Over the last two years bitcoin, and the crypto space in general has traded more like a liquidity driven speculative asset and less like the digital store of value that its promoters promised. There are many, many, many dodgy operators in the cryptospace, but I do respect Plan B’s efforts to try and value bitcoin in some sort of intellectual framework. His Stock-to-flow model has bitcoin as a buy now. Green shading is seen as an optimal moment to buy, and unusually in this model, green is far below the model value. If the model is correct, then bitcoin offers very large returns over the next few years.

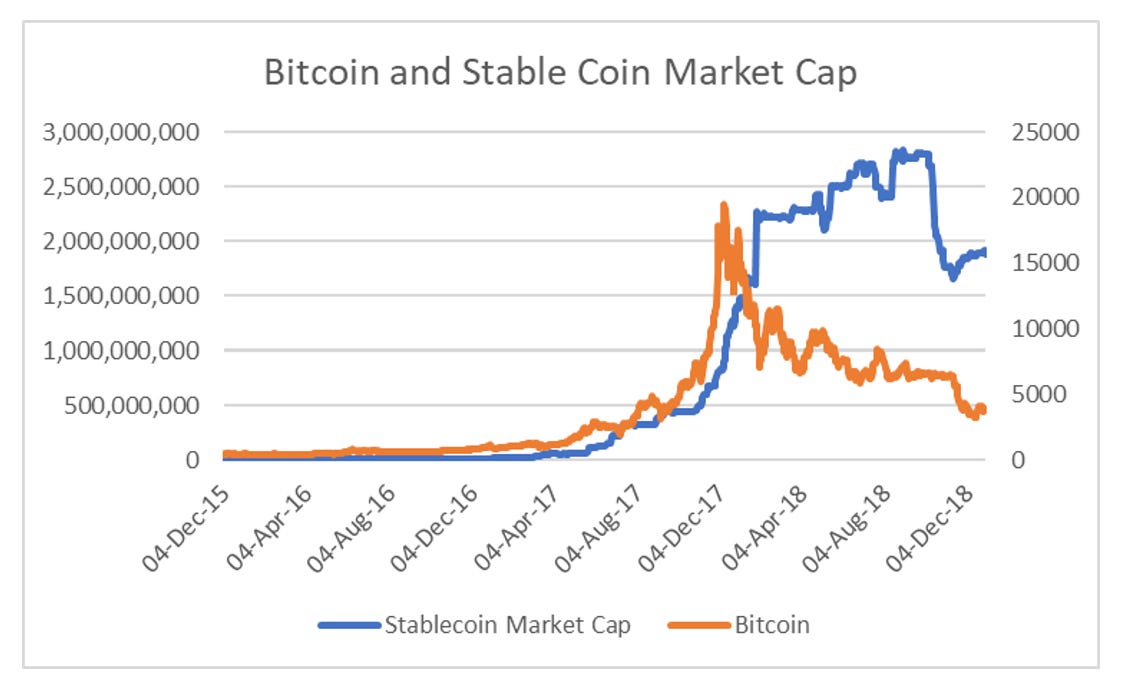

How do I look at liquidity? Well the market capitalisation of stablecoins seems like a good proxy for retail flow and activity. If you look at the first big bitcoin break out, stablecoin market cap surged.

In recent years, stablecoin market cap and bitcoin have both had a parabolic rise. What I find very bearish about this is that bitcoin has traded sideways from mid 2020, even as stable coin market cap has nearly tripled over this time. Currently stablecoin market cap is USD 129 bn.

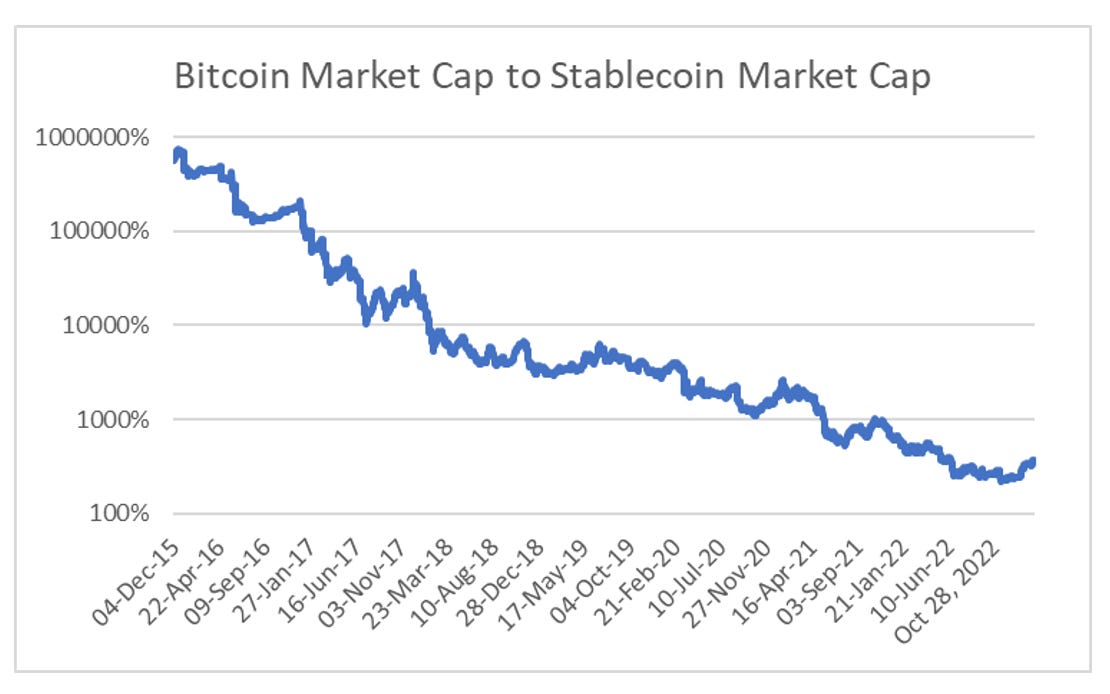

So when I look at the bull run of bitcoin in 2017 and then again in 2020, stablecoin saw its market cap rise 6 times. But what we have seen is that the relationship of stablecoin market cap to bitcoin market cap has been declining over time. That is you need more stablecoin relative to bitcoin.

These two observations, that a surge in bitcoin coincided with a surge in stablecoin market cap, and that this relationship requires more stablecoin over time gives you a target of USD 1tn of market cap to stable coin to help drive a bitcoin boom. This may be possible, but with 2 year treasury yields at nearly 5% and the highest in 20 years, is it really likely that crypto can attract the entire deposit base of say JP Morgan?

What I am trying to say is that the law of big money is beginning to work against the crypto world. The flows needed are getting very large, and in contrast to 2017, or 2020, fiat currency is offering some stiff competition. Liquidity suggest bitcoin is dead money absent a big change in monetary policy, while stock to flow policy suggests huge upside. There are a couple of bullish signs for bitcoin. CFTC data shows that futures position is now negative again, leaving room for a squeeze higher as happened in 2020.

We can also see the market is extremely bearishly positioned in the former software, now listed bitcoin proxy, Microstrategy. With 33% of its shares outstanding shorted, a squeeze in bitcoin could easily lead to a squeeze in Microstrategy. The market cap of Microstrategy is only USD 3bn, so while it dose indicate bearish sentiment, it does no counteract the big money needed to drive higher stablecoin market cap.

Ultimately, why take the risk on crypto when short term treasuries yield so much? One for the true believers.