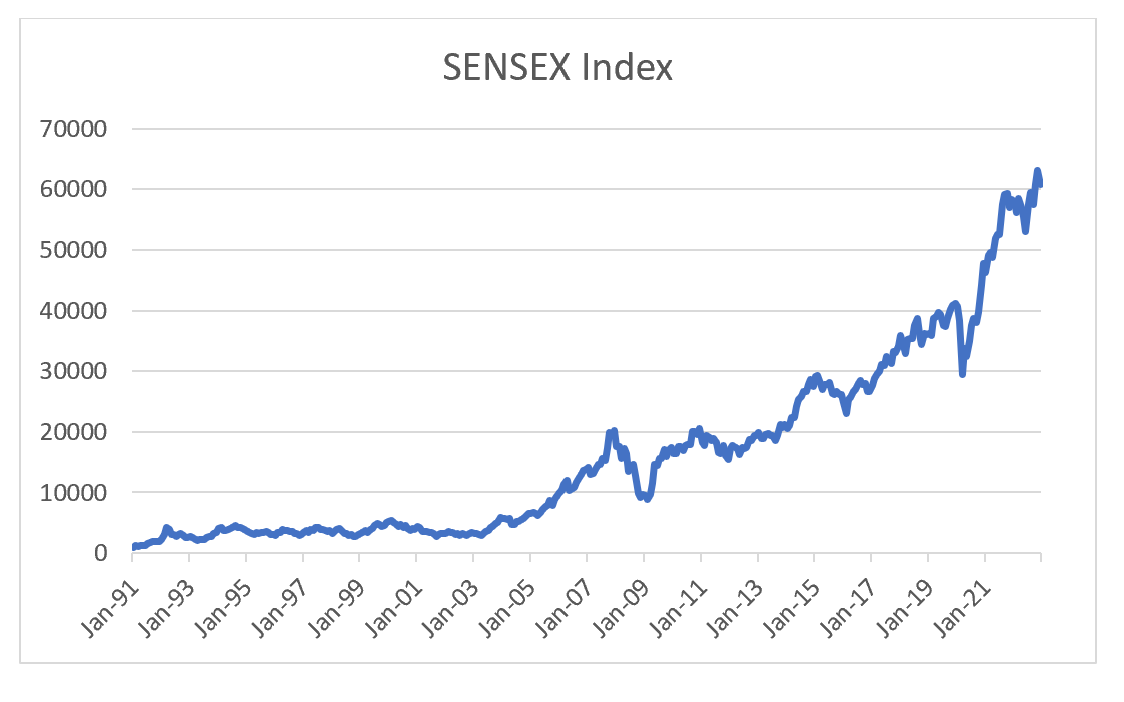

Investing in India almost sells itself. Young and growing population, and unlike China with a large focus on consumption. The US confrontation with China makes India a likely beneficiary, and a large diaspora means that India has plenty of connections with the western world. And its the world’s largest democracy to boot. This has always been the promise of India, but for the large part of my career, India has been where emerging market fund managers go to die. This might seem like a strange thing to say, as the SENSEX (the benchmark Indian Index) has been a pheromonally good performer.

However, beneath the surface of this index has been some brutal realities for investors in Indian equities.