WHAT IF CHINESE CAPITAL FLOWS ARE MORE IMPORTANT THAN JAPANESE CAPITAL FLOWS?

Japanese capital flows used to be the dominant player in international markets, but China looks to be more important now.

Japan, until recently at least, played a unique role in international capital markets. Japan was for many years the largest holder of US treasuries, until overtaken by China in 2008. Recently it has resumed its position as largest holder of US treasuries, as Chinese holdings have begun to fall.

However these treasury holdings reflect foreign reserves, and hence government position in international capital markets. Private sector positioning tends to be more interesting for asset markets. A good example is Korea, which nominally shares many features with Japan, including large treasury holdings. However unlike Japan, when we strip out the government position in international investment position, Korea has historically been in a private sector deficit. Korean private sector position deteriorated significantly in 1997 and 2007, prior to the Asian Financial Crisis and the Global Financial Crisis. Japan private sector holds a surplus, which tends to explain its safe haven status versus the Korean won.

Net International Investment Position (NIIP) also offered some early warning on problems building in Europe. The NIIP between Germany and Spain rapidly widened from 2005 until 2008, before the Eurocrisis began to build in 2011.

When we look at China private sector NIIP, we find that China is still in deficit, unlike Japan and Germany and more like Korea or Spain.

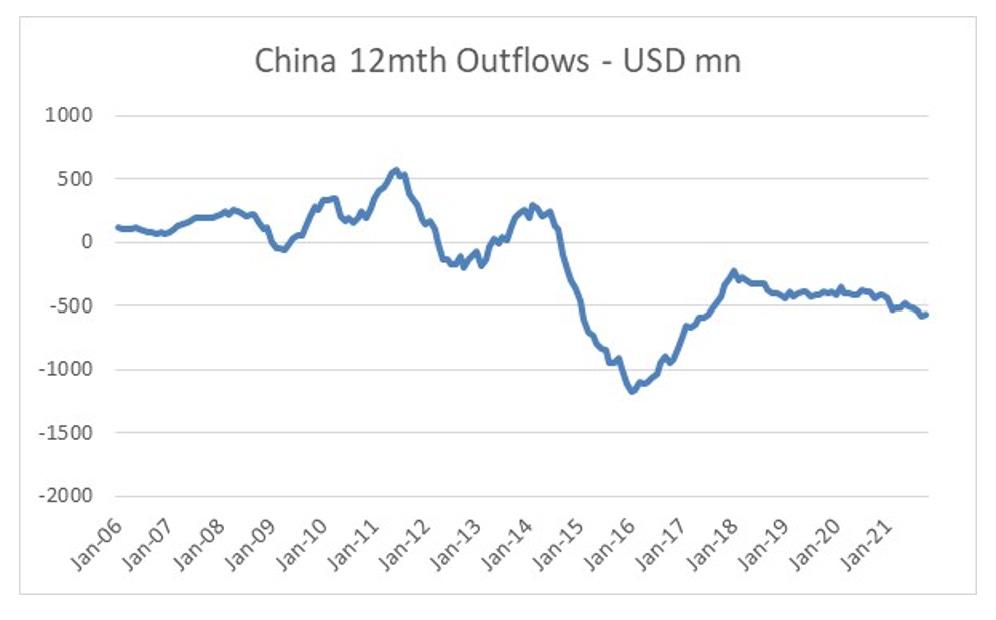

However, since 2015 the Chinese capital account and currency market have not been entirely free. Under devaluation pressure, the Chinese authorities have put intense pressure on the private sector to sell and reduce exposure to US assets in particular. This government influence has led to a big change in the relationship of foreign reserves and trade balances in China. Until 2015, it was typical to see Chinese foreign reserves to rise more than the trade surplus. Since 2015, Chinese foreign reserves have not risen with trade surpluses. The gap between foreign reserve accumulation and trade surplus we can think of foreign inflows and outflows. Since the start of 2015, the cumulative implied outflow is USD 4 trillion.

