Short selling is best avoided by every investor. One of the reasons I stopped managing money was not because I could not make short selling work, but I had one of my best short selling ideas come purely from politics - namely Chinese tech companies (rename Sino Stocks in the title as I feel like a bit of alliteration today). As I pointed out in my “Why I Stopped Short Selling” post of November 2022, my last great short selling trade was Chinese tech stocks. To quickly recap, I was reading Bloomberg, when an article flashed up that the Chinese regulator had asked domestic tech companies in for a meeting. This sounded bad to me, so after an hour search on the internet, I was able to find which companies had been called in - a screenshot is below.

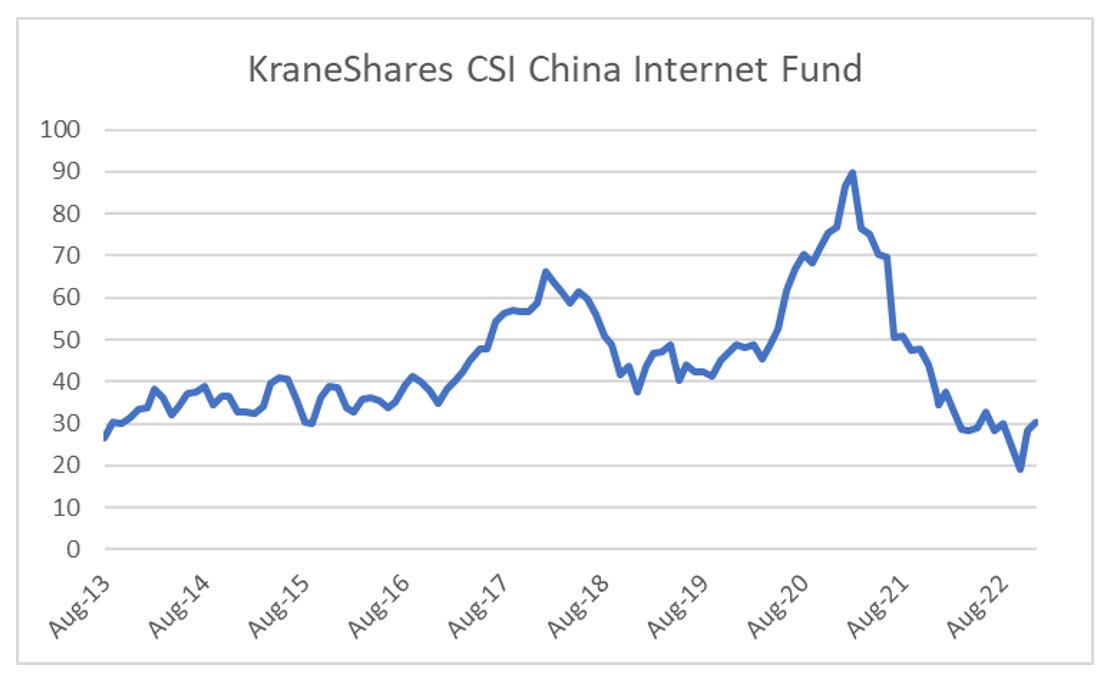

For American investors, this was pretty much the entire make up of the KraneShares CSI China Internet Fund (KWEB US). As with any really good short - they halved from 90 to 46, and then promptly halved again. 82% peak to trough fall.

