“The Price Is The News” is a concept shameless ripped off from the macroman blog run by Cameron Crise, now of Bloomberg fame. Its a great concept, and in essence what it means is that when price moves in stocks are the news, it generally means that you should be very cautious. A good example is the recent news flow in regional banks in the US, where price is very much the news. I did not pick up the deposit outflow news in this sector, so I was surprised as most people when Silicon Valley Banks went under. And like everyone else, I went to look at what other banks could be under stress. I found 11 in a very quick analysis. Of the 11 banks I found that looked troubled, 9 have seen the share prices decline since the 15th March, despite a rising S&P 500, and 2 have had rising share prices. The biggest fall was 17% but one of the risers was up 73%, with a single day rise of 50%. That bank was First Citizens BancShares - and the reason was that it was acquiring parts of Silicon Valley Bank.

A short seller I heard speak once described such huge one day moves in short positions (often driven by M&A) as an axe to the forehead, as they are extremely painful, and come out of the blue. How can we avoid axes to the forehead? The above story shows you should be cautious shorting any area that is in the news. But understanding why regional banks are in trouble, should lead to some other short ideas quite naturally. So why are regional banks in trouble? For me the simple reason is that with Fed Fund Rate above the yield on lending to corporates, banks can’t operate profitably.

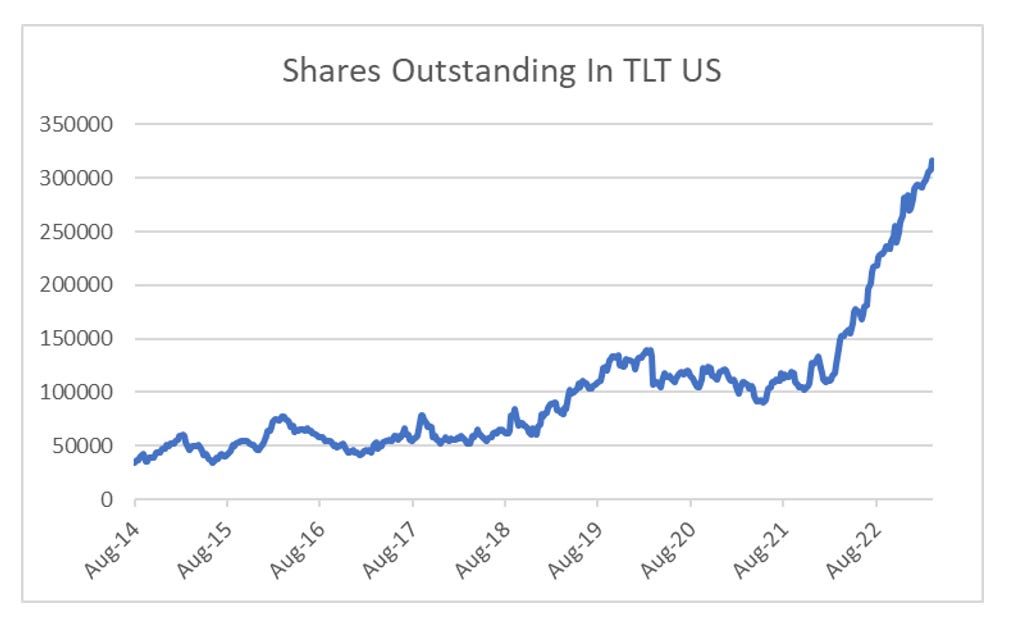

Here is where it gets interesting, as the market has basically assumed the next thing to happen is that the Federal Reserve will cut rates to protect the market, and we have seen huge flows into TLT US.

The irony of this is that this pushing down bond long dated bond yields everywhere, which is worsening the bank crisis. My view is that “political” changes means that inflation will not come down, and the Federal Reserve will likely not cut rates, and even if it does not by very much, before raising them again. So that view means that the liquidity crisis at banks will continues, and interest rates will keep rising. Where can we short, without breaching “the price is the news” rule, and avoiding axes to the forehead.