I have tried shorting US healthcare stocks before. It tends to be much trickier than you would think. Theoretically, it looks attractive. The US healthcare system has always stuck out as an anomaly in the rich world. The US spends more, but seems to get less back for the money it spends. Finding graphs like the ones below, are pretty easy. The implication is that as countries spend more on healthcare, people should live longer, but this relationship was breaking down even before Covid. Recent data has shown life expectancy falling in the US. In other words, US healthcare companies overcharge, and are at risk from cheaper competitors, or political changes.

The first problem is that the US freely acknowledges that it allows the free market to price drugs. Th view then is that the US allows drugs companies to price drugs correctly, which gives them the incentive to invest correctly. And the evidence for this is that US pharmaceutical R&D spend is more than the rest of the world combined. The extension of this analysis is that the rest of world is freeriding on American research.

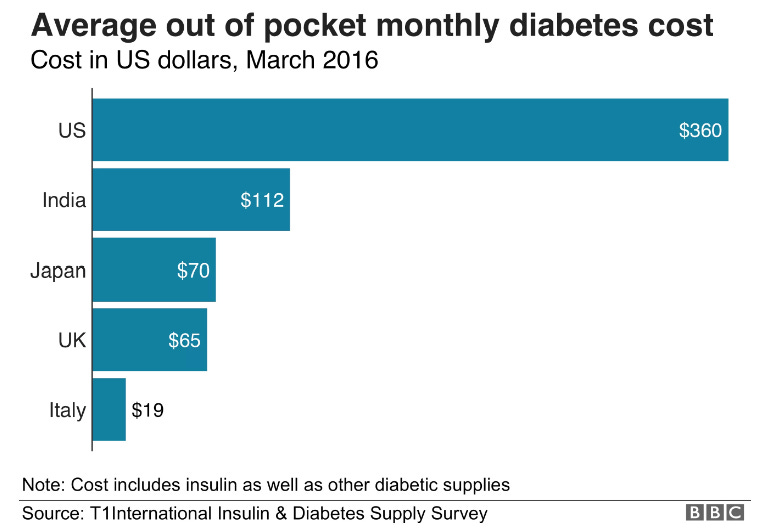

The other way to look at this is that US drug companies are price gouging. Insulin, which diabetics need to stay alive, is much more expensive in the US than elsewhere. Is this higher cost justified is a tough question. The US healthcare system is not only profit maximising, it is also designed to keep people working. The insurance companies often pay a huge discount list prices, making it vital for most Americans to have health insurance.

That’s the pro and cons of US healthcare stocks. The first would suggest that they are buy and hold stocks forever, the second that you should exercise extreme caution. If that is the theory, what happens in practice?