The open secret of this Substack is that it has been a place for me keep thinking about markets, while not having the pressure of managing other people’s money. Why? Well in my time managing money, I developed a system based on asset flows that used to predict the system almost perfectly. And even more usefully gave a way of managing money that was very different to other people. It would great from 2011 to 2016, but started being sporadic from 2016, and completely broke down during Covid. So 2021, I gave capital back, and started this Substack in 2022. If you want to know how my model broke down - please look here:

Over the last year, I have been developing a “pro-labour” investment theory. The core idea is that China is moving away from “pro-capital” policy towards “pro-labour” policy. Key features of this is breaking up tech monopolies, and actively seeking to weaken property prices. The contrast of the performance of Chinese tech companies to US tech companies is extreme. Hang Seng Tech Index includes most well known Chinese tech companies.

My assumption was that pro-labour policies would be bad for markets. First of all, labour would get more of the pie, secondly inflation would be stronger than expected. Thirdly strong inflation would lead central banks to be much more hawkish (as they tried to create asset deflation to offset wag inflation). With these assumptions, I guessed that commodities would do better than expected and bonds would do worse. So I like the trade, long GLD / short TLT (GLD is a gold ETF and TLT is a long dated treasury ETF). This has performed well.

I was bearish to neutral on US assets. Pro-labour shift for me means that nominal demand is strong, but this is offset by much tighter financial conditions. Using the KDP High yield daily, this is what we can seen, with high yield trading for a year, at the levels we saw in bear markets (only corrections in some case) in 2015, 2018 and 2020.

Despite higher yields on corporate debt 2023 has seen Nasdaq rally 23%, and the Dow Jones is barely off all time highs.

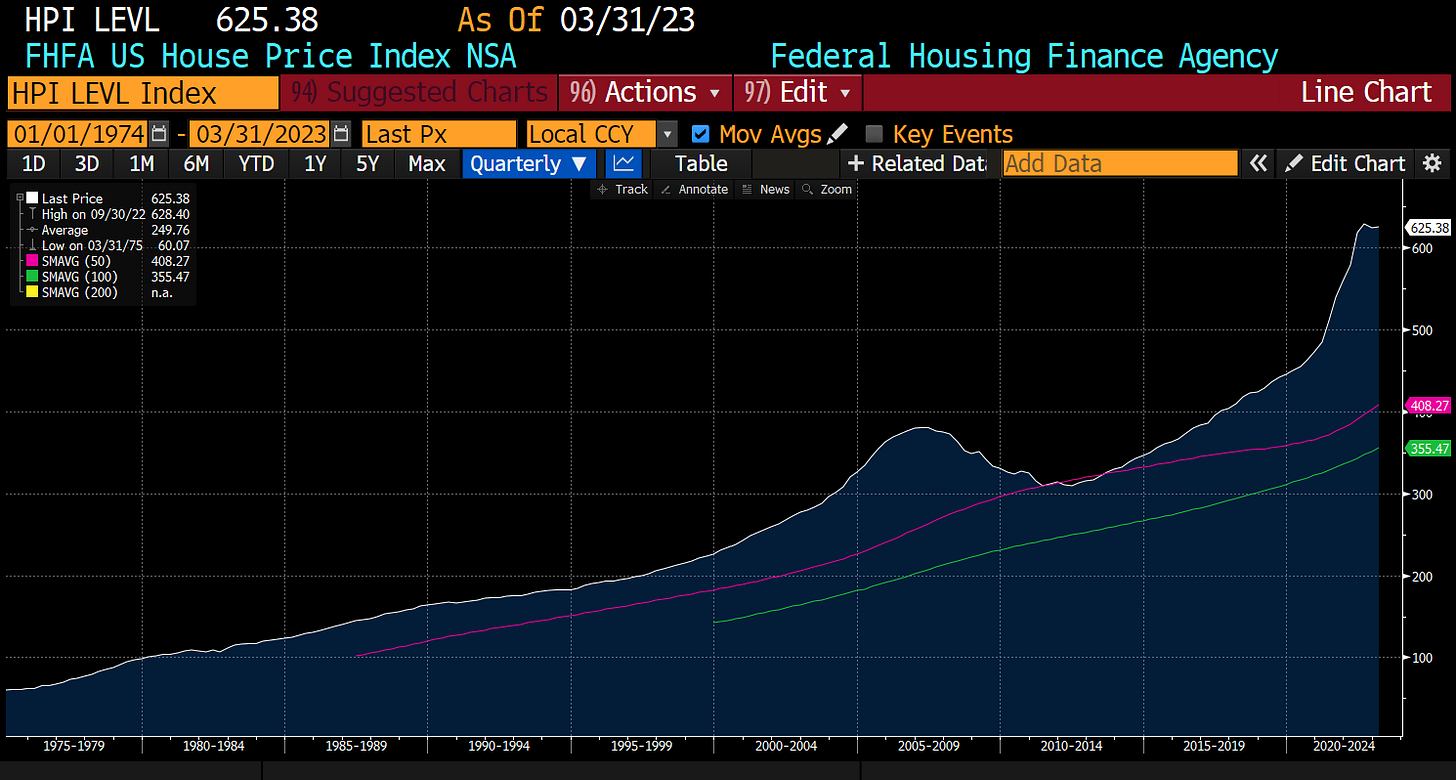

At first thought, this made me think that I was potentially wrong about pro-labour policies shifting from China to the rest of world. But this is a “political analysis” not a financial analysis. For most voters, the asset that is most important is housing, not stock markets. When we look at US or UK housing prices, then the pro-labour shift is more apparent, if only slight.

Same for that other bastion of capitalism, the UK.

Why have stock markets been so strong in 2023? First there have been a (small) let up in food inflation.

Secondly, a shift to pro-labour in my mind means we need to get used to the idea of no recessions. To help you with this idea, name a large recession in 1950s or 1960s? You cannot, as there wasn’t. So Initial Jobless Claims is not going to weaken in my view. The last few years is the “new normal”

In a pro-labour world, I still think commodity demand is stronger than expected, and inflation remains higher than expected. Which is why I like GLD/TLT so much. I cannot understand why Joe Public likes TLT so much, but hated gold still.

So why have equity markets been so good? Combination of weak energy prices and surprise at the resilience of employment. I suspect the next move is higher bond yield and higher commodity prices.