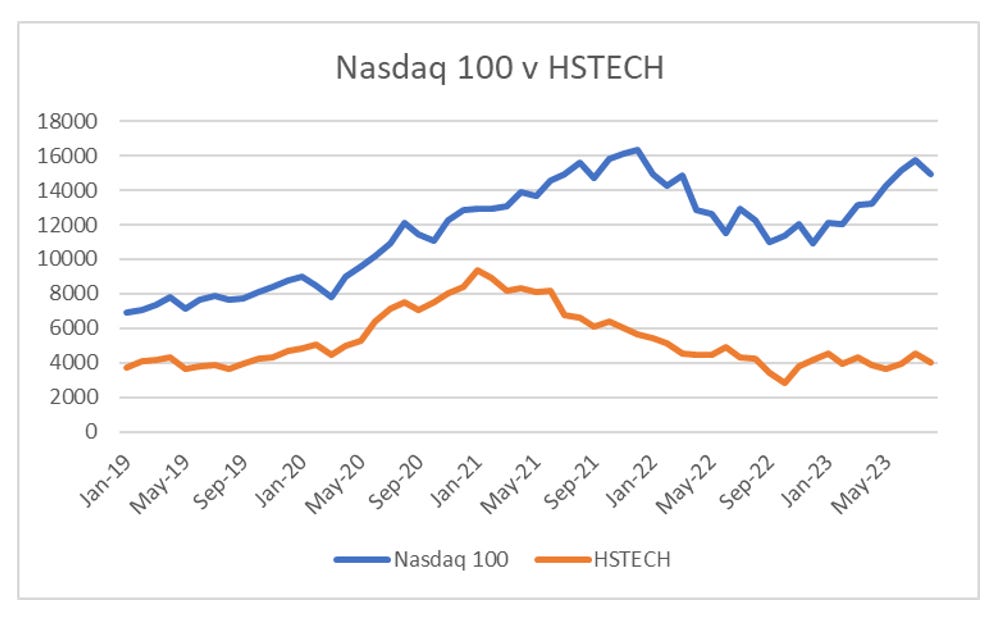

Since 2016 or so, it has been obvious to me that macro was not working the same way as before. The problem was trying to work out what has replaced macro, and how to monetise it. The big observation for me in 2021 was that politics was actually dominating economics, and I needed some time away from markets to develop a political model of investing. The most profound feature of a politically driven market has been the stark divergence in Chinese and US tech stocks. the only reason for the divergence has been different political regimes - where the US is very pro-capital, and China is very pro-labour (almost anti-capital).

Once I started looking at the world from a political point of view, I started thinking that we were beginning to see a shift from pro-capital policies (which are naturally deflationary) to pro-labour policies (which are inflationary). Pro-labour policy choices both help cause, and are driven by commodity inflation. In particular, when food prices are rising, politicians and governments come under real pressure to “do something”. The still elevated CRB Food Index is a good sign of this pressure.