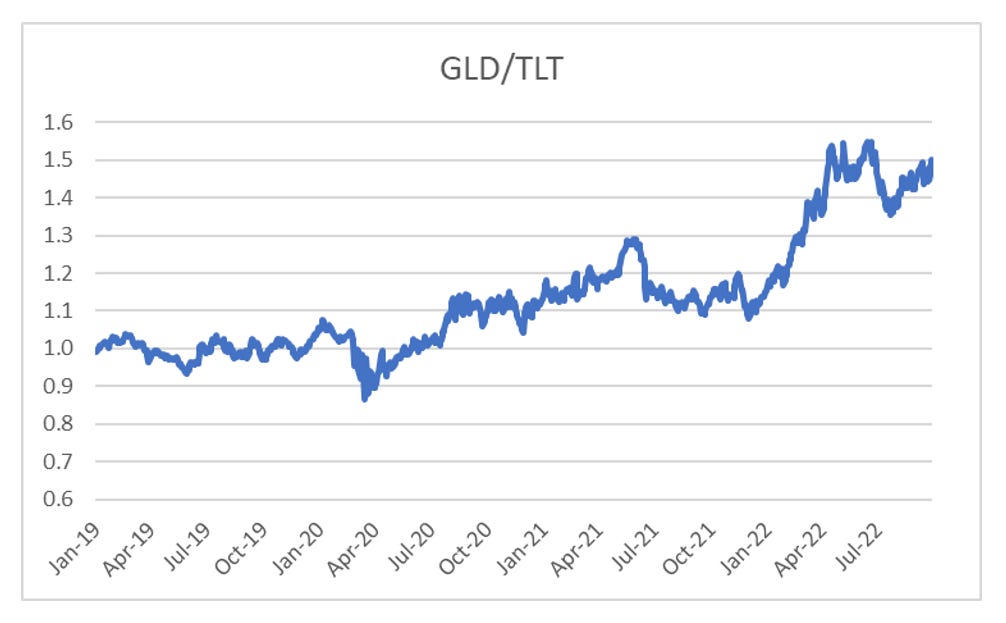

I do believe that we are now well into a political transition away from capital to favour labour. The last time we saw such a transition was after World War II, and the trade that seemed to work best was long gold/short bonds. A long term chart is below.

One of the supporting arguments for this theory was that food inflation would provide the impetus for political change. That is if food prices rise, then governments will be forced to act. This has played out in markets, but in a way that I did not expect. US food CPI has surged, and has a very 1970s feel about it. While Japanese food CPI has remained somnolent. So the Federal Reserve has been aggressive in monetary policy, while the BOJ remains keen on negative interest rates.

In case you have been in a cave this year, this has caused the Yen to crash against the dollar. On a BIS Real Effective Exchange Rate basis, the Yen was only cheaper in the early 1970s, when the Yen/USD exchange rate was 350 to the dollar, rather than 145 it is today.

What is odd is that when we look at strong dollar environments such as 1982, 2000 (peaks in the blue line above), bonds have been much better than gold. In fact, you would be suffering losses on both sides of the trade. This time, so far, bonds have been as poor as gold.

However, long gold short bonds in other major market has been and remains a great trade in almost all other major currencies (unhedged). Being long gold versus JGBs has been a wonder trade since Covid.

The question then, is why have commodities sold off, and bonds also been weak? I suspect the answer is China, which unlike the rest of the world has been engaging in lockdowns. This has led commodity demand to be weaker than expected. Commodities have to price immediate supply and demand, while long dated bonds have to take a view on inflation over the life of the bond.

We recently saw President Xi make his first overseas visit since Covid. Does this signal some potential softening in Covid policy going forward? Such a policy change would be very inflationary, if we look at the response other economies of ending lockdowns. Even more intriguing for me is that Chinese pork prices have surged again recently, which makes me think another surge in food inflation is coming (see food inflation posts for more info).

So I will stick with long gold versus short bond trade. It is working in Japanese Yen, Euros and Pounds. And if the dollar starts falling, it will surely work in USD as well.