I first went to Japan in 1991 as a 17 year old high school exchange student. I went on to do a degree in Asian Studies (and Economics), and a university exchange to Japan in 1994. When I start working in finance in 2000, one of the things that struck me was how different the Japanese experience was to elsewhere. We were taught that equities always outperform bonds, that large fiscal deficits would imply a weak currency, and inflation was inevitable part of life. When I pointed out that this did not hold in Japan, I was usually told to either shut up, or that Japan was special, so could be ignored. This always struck me as a odd way to do treat the second largest economy in the world, and the largest holder of foreign exchange reserves. For long time readers, you should be aware of my “Japan as the Saudi Arabia of savings” theory, which explained Japanese experience from 1994 up to 2016 very well, but not so well since. I have been contemplating a different way of thinking about Japan.

To follow this analysis, you are going to have to accept a few basic assumptions. First of all is that the US has a very high level of influence on Japanese policy making. This leads to unusually close relationship both economically and politically. One of the distinct features of this is that not only is Japan the largest owners of treasuries, almost uniquely, it ONLY holds US Treasuries as foreign reserves.

This is very different to everywhere else in the world, even countries with very similar economic and political arrangements, like South Korea.

The point of this is to show that Japanese policymakers hew very closely to US policy. With this observation, perhaps we can look at the Japanese economic experience of the last 40 year or so through an American political lens and see if it makes sense. One of the first economic problems that the US faced after World War II was that the US economy was increasingly uncompetitive against its European and Japanese peers. The most visible sign of this was the falling gold reserves of the US.

It is very easy to see the Japanese agreeing a deal to allow the Yen to appreciate, and to go along with the idea of holding treasuries instead of gold as foreign reserves. This led to the first mega trade with Japan - long yen from 1970 to 1990. Since 1990, it has been a wash trade.

In 1980, Ronald Reagan came to power, and we saw politics in the US shift to pro-capital away from pro-labour. One of the key tenets of pro-capital policies is the freedom to buy from wherever is cheapest, with no regard of any political cost. That is, if Japan was cheaper at making cars, then why not buy Japanese cars, for example, but broadly speaking the ideals were of freedom and efficiency were pursued.

Allowing Japanese car makers to compete rigorously with US auto makers also had a secondary benefit. US union power was disproportionally strong in auto makers. By opening up this sector to foreign competition, it should help reduce the power and influence of the unions in the private sector. That is Japan was used as the hammer to break US union power. That is to reduce the political power of pro-labour proponents.

The boom in Japanese manufacturing also led Japan to overtake the US semiconductor industry in the 1980s. As late as 2010, Japan was still a similar size to the US.

As Japanese semiconductor market is dominated by Japanese semiconductor makers, this meant in the late 1980s, Japan producers also had the largest market share. And this is where Japanese problems began. If Japan maintained its technological lead over the US, it would likely face increasing political pressure from the US. It would need to either succumb, or return to the disastrous policies of the 1930s and begin to compete with the US.

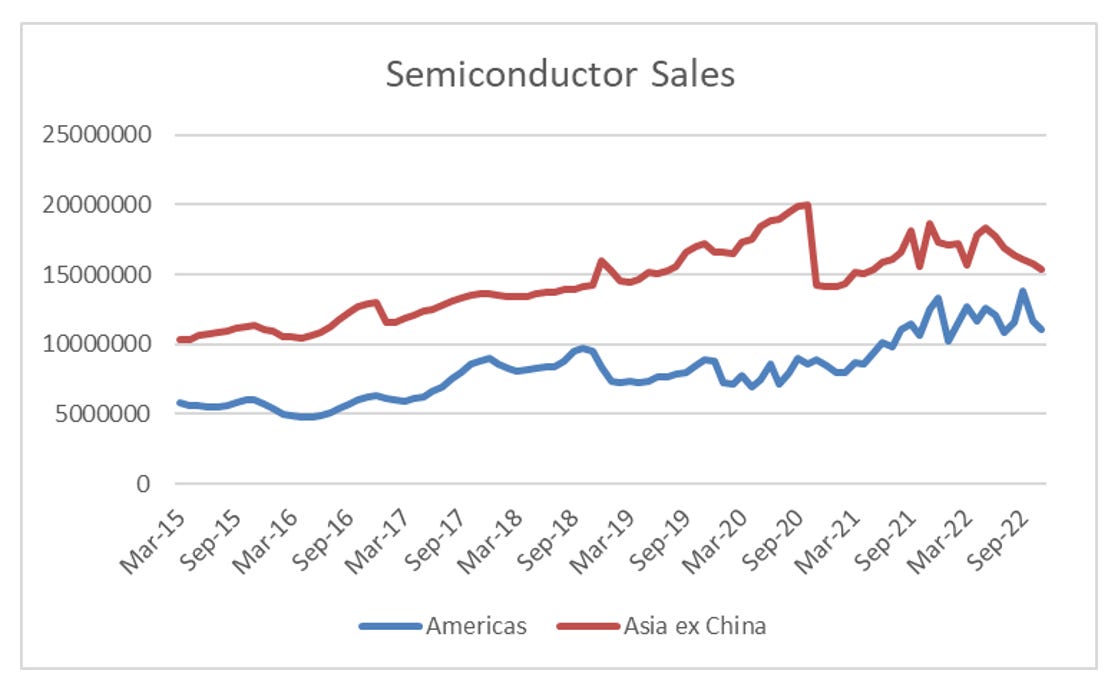

Asian sales ex-China has been larger than the US for many years, although US companies have much larger market share outside of Japan, which is probably why even though Asia ex China sales are larger than the US, US market share from above totals more than Japan, Korea and Taiwan combined. It should be remembered that not only are Korea and Taiwan strong military allies of the US, both are former colonies of Japan, and Japanese engineers were instrumental in the setting up of their semiconductor industries. It should be pointed out that neither Korea or Taiwan have an equivalent to Tokyo Electron (semiconductor equipment maker).

In essence, in late 1980s Japan was beginning to look like a strategic competitor to the US, and choose stagnation, and a peaceful life, rather than rupture with the US. I think this makes sense to me. Turning Japan from a strategic competitor back into a natural ally of the US is good statecraft, and given the disaster that World War II was for Japan, an understandable decision. Using this line of thought, Abenomics did indeed mark a political change in Japan, away from managed decline to something else. Where exactly, will be subject of another post.