THE CAPITAL DESTRUCTIVE NATURE OF THE US SHALE INDUSTRY

Ultimately, the US fracking industry has become an industry that transfers wealth from capital providers to land owners.

The development of “fracking” has transformed the energy markets, with the US seeing a massive increase in its production of both gas and oil.

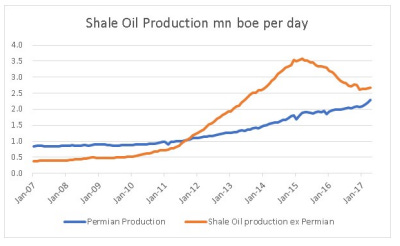

The entire oil industry underperformed as the oil price collapsed from 2014 onwards. But as can be seen, US Oil production has begun to increase over the last year. This has been driven by two factors. Firstly, huge growth in Permian basin drilling, which the oil and gas industry tout as having the potential to have more oil than Saudi Arabia. The second is claims by the industry that process improvements have driven the cost of production much lower.

Certainly, US oil production has become dominated by the Permian basin.

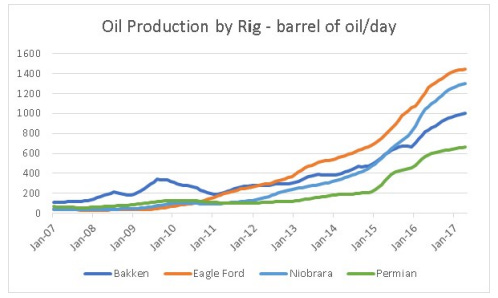

Shale drillers have managed to improve efficiency by getting much larger production per rig.

This has been achieved by increasing the number of wells drilled per rig, and by also drilling stacked plays, where they drill basins that are stacked on top of each other. Drillers have also drilled longer laterals (lateral is the length of horizontal drilling) and also reduced spacing (so that there is less space between rocks when broken up to get the trapped oil and gas).

The problem with the technological improvements of shale producers is that they require the drillers to own land where the basins are stacked and closer spacing is profitable. Of all the shale regions in the US, the Permian basin is the best suited for the technological improvements in drilling. This explains the big increase in shale production from the Permian even as other regions have seen production fall.

The big capital cost for drillers is not rigs anymore, but land. The problem for shale drillers is that the US land market is very efficient, and land values in the Permian have adjusted higher substantially. http://www.cnbc.com/2016/12/16/land-rush-us-oil-drillers-pack-into-the-permian-basin.html

Higher land values, means that profitability of the shale industry need to increase too, to cover the higher depreciation. Unfortunately, shale drilling wells tend to last only 10 years or so, with half of all production extracted in the first 18 months. That means the driller needs to fully depreciate capital expenditure over a relatively short period of time. High land values mean that after depreciation almost all profits are wiped out. This explains why despite improving technologies, shale producers have a continual need to issue equity.

Ultimately, the US fracking industry has become an industry that transfers wealth from capital providers to land owners. If we consider these stocks as plays on the land prices in the shale regions, rather than as oil plays, then the way these stocks trade make more sense. Given that drilling acreage prices have risen so much, the upside to shale drillers seems limited to me, while the downside is potentially large.