Unlike Japanese outflows, which were private sector driven, and typically yield seeking, and hence very sensitive to changes in interest rates, or currency movements, Chinese capital outflows are less likely to be influenced by yields. It seems possible that this capital flow has likely gone to the US, as the private sector NIIP has blown past any previous metric, including the dot com bubble. Since 2016, the private sector NIIP deficit in the US has increase by USD 4 trillion - in line with the missing foreign reserve build up in China.

The problem with this theory, is that if the Chinese private sector has accumulated USD 4 trillion of assets, then the Chinese private sector should be recording a large surplus in NIIP, rather than a deficit. It is highly likely that the outflows have gone unreported. One way to try and confirm this is to look at the combined surplus and deficits of NIIP, and see if there is a discrepancy. There has been variation in the combined surplus and deficits (theoretically it should sum to zero), but we can see that in recent years the discrepancy has widened from USD 2 trillion to nearly USD 5.5 trillion, which would be inline with unreported capital outflows from China.

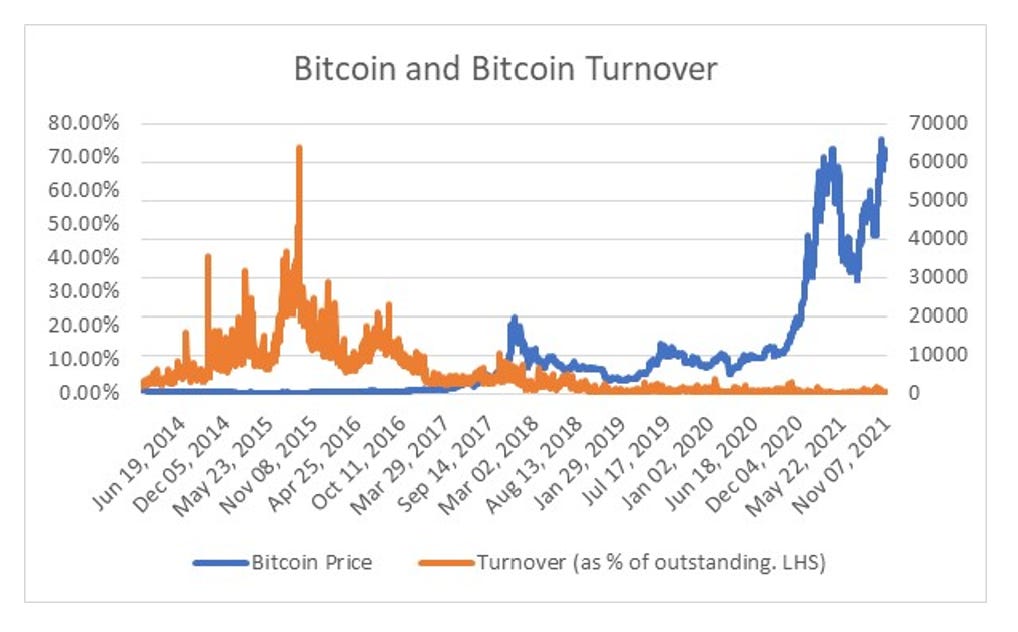

Another possible connection to outflows from China is that bitcoin volume exploded higher in 2015, when China began to suffer outflows. Turnover as percentage of outstanding hit all time highs in 2015, and has never returned to these levels, although turnover in terms of dollar value has risen dramatically. Recent Chinese government action to ban all cryptocurrency transactions hint that crypto has been popular way to move capital.

What does it all mean? It makes the big question in market, not what the Federal Reserve or the ECB going to do next. The question is what makes mainland Chinese capital outflows reverse? Falling property prices? A weaker exchange rate? Taking fright at US fiscal deficits? Your guess is as good as mine, but the data seems to indicate that Chinese capital flows already dominate market action, and a reversal could lead to dramatic change in market dynamics.