THE END OF THE MINING BUBBLE

“Mining companies have reported record profits on the back of an expanding Chinese steel industry. However, the financial health of the Chinese steel industry is deteriorating rapidly.

In my investment career, I have seen two investment bubbles deflate. The first was the dot com bubble of the late 90s early 2000s, and the second was the US housing bubble, which ended with the financial crisis of 2008. While there are many drivers for investment bubbles, loose credit is often amongst them, I have also noted that investors often base decisions on a fundamental belief that is ultimately proven wrong. In the case of the dot com bubble, heavy investments were made in technology related areas on the belief that internet traffic was doubling every 100 days and would continue to do so, (see http://www.economist.com/node/1234733). The housing bubble in the US was driven by the belief that the US could never suffer a fall in nationwide house prices.

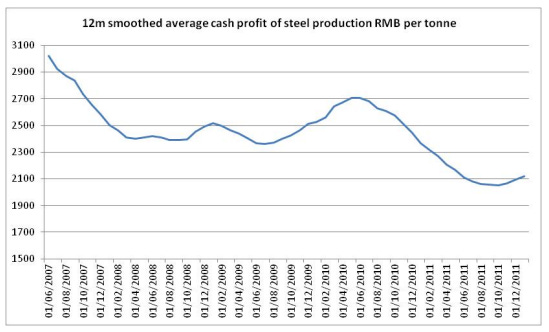

Recently, I have noticed that mining has begun to suffer from its own “belief” driven investment. In its most basic form, it comes from the belief that Chinese steel production can only rise further as this has been the experience of other steel industries in east Asian markets. The presentation that I found on the internet from Rio Tinto is a classic example of this market belief, (see http://www.riotinto.com/documents/111128_Rio_Tinto_Investor_Seminar_slides.pdf - page 36). However, the market belief of an ever increasing Chinese steel industry is beginning to run into ever more depressing commercial reality. As noted in my previous note on iron ore, cash margins at Chinese steel producers are declining.

However, lower margins have not caused Chinese steel production to decrease, but in fact it has increased to a new record level, and together with a new record share of world steel production.

Rising steel production with falling cash margins has left the industry with static aggregate profit despite a big increase in production.

The profits numbers have been estimated by taking the cash margin and multiplying it by steel production. While this is only an estimate of industry profitability, a large part of the Chinese steel industry reports profits either to the HK Stock Exchange or to Chinese stock markets. The aggregated numbers below are based on 19 Chinese steel companies, including 7 out of 10 of the largest producers.

While a little cumbersome, the aggregate shows that operating profit for the industry is running at below 2004 levels. More worrying, leverage ratios are showing signs of distress.

2011 full year numbers are not out yet, but quarterly numbers have shown further deterioration at Chinese steel companies.

What the above ratios show to me is that despite declining profitability in the Chinese steel industry, capacity has only been increased through the extension of credit. This is adding to the risk that we may see major consolidation in the Chinese steel industry.

I observe that Alcoa in their fourth quarter presentation note that one third of Chinese aluminium smelters operate at a loss (http://www.alcoa.com/global/en/investment/pdfs/Alcoa_4Q11_Earnings_Presentation.pdf - page 37). The above analysis makes me believe that a similar percentage of the Chinese steel industry is marginal, and could also close if demand slows.

Recent results from large listed mining companies show that they have become very reliant on profits from their iron ore divisions. Rio Tinto (“Rio”) reported a 10% increase in EBITDA in 2011, from 26bn USD to 28.5bn USD. However the iron ore division alone had profits grow from 16.6bn USD to 20.9bn USD. BHP Billiton (“BHP”) in half year to 31/12/2011 results reported an increase in EBITDA from 14.8bn USD to 15.7bn USD. Iron ore reported an increase in EBIT from 5.8bn USD to 7.9bn USD. BHP also saw a big increase in its petroleum business. The other mining businesses produced negligible growth. Operating margins in iron ore for both BHP and Rio were over 60%.

One final observation on mining shares is that they are often used by investors as a hedge on inflation, particularly due to the very loose credit conditions that currently prevail. The highest period of inflation in the western world (ignoring the Weimar Republic) occurred during the 1970s and early 80s. See below the share price of BHP (in Australia dollars) from 1968 to 1985.

The above period coincided with very high inflation. Investors in BHP lost more than 90% in real terms, and took 17 years to break even in nominal terms.

Mining companies have reported record profits on the back of an expanding Chinese steel industry. However, the financial health of the Chinese steel industry is deteriorating rapidly. The potential for a substantial move lower in commodity prices and mining stocks is rising in my view.