SPOTTING PROPERTY BUBBLES IN EAST ASIA

Typically a country that is undergoing a property bubble will exhibit some very easily identifiable characteristics.

Typically a country that is undergoing a property bubble will exhibit some very easily identifiable characteristics. As credit flows into the economy, inflated property prices and increased domestic demand tend to cause the country in question to suffer from a large current account deficit.

Ireland shows this relationship.

This relationship also held in the recent US housing bubble. As a general rule this works, however it failed to provide a useful signal in the biggest property bubble in living memory – the Japanese bubble economy of 1980s.

Japan’s current account remained in strong surplus even as property prices surged.

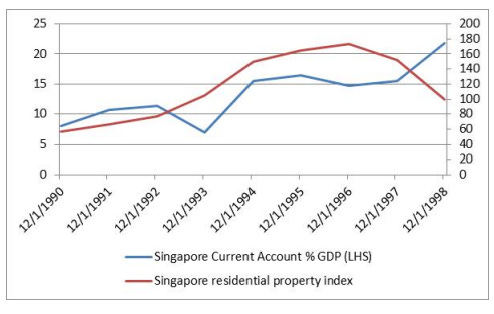

Perhaps even more intriguingly Singapore did not even see a dip in its current account before it saw a major fall in property prices in the late 90s.

What makes Japan and Singapore different from the US and Ireland? The key differences are that both Japan and Singapore have export driven economies with (at the time of the property bubbles anyway) very high savings rates. This meant that credit fuelled domestic demand could be easily met with domestic investment and production. This means trade data is not going to provide a good sign of a property bubble in export driven economies with high savings rates. In such economies we need to look more closely at direct credit flows to get a better idea of whether a property bubble is inflating.

One area that I have been looking at is borrowing in foreign currency from foreign banks to countries with property bubbles. The theory being that as the bubble grows, more and more credit would be drawn into the property sector and corporates would need to borrow more from overseas. To get around the problem, that naturally growing economies tend to have more debt, I look at the net positions of countries, in order to get an idea if borrowing is growing faster than it should. The following data is all taken from BIS and is in USD millions.

The net position of banks seem to offer at least an idea of where danger may be building in the system. One problem is that the BIS data is presented with a 6 month lag. This leads to the natural question, are there any other countries in East Asia with high savings rates that are showing a sharp increase in foreign bank borrowing?

Investors should be aware of the rising risk in Chinese and Singapore property.