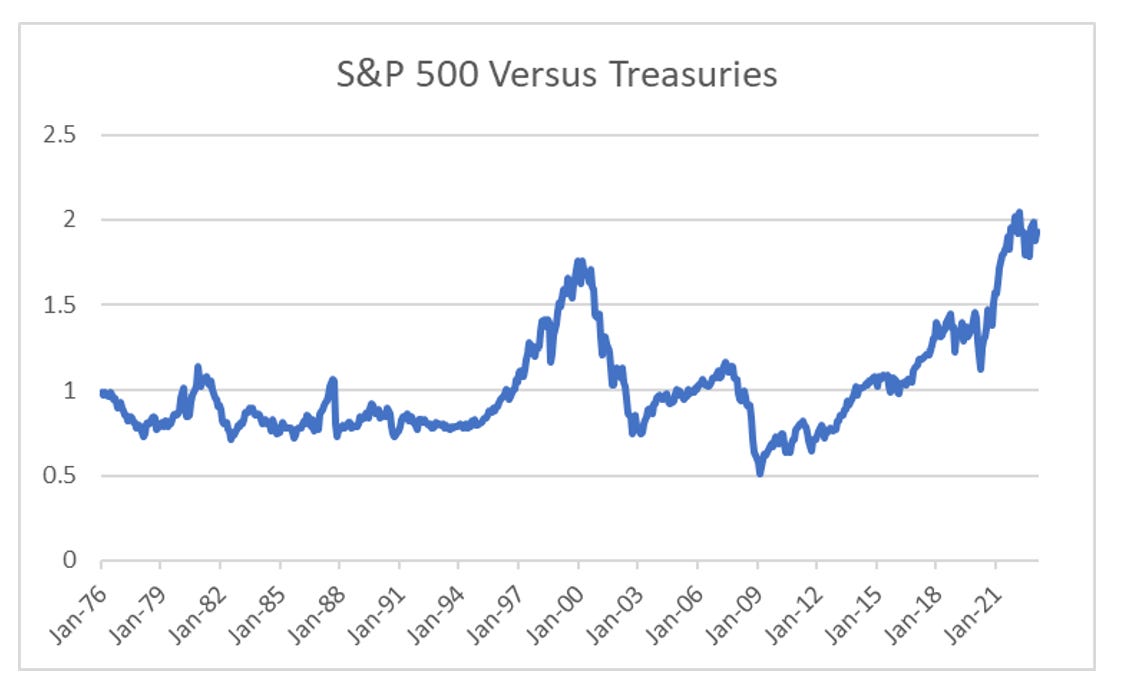

Stock market lore has it that the most dangerous words in investing are “this time is different”. That may be true, but when someone is called the “next Warren Buffett” must run a close second. In recent years, Cathie Wood, Sam Bankman-Fried and Chamath Palihapitiya have all been called this (I suspect Chamath probably called himself the next Warren Buffett). For the grey haired out there, you may well remember Eddie Lampert and the Sears saga also had the “next Warren Buffett” moniker thrown around, and Ackman was being called the next Warren Buffet before Valeant debacle. Needless to say, getting called the next Warren Buffett has been more a sign of the top in each investors investing strategy. What Buffett has really got right was to always be invested in equities over bonds. My formative years looking at Japan, and then the US made me think you wanted to be long bonds, and short equities. Looking at the performance of the S&P 500 versus a treasury index show that since the GFC, equities have been the place to be.

The Japanification of the world made me think bonds would always outperform equities, and I was wrong on that. But what I admire about Buffett was to build a business and process to allow me to monetise that view as efficient as possible. How did he do that? If you take a close look at Berkshire Hathaway, the insurance business is the beating heart of the company. This is Buffets view as well. Its starts with National Indemnity Company (NICO). Below is taken from their website.

