THE COMING IRON ORE DEFICIT

Iron ore miners have cut capex as iron ore prices have fallen, but we are now seeing a structural increase in demand as China phases out is own mining industry and India is beg

Chinese steel production has stabilised at relatively high level, while Chinese iron ore volumes have begun to decline.

While recently declining Chinese iron ore volumes explain the recent increase in Chinese imports of iron ore, further analysis shows that the quality of Chinese iron ore that is currently produced has deteriorated to such a level that most Chinese iron ore production is probably uneconomic.

China, unlike the rest of the world, reports its iron ore volumes in gross terms; it does not adjust for declining iron content within its production. We can calculate the iron content of Chinese iron ore by taking total steel production, working out the iron ore needed, subtracting iron ore imports and putting the remainder over the total iron ore production volume. This method suggests the implied iron content of Chinese iron ore has fallen from 55% in 2004 to 10% today.

Recent government announcements have focused on reducing pollution in China. One method has been to reduce the usage of low quality iron ore, as iron ore with low amounts of iron content require the burning of more coal to get rid of impurities. It seems likely that China will look to phase out its iron ore industry in the next few years. Over the last twelve months, China used 173m tonnes of domestic iron ore, to supply 13% of total Chinese iron consumption.

India recently overtook Japan to become the world’s second biggest producer of steel and now produces at roughly the same level as China did in 2001. On a per capita basis, India still greatly lags behind most economies.

India plans to increase steel production dramatically. Official targets of the National Steel Policy include 300m tonnes of production in 2030 from 100m today. http://www.livemint.com/Industry/M3OTLQswKIIJaX2OELIusK/Cabinet-clears-National-Steel-Policy-2017-for-higher-product.html The general view is that India will struggle to increase its steel production so quickly. I would argue the opposite. Indian banks have struggled with bad debts since 2010, much of it related to credit stress from the steel industry, as China flooded the markets with cheap steel. Chinese exports of steel are now falling, and steel margins globally are recovering. That India has been able to grow steel production at CAGR of 7% while commercial loans have been falling in nominal terms, suggests a recovering banking and steel sector could see a steep acceleration in growth rates.

However, India’s original target for 100m tonnes of steel capacity was 2020, and it looks likely to surpass this target 3 years early. To my mind, India looks likely to see a significant growth in steel production comparable to the Chinese steel industry growth from 2001 to 2006, when steel production tripled from 100m to 300m tonnes.

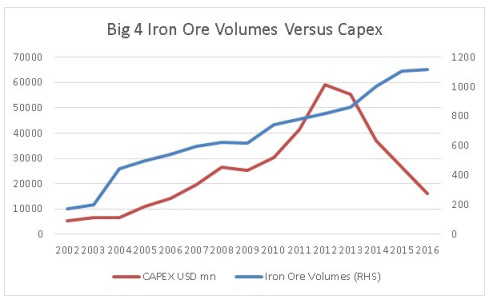

The big 4 listed iron ore producers are Rio Tinto, Vale, BHP and Fortescue. Below is their combined capex and combined iron ore volumes.

Of the big four, volumes have stopped growing at BHP and Rio Tinto. The fall in capex is already affecting volume growth. Volume growth seems to slow five years after capex peaks, suggesting capex would need to increase now for any large increase in volume 5 years from now.

If we assume that Chinese iron ore production is phased out, and India hits its steel production targets, iron ore volumes would need to increase by 500m tonnes. To be conservative, we can assume only 80% of the growth needs to come from the big 4, implying 400m tonnes of new iron ore volume.

Fortescue, the newest of the big 4, spent close to 19bn USD to reach current production rate of 200m tonnes a year. Hence, 400m tonnes would probably require close to a 40bn combined capex.

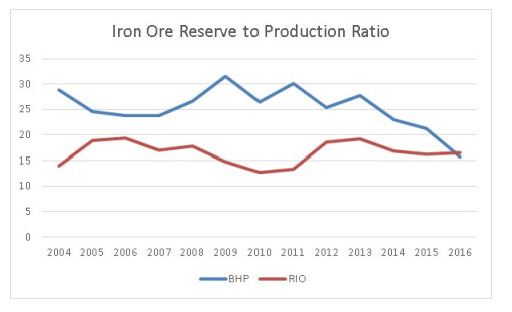

However, this capex number looks too low. The problem is that both BHP and Rio Tinto have seen reserve production ratio for iron ore drop quite significantly in recent years. This implies that they have not spent enough on finding new iron ore, as recent capex has been too low. It also implies that existing production may see declines without increases in capex as old mines become depleted.

The reality is that the iron ore miners have cut capex as iron ore prices have fallen, but we are now seeing a structural increase in demand as China phases out is own mining industry and India is beginning an infrastructure build. It also seems to me that the market is aware of the need of higher capex from mining companies. This can be seen from the historically unusual disconnect between companies providing mining equipment stock e.g. Caterpillar, and large iron ore producers e.g. Vale.

The miners are looking to pay down debt, so an increase in capex would have to come from an increase in earnings. Iron ore prices look too low to me.