WHAT IF TECH IS NO LONGER DEFLATIONARY?

Technology should be deflationary by definition, but crypto has created a link between loose monetary policy and technology pricing.

After the dot com bubble, there was a profound 10 year bear market in tech. The best way to understand it is to look at leading foundry (ie outsourced) chip maker TSMC. From a peak in 2001, average selling prices (ASP) fell fairly consistently until 2011, even as volume of chips sold always increased. However since 2011, the ASP has increased.

While it may seem odd to look at only one company when discussing tech deflation, TSMC has 90% market share in physical manufacture of cutting edge chips, while leading semiconductor companies such as nVidia focus purely on design and outsource to TSMC. Hence rising prices at TSMC indicates rising prices for everyone. The semiconductor industry is constantly reinvesting to improve productivity. Typically, there is a marketing term, such as 5 nanometre to indicate how sophisticated the process is. The smaller the distance, the more advanced the technology. TSMC has introduced a new 5 nanometre semiconductor. As can be seen below, this has not caused sales of the older 7/10 nanometre to fall.

Historically, the introduction of more advance semiconductor processes led to sales declines of older technologies. Particularly in 2000 and in 2006. But now we find that sales of 0.15 and 0.18 micrometre semiconductors remain at near all time highs, despite being nearly a 20 year old process. (Note 0.15 micrometre = 150 nanometre)

Many of the reasons given for the strong pricing of semiconductors do not really hold for chips that were first produced 20 years ago. The equipment is readily available, the process is widely known, and Chinese semiconductor manufacturers have already mastered this technology. However, one big difference has been the boom in cryptocurrencies, which creates an upward lift to semiconductor prices as demand for mining rigs will rise and fall with crypto prices. The upshot of rising semiconductor prices is that we are beginning to see inflation in computer hardware, and area that has traditionally been deflationary.

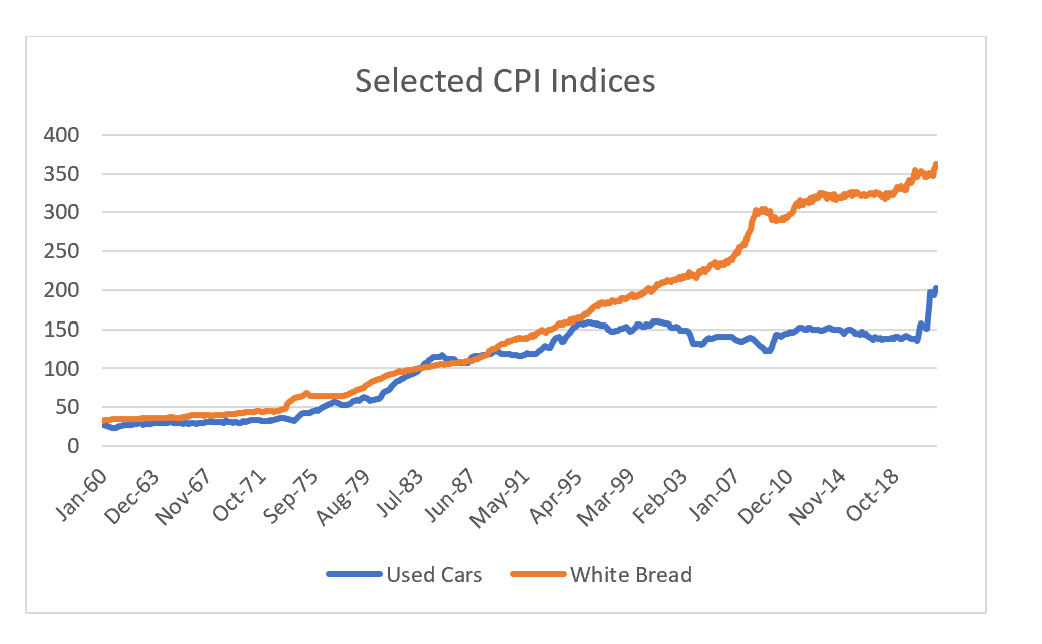

The emergence of crypto is bringing inflation to the tech industry. This is happening at a time when bread and auto prices are breaking out of prolonged periods of subdued price action.

Most Americans are likely to eat bread, drive a car, or buy some electronics. For the first time in at least a generation, they would be seeing inflation in all these areas at the same time. No wonder the Conference Board Consumer Expectations of Inflation has recently been at some of the highest levels ever seen.

If tech is no longer deflationary due to increased demand for crypto, only monetary policy that is tight enough to cause crypto to fall will be enough to control inflation. As crypto is a very new feature of modern economics, we should hold central bank’s claims of being able to predict and control inflation in even lower regard than now (if possible).