask why is the Australian dollar not stronger? Well you don’t have to think too hard to come up with reasons. China has been very ambiguous about the Russian invasion of Ukraine. And it quite clearly opens up the risk of further financial sanctions on China. Would you want to own the Australian dollar in those circumstances?

And so the answer to what is happening to Yen, is the same answer to all macro questions these days… politics.