Equity markets have been very strong, with the S&P 500 down only 9% this year, and the Nikkei actually up for the year. Europe is also only down 12% this year, despite all its problems. The proximate cause of this rally is the fall in the oil price, which has fallen from a peak of USD 124 to USD 87 (WTI) a barrel today. This seem slightly odd when you look at US natural gas prices, which are at the highest levels since 2008.

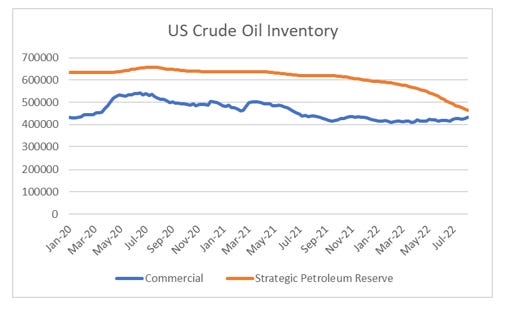

What is even more odd about a rally in equities driven by falling oil price, is that is has happened during a period of extraordinary collapse in crude oil inventory at the US government controlled Strategic Petroleum Reserve.

The other way to look at the market rally, is that is has coincided with a rally in high yield bonds. The KDP high yield daily peaked at 7.76% on 30th of June, and has rallied to 6.34%. If you look at the KDP Daily, buying equities when the KDP peaks has been a massively winning strategy. However, unlike previous peaks, I am not sure the US 5 Year Treasury yield has really peaked.