The movement to pro-labour world seems to be everywhere but the stock market at the moment! But politically, the barriers to a pro-labour shift have been building for some time. US net worth to GDP has been pushing at levels not seen since at least pre World War II. This is last updated to March 2023 levels.

US Unit labour costs have begun to surge.

Although when we look at this on a log scale, we can see that this have barely begun to move.

Despite US unit labour costs being stagnant, individual tax revenue has risen significantly, while US government corporate tax take is at levels first seen in 2007. Not hard to see how heavily skewed US policy has been towards corporates and away from individuals.

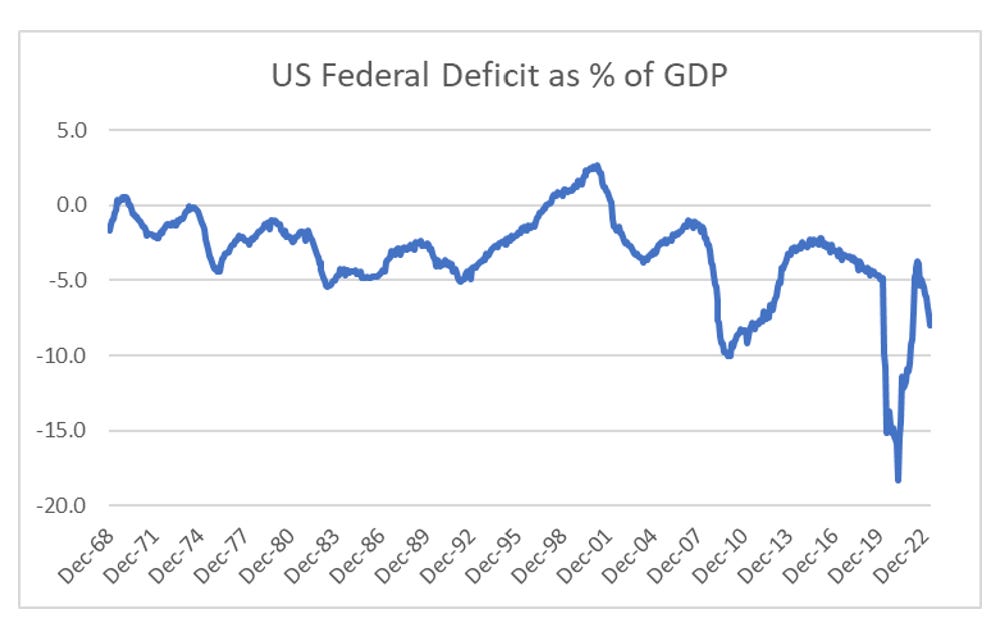

The problem is that increasing the tax take on income earners is no longer able to balance the budget. The most obvious reason for this is that the GDP share to corporates have grown so much. This is a natural consequence of incentive structures that are hostile to individuals and welcoming to corporates.

It has been obvious that both Trump and Biden have sought to win over labour, as these votes have been up for grabs. However neither President has been able to find a way to pay for it. At some point, the dynamics of large amount of debt, and rising interest rates will force an increase in tax collection. Political calculation would suggest corporates. When even the Republican Florida governor is hostile to Disney, you know the world is changing.

Change does seem coming closer in financial markets. As noted before, markets are pricing in more default risk in US treasuries than Apple bonds.

Even with the debt ceiling agreement, CDS on US treasuries are higher than Apple CDS.

The CDS spread above implies that politicians would prefer to default than tax corporates. But one thing is for certain, politicians go where the voters are. The logic of taxing and taking on corporates are getting hard to ignore. Voters are already drifting this way. Right leading parties have been bleeding voters to nationalistic and populist parties for years, and have already remade the UK conservative party and US republican party in their own image. The middle ground already lies in the tax (corporates) and spend (on workers). The spending part of politics has already been realised, the taxation is coming soon. Fiscally liberal and culturally conservative seems to be new centre. A tax on share buybacks seems a good place to start.