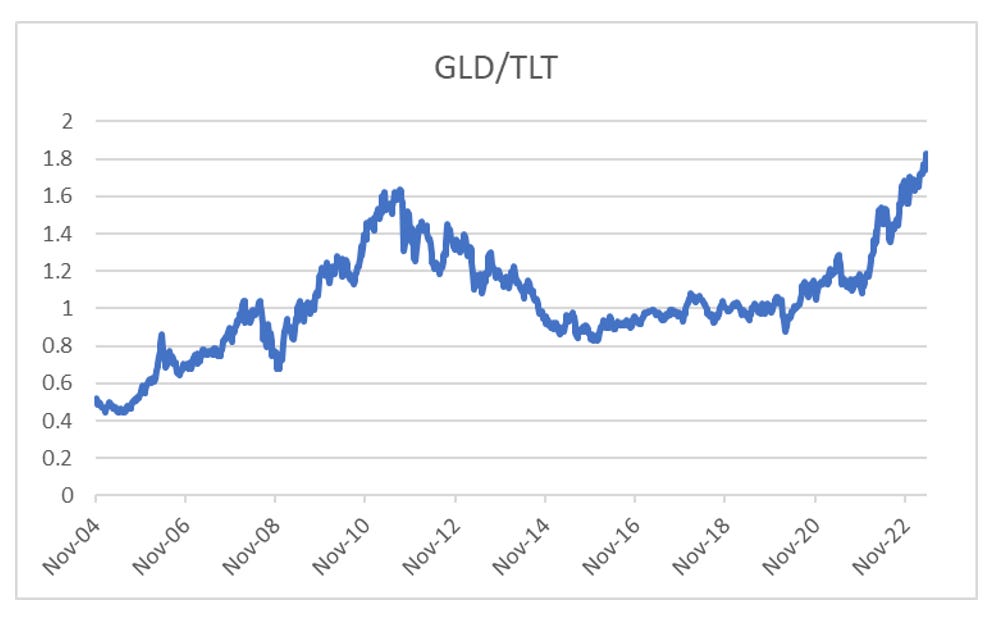

Ideas are easy, execution is hard. The idea of a shift pro-labour from pro-capital is actually very easy to understand. Pro-capital policies have become unpopular, and the road to electoral success is now paved with pro-labour policies. Looking at minimum wages to the S&P 500 or house price to income ratios, it is very easy to see either wages rising substantially. My view on how this happens, is that as wages rise, consumption surprises to the upside. Poor people, by definition, tend to spend rather than save so as you give them more money, the multiplier effect is much larger than the “wealth” effect. This creates inflation, and central banks raise rates, which puts pressure on asset prices. The simplest expression of this is long gold, short treasuries (GLD/TLT) which has continued to trade very well.

Running with this logic a bit further, the policy should be aiming to reduce income inequality, and favour small caps of large caps for example.