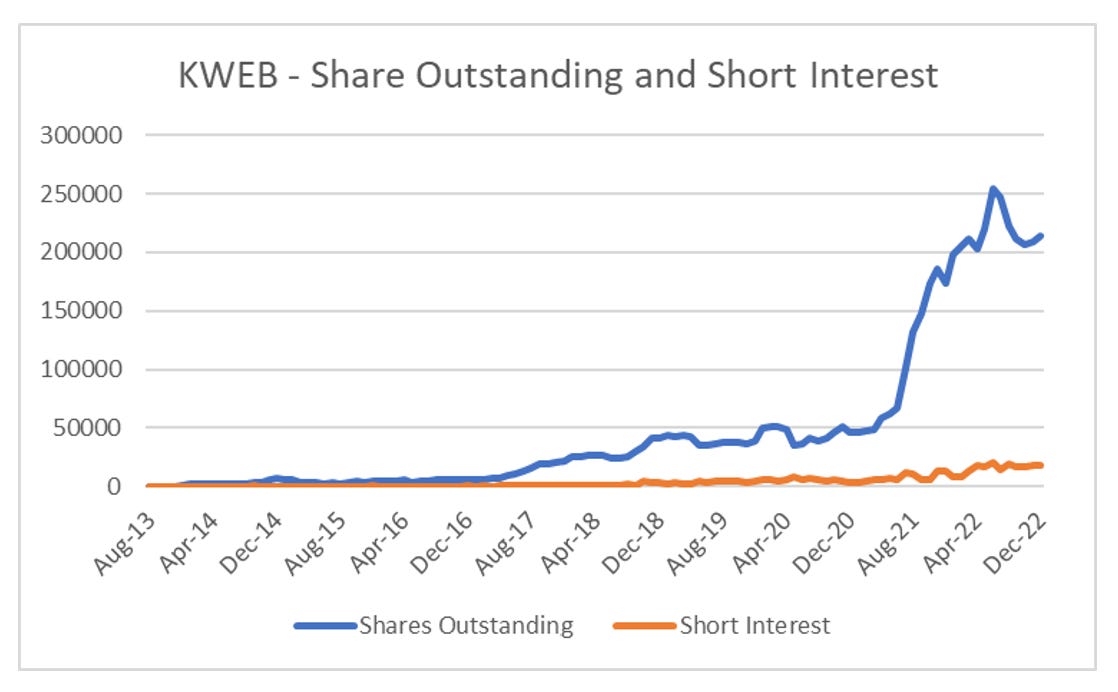

KWEB has been a fantastic short. In retrospect, what made it such a good short was that investors were buying the dip all the way down (falling down the slope of hope). For short sellers this should have been great, except that the rally in Chinese tech stocks over the last few months has meant that anyone who short sold KWEB in 2022 is now under water. If we look at fund flow into KWEB, we can see that as it first started to fall in 2021, investors aggressively bought the dip. And when the ETF started to fall again in 2022, short sellers added to positions. This makes KWEB one of those very special ETFs where neither short sellers or long buyers of the ETF have made any money.

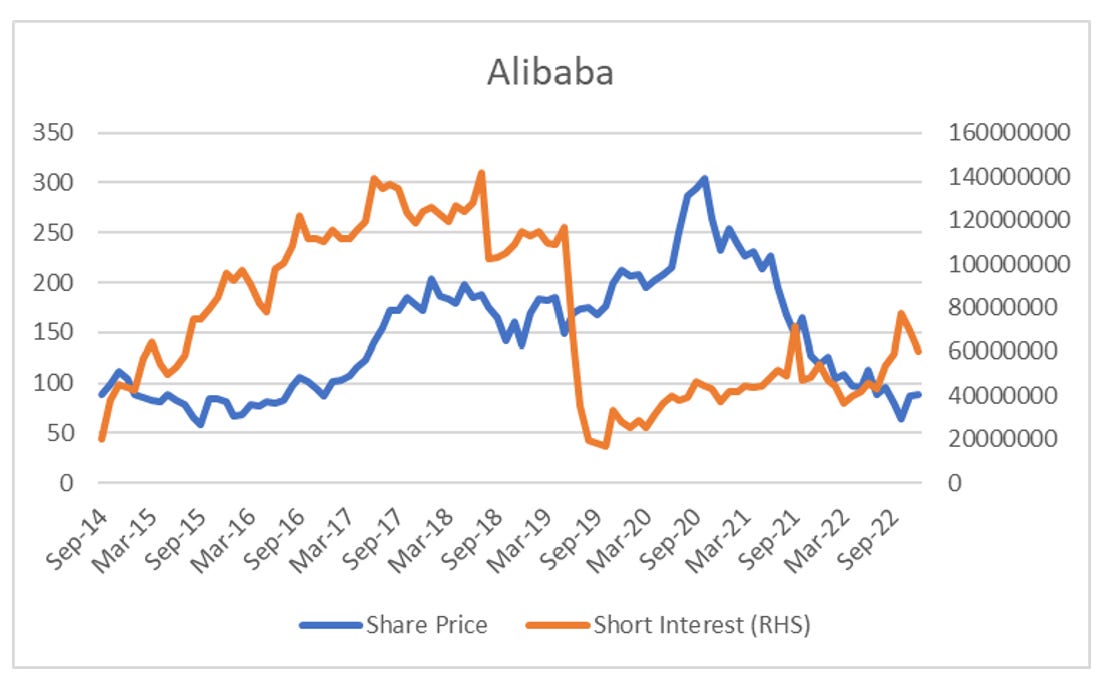

Perhaps a better illustration of the how short selling sucks in the experience of short sellers in Alibaba. When it was first listed, it was common for the short and distort community of short sellers to claim that Alibaba was faking its numbers. Short interest in Alibaba remained elevated even as the stock even as more than doubled in 2017, inflicting significant losses. In 2019, for reasons that escape me short interest collapse, and remained at low levels until 2022, when short interest double just before the stock doubled again.

The problem with Alibaba for short sellers, and one I understood when I closed the position after it had fallen 50%, is how do I know that the Chinese government changes its mind, and decides that it actually needs Jack Ma? Alibaba has doubled from the lows, and is up 26% this year, and today we see news that Jack Ma has potentially come to a deal with the Chinese government. Maybe there are some short sellers out there who believe they have inside knowledge on the political machinations of the CCP, but I doubt it. I guess the point of this post is to show that successful short selling tends to work when you are all alone. Crowded and popular shorts is where short sellers goes to die - which is why I always endeavour to recommend shorts that are unusual and unshorted. Good luck out there.

Share this post