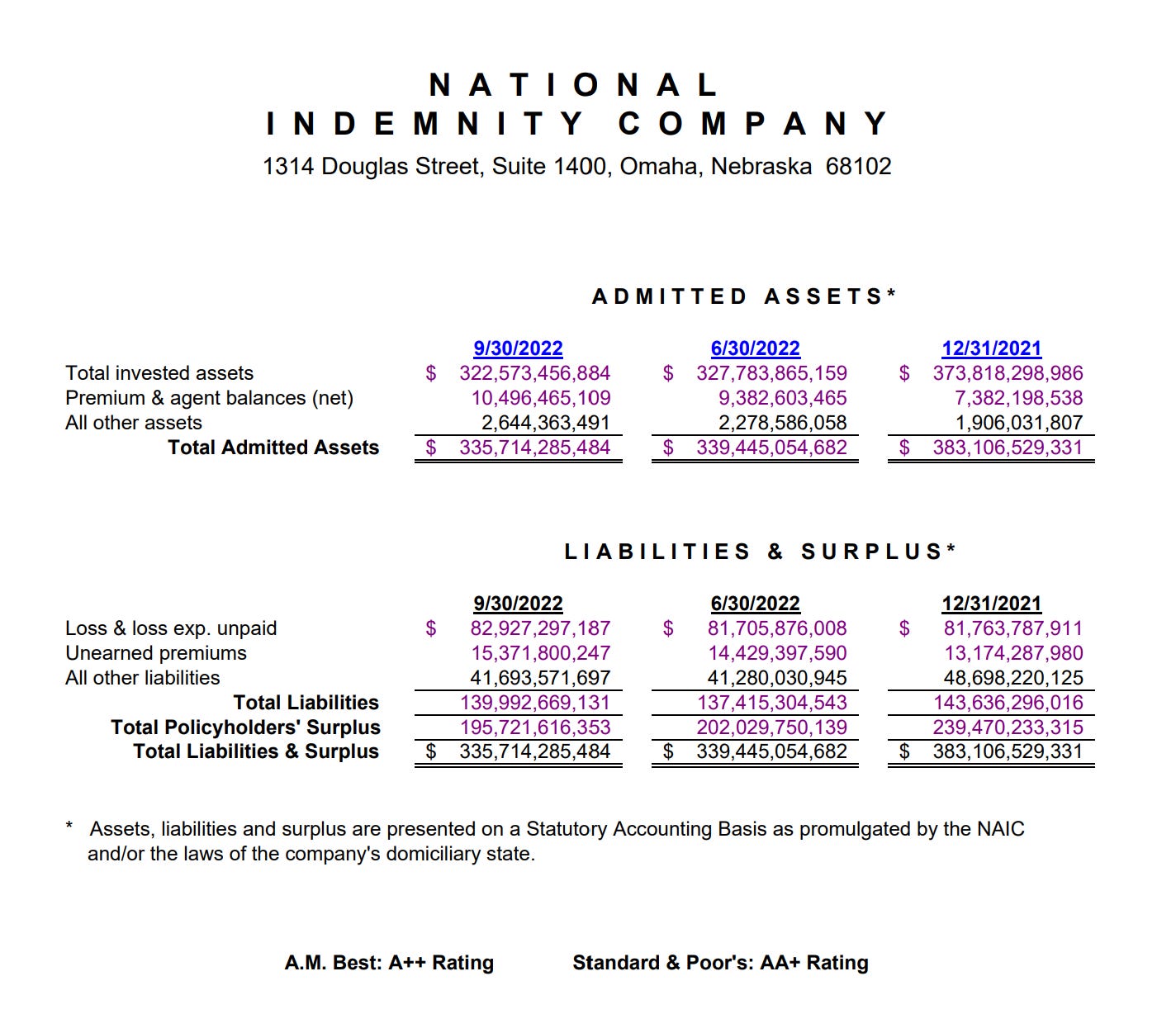

How large is NICO? Well their one-page account is reproduced below. This is all the detail that gets released from NICO. Its operations get bundled in with all the other insruance businesses at Berkshire. But it is very large part of the business, with USD335bn of assets, and nearly USD200bn of policyholder surplus (which I read as equity).

Now typically the insurance business is very conservatively managed. Most large insurers keep the majority of their assets in fixed income. The reasons tend to be obvious, but when things are going wrong, they can access cash easily, and no risk of investment losses. However, Berkshire has always invested in equities, and avoided bonds. You can see that clearly when you compare Berkshire to other reinsurers. If we look at the world’s largest reinsurers, by reinsurance premiums, we can see the Berkshire is 6th largest. But by shareholder funds, it 10 times larger than anyone else.

