NVIDIA is the latest member of the trillion dollar club. A 200%+ rally in the share price this year has seen its market capitalisation reach USD 1.1 trillion as of today. NVIDIA has been around for a long time, but only from 2016 onwards has it really started to outperform.

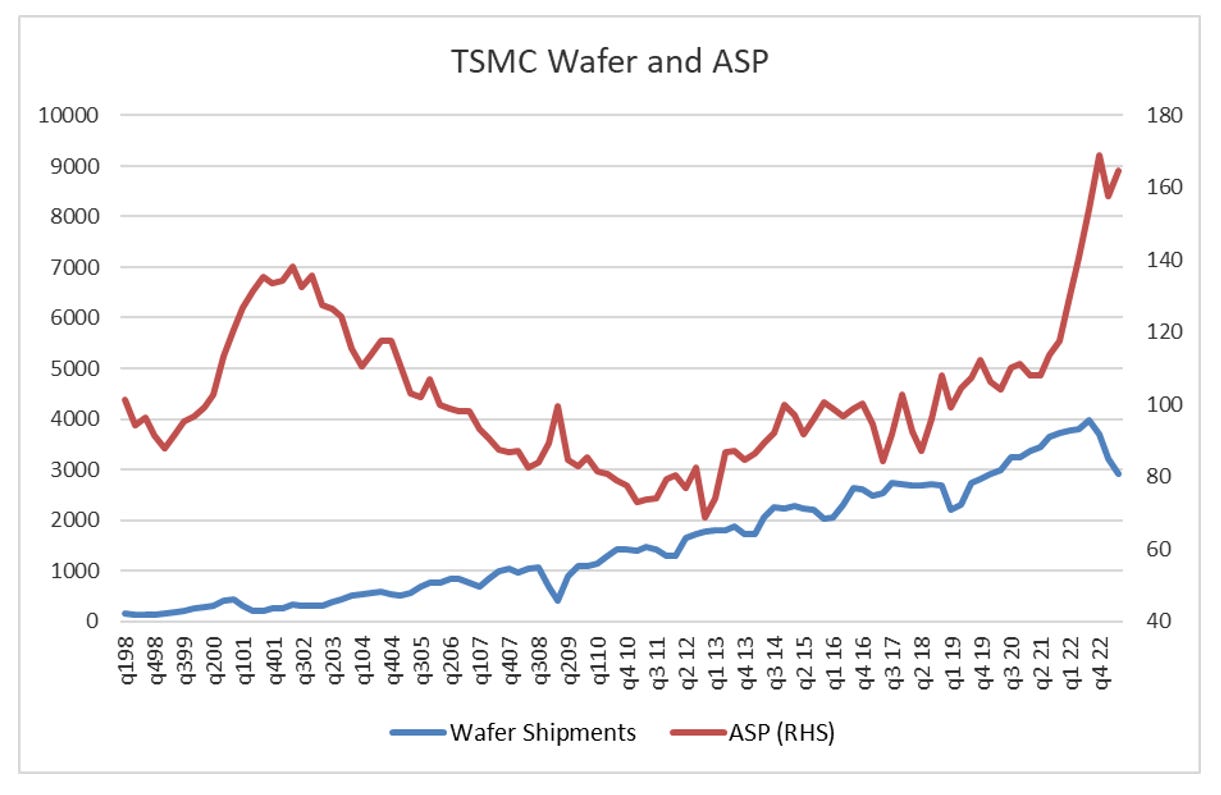

NVIDIA designs high end chips that powers cloud computing and is now powering the AI revolutions sweeping the tech industry. NVIDIA designs the chips, but TSMC builds them. TSMC is very transparent, so I always find myself drawn to TMSC data when trying to understand the semiconductor industry. . TSMC as the main supplier of high end chips was by far the most transparent company, offering clear data on both pricing and volume. When you chart volume and pricing for TSMC, two things become apparent. One is that volume always rises, except for brief dips during a recession. Secondly, that pricing drives profitability. During the dot com bubble pricing rose rapidly, and fell during the bust. In the long tech bull market since 2011, pricing has been on an upward trend.

