THE END OF THE JAPANESE FARMLAND BEAR MARKET?

Japanese farmland is difficult to purchase, even for Japanese nationals. So how can you get exposure to a rise in farmland values?

At the peak of the bubble economy in 1991, Japanese farmland was worth six times as much as US farmland according to US data from the US Department of Agriculture (‘USDA’) and Japan data from the Japanese Real Estate Institute (‘JREI’).

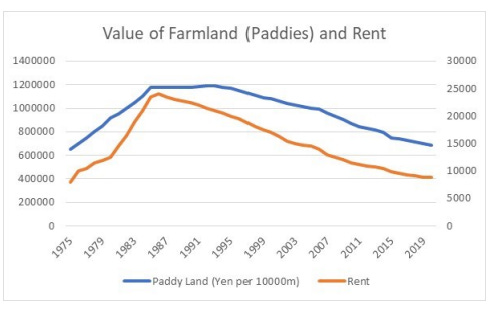

While the above chart shows Japanese farmland values being constant from the late 1980s to the 2010s, in Yen terms it has been falling. According to the most recent report on Japanese farmland from the JREI Japanese farmland values have been falling continually since 1993, and rents have been falling since 1987.

The fact that Japanese farmland is trading below US farmland values is surprising, as Japanese food prices tend to be higher than US prices for agricultural products. Japan is both a large producer and importer of US pork, but wholesale pork prices in Japan are usually 2 to 3 times US prices.

One reason for fewer farmland buyers has been the contraction of the Japanese pig farming industry. The number of farms has fallen by nearly 90% while the number of pigs farmed has fallen 20% since 1991.

However, the emergence of China as a large importer of pork could change the fortunes of Japanese pig farmers. China now imports more pork from the US than Japan.

Chinese pork prices have now also moved above Japanese pork prices.

Japanese farmland is difficult to purchase even for Japanese nationals. However, most Japanese bank lending uses land values rather than building values for collateral (earthquakes have made building values unpredictable). If land values start rising, then Japanese banks should also begin to benefit. Japanese banks, just like Japanese farmland have roundtripped back to the 1975 index levels after spiking higher in the 1980s.

Both Japanese land and Japanese banks look like beneficiaries of rising food prices in Japan.