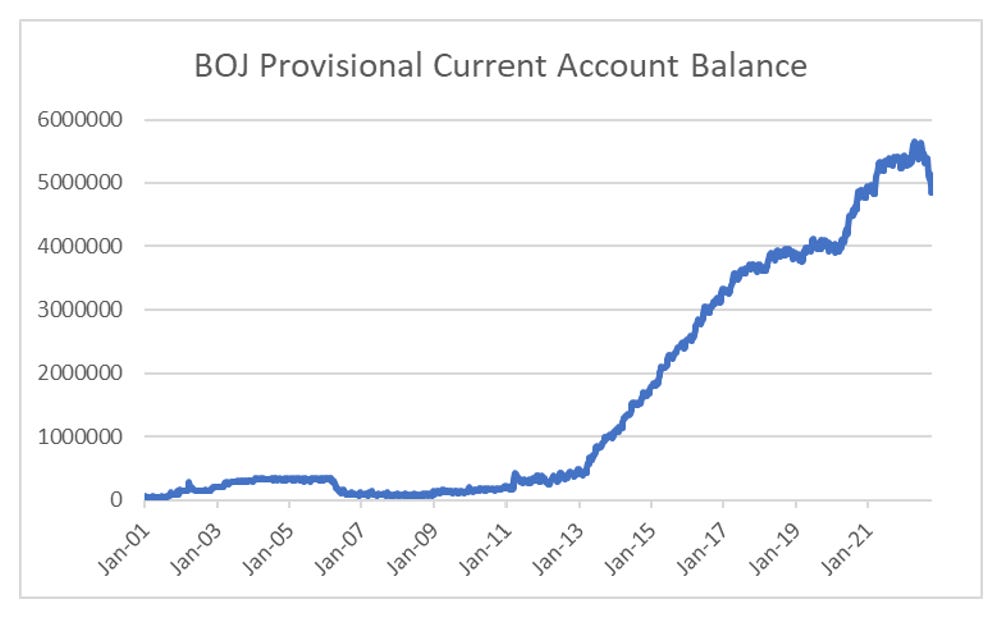

The BOJ has made it very clear that they see no need to tighten monetary policy and have been rewarded with a super weak Yen. But one of my favourite lead indicators for BOJ started to inflect towards monetary tightening. Is the BOJ saying one thing, and doing another? The lead indicator is the BOJ Provisional Current Account Balance, and pretty much tracks the BOJ balance sheet. When the BOJ first experimented with QE in 2002, and then ended it in 2006, the balance sheet rose and fell in line with that experiment. And since Abenomics began, the balance sheet has moved in line with that commitment. I was very surprised to see this fall in the most recent numbers given the comments from Kuroda.

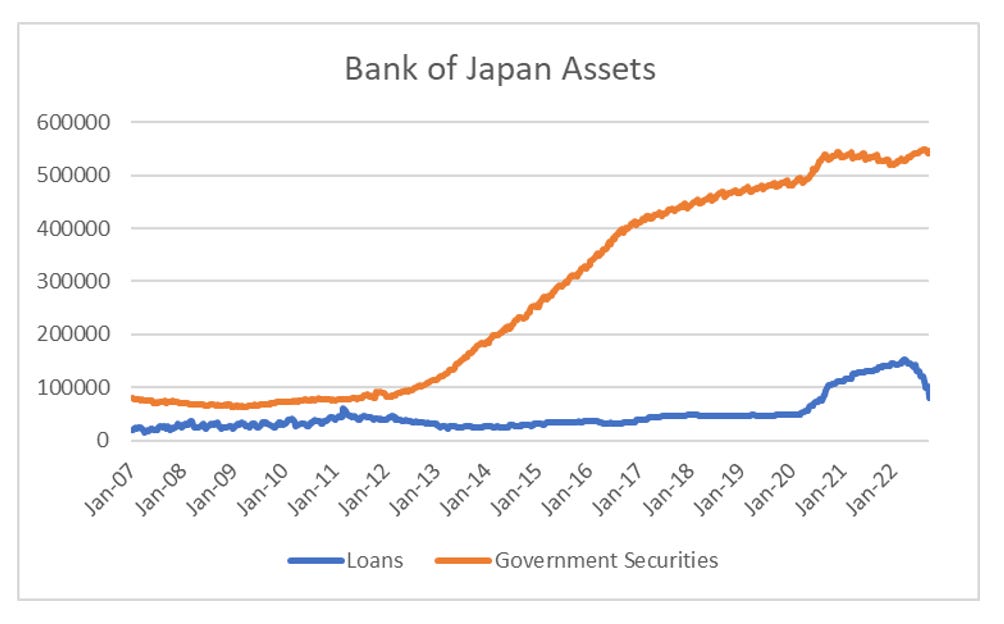

Talking to a friend about this (I sometimes wonder where I went wrong in life that I talk about the BOJ balance sheet with friends….) he pointed out that the contraction was entirely from BOJ loans, while BOJ ownership of JGBs was entirely unchanged.