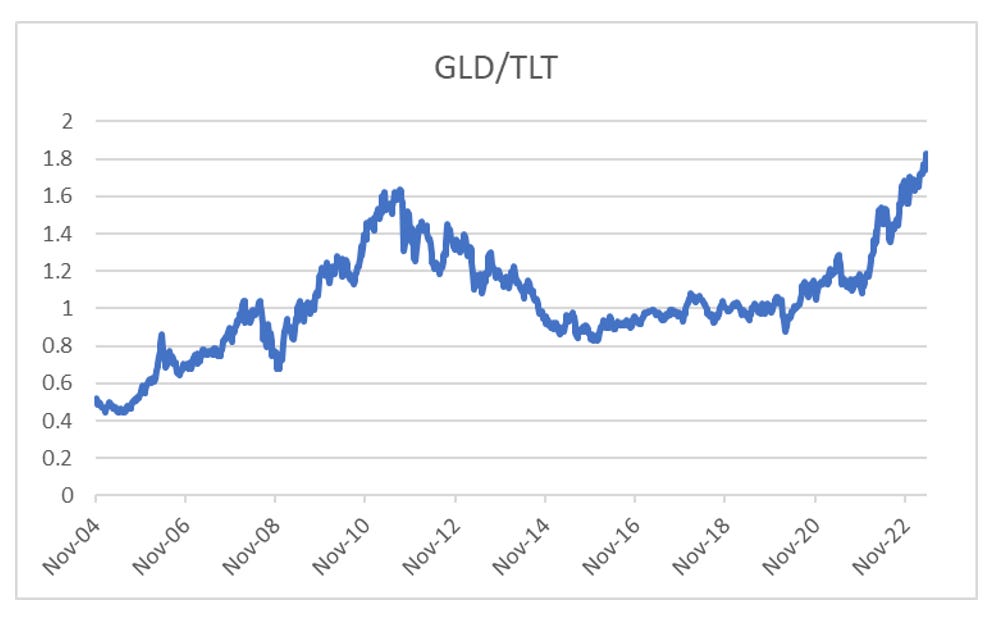

I have just got back from an epic month of travelling. I have been to Trinec in the Czech Republic twice, flying into Katovice and then Krakow airports, and then driving two hours. Its the first time I have been in Poland for 10 years at least. I have also been to Abu Dhabi for the first time in 5 years, and then to Bangalore in India for the first time in 10 years. In between overseas trip, I also made it to the almost mythical Butlins in Bognor Regis. With so much travel time, I was able to think about my pro-labour versus pro-capital theories. The core trade of GLD/TLT continues to trade well, and has broken out to new cycle highs.

On the long term graph, which uses a treasury return index, rather than TLT, it has traded well, but has yet to take out 2012 highs.

This view was driven by what I saw happen in China in 2021, when antitrust policy was aggressively enforced, and the government tried to implement a number of policies that would be pro-labour. What was deeply frustrating about 2021 for me what that my Chinese tech shorts worked great, but I kept losing money on my US tech shorts. It made a number of people, including myself think maybe I should have held on for another year, but as 2023 wears on, I find myself looking at US tech, and not seeing the mean reversion I would expect. Yes Nasdaq 100 is well off its peak, but it is up 24% from the low, and same prices as a year ago.

As a hedge fund manager that specialised in short selling, I liked to see mean reversion. That is winners becoming losers and loser becoming winners.. Mean reversion has been a part of the market since I started as a fund manager, but no longer it seems. Betting on mean reversion in the S&P 500 since 2018 or so has been a career ending move. One way to see it was that in 1999 and 2007, when one stock got to 5% of the S&P you should start thinking about mean reversion.

Showing the actual stocks in question makes it easier to understand this mean reversion idea. Microsoft and tech in general peaked in 1999. Exxon and oil in general peaked in 2008. But Apple and tech in general just keeps on going. This is slightly out of date - but as of today I have Apple at 7.4% of the S&P and Microsoft at 6.6% of the S&P 500. Berkshire Hathaway has a very sizable part of its equity tied up in Apple stock as well, and is 1.7% of S&P 500.

If you had to ask me what has changed to keep winners winning and my best guess would be that the job of pricing stocks is no longer left in the hands of fund managers, and is largely determined by the corporates themselves. Using Bloomberg data, which gives us the market capitalisation of a stock market, we can then use the price to determine the shares outstanding. When we look at the S&P 500, we can see that in 2023, the trend of buying back shares has continued.

The contrast to HSCEI is interesting.

Or in the specific case of Apple, we have seen shares outstanding fall dramatically.

Apple has continued to buy back stock, even as its earnings yield has been lower than its bond yield.

And to be fair, with Apple bonds yielding so much less than inflation, what is wrong with buying back shares?

So why is there such a big divergence between China and the US? There are two reasons that I can see. One, Chinese policy making is unified, so when the CCP decides that large corporates need to be cut down to size, all branches of the government work in unison. While in the US, you could make convincing arguments that there are significant parts of the governments with a strong pro-capital bent. And that corporate lobbying is still very effective in the US, while totally ineffective in China. This argument would then lead to a very bearish outlook for the US. That is the pro-labour shift is still happening, just slower.

The other argument that has been brought home to me in my travels, is that globalisation and capitalism is very effective in flattening income differentials between countries. Does that then mean deglobalisation will see income differentials between countries open wider? Is the success of the Nasdaq, and the weakness of the HS Tech represent the US moving in its own ecosystem, and becoming vastly wealthier than the rest of the world? If so, then winners are going to keep winning.