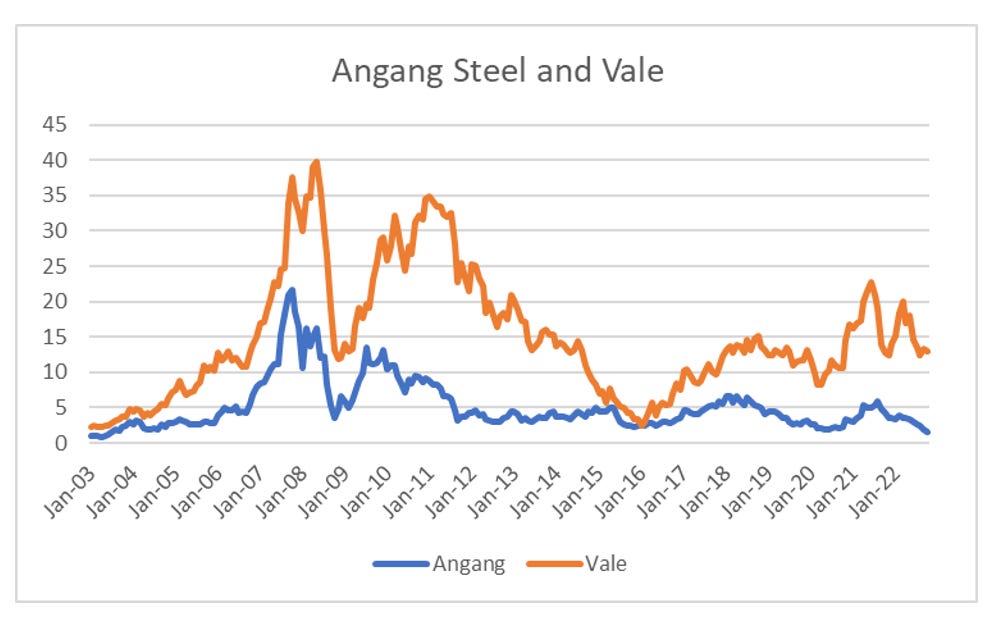

In the last update on short selling, I introduced the idea of supported and unsupported bull markets. One example I used was the experience of iron ore producers and Chinese steel makers, specifically Vale and Angang. The divergence between Vale and Angang in 2011 created an unsupported bull market - and signified that more research was needed.

When I took a closer look at the steel and iron ore industry one big difference stood out. The large Chinese steel makers where cutting capital expenditure (CAPEX) while the large miners were increasing CAPEX. That is the iron ore producers were gearing up to sell more iron ore, just at the Chinese producers were planning on selling less steel. One of these industries had to be wrong.

In this case, you could short iron ore miners with confidence. In the last note I highlighted another unsupported bull market, so I have been taking a closer look at that industry, to see if I can find a smoking gun like the chart above.