Semiconductor inflation has been good for NVIDIA and TSMC’s profits, sales and the share price. The question is how sustainable is it? Typically, electronics are a source of deflation, and have been for a very long time. CPI of Personal Computers and Peripherals has been very indicative of this deflation, which continues today.

When we look at YoY numbers it is not so obvious that PC and computers are deflationary anymore. And as the TSMC data would suggest have been far less deflationary since 2011.

Consumers tend to be sporadic buyers of high end semiconductors. Producers and manufacturers tend to be constant buyers. Producers tend to see this more directly, and in US PPI data we can see a definite trend change.

The tech industry is naturally deflationary. The whole point is to create new products that are better for the same or lower prices ever few years. So what has caused this inflationary change? Well my best guess was cryptocurrency, which has a naturally inflationary trend, and directly links processing power to the market value of cryptocurrencies. The rise of Bitcoin seems to coincide with changing pricing regime at TSMC.

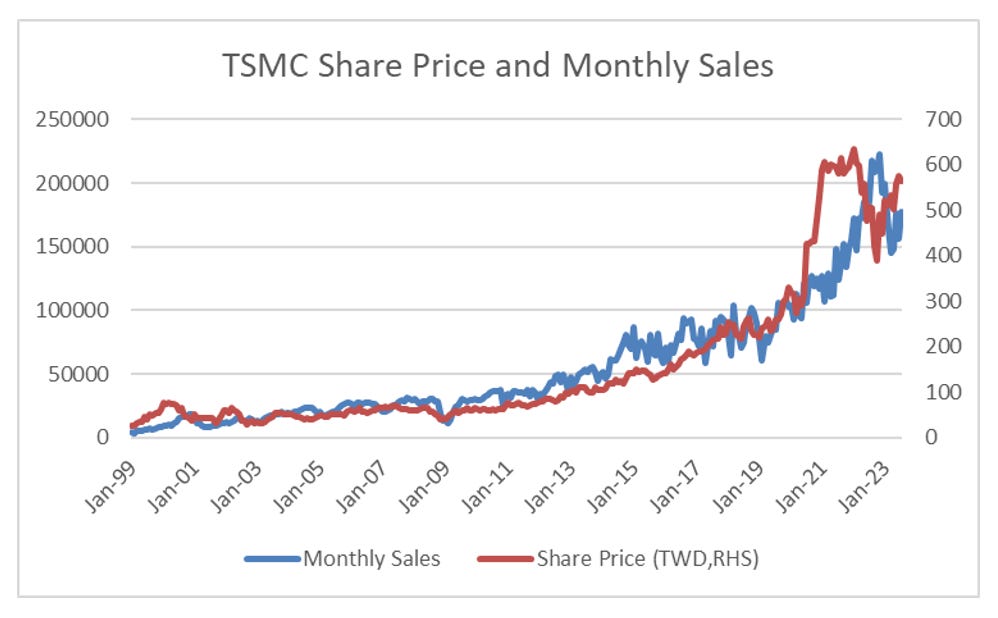

So is surging Nvidia share prices telling us that tech inflation is here to stay? Again, I prefer to look at TSMC rather than NVIDIA here. One of the other things that makes TSMC different to US tech stocks is that it has not participated in share buy backs. TSMC share price has tended to follow its monthly sales number pretty closely, and as volume sold always rises, makes TSMC a play on where semiconductor pricing is going. I would also note that TSMC share prices tends to move in advance of falling sales.

When looking at the performance of TSMC vs NVIDIA, you run high risk in NVIDIA when TSMC is not confirming, as you saw before the 2019 sell off, and the 2022 sell off. TSMC has been conspicuous in not following NVIDIA higher in recent weeks.

One proviso, NVIDIA has just committed to USD 25bn share buyback. Which as we have seen in many cases, can disrupt historic relationships between share prices (see McDonalds in previous posts). In this case, the share buy back seems extreme and potentially value destructive. I would be cautious on NVIDIA.