Another difference difference between specialist reinsurers like Munich Re and Berkshire is that Munich Re pays a large dividend to its shareholders. That is, gains from underwriting are paid out to shareholders. To grow, Munich Re needs to write more insurance. Berkshire on the other hand, does not pay out dividends, and just needs its portfolio to grow. In essence, the reinsurance model allows Berkshire to be invested in equities with permanent capital, no need to pay tax on either capital gains or dividends, and if insurance pricing is good continually grow its available capital. This sounds so good, why have other fund managers not tried to replicate the model? They have. Greenlight Capital have a listed reinsurance company. Performance has been poor. There are many other firms that have asset management led reinsurance firms, but none the size of Berkshire. My best guess is insurance is hard, and new entrants tend to end up with the worst insurance clients.

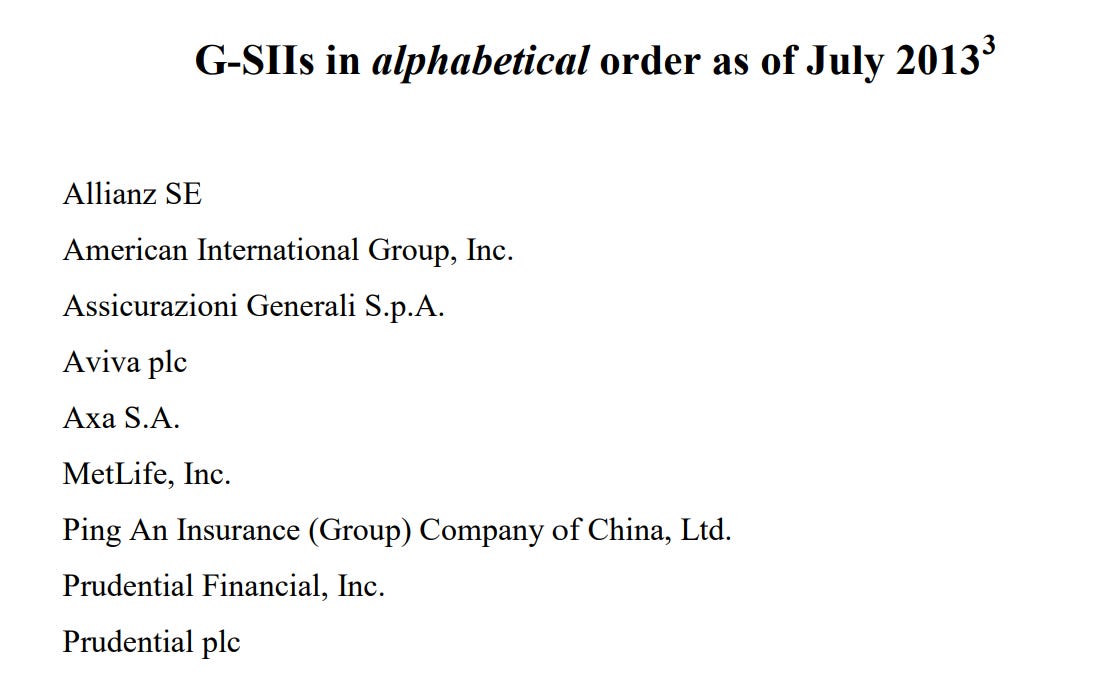

The one odd thing about reinsurance business is that it seemed to escape almost all regulatory attention after the GFC. For a while nine large insurers were nominated at Globally Systemically Important Insurers (G-SII), but none of them were reinsurers. I don’t really follow the logic of how insurers can be systemically important, but reinsurance can’t be. Perhaps one of my readers can enlighten me.

As I mentioned, the whole business is built around the idea that equities outperforms bonds in the long run. When that did not happen, in 2008 (see the chart above) - Berkshire CDS blew out.

So if you want to be the “next Warren Buffett” you need three things - be great investors, have a great business structure, and somehow convince regulators to allow you to invest insurance assets completely differently to all your competitors. A tough ask in my view, which is why no one else has come close.