Two separate subscribers sent me a copy of an interview Russell Napier did with themarket.ch (Russell Napier: The world will experience a capex boom). It is not paywalled so should be easy to find. To paraphrase Russell One (R1) (left-hand side in above photo - I am on the right-hand side - yes, recent photo), that we had a big government period from 1939 to 1979, where government controlled everything, and we had inflation and financial repression to get debt to GDP down to manageable levels. Once this was achieved, this gave governments the financial freedom to embark on free market policies. Now that debt levels have rebuilt to high levels, we are now embarking on a period of high inflation and high nominal GDP growth, driven by reshoring, and the green energy transition, credit guarantees and so forth. The nice thing about this analysis is that it gives you clear political bookmarks (at least in the UK), with the surprise election of Clement Atlee in 1945 (beating war hero Churchill) marking a political shift to the left, and the election of Margaret Thatcher in 1979 marking the shift back to the right.

When I first started thinking about a shift back to the political left, and what this meant for financial markets my line of thinking was very similar to R1. But then I realised there were some big problems with this line of thinking. One assumption is that once debt levels get too high, governments will shift to inflationary policies. The problem with that analysis is that Japanese debt to GDP ratio has been very high for very long time, and still has some of the lowest inflation levels in the world. The idea that once some level of debt to GDP, say 100%, is breached causes a shift in government policy would have made you expect strong Japanese inflation since 1995. That has been very wrong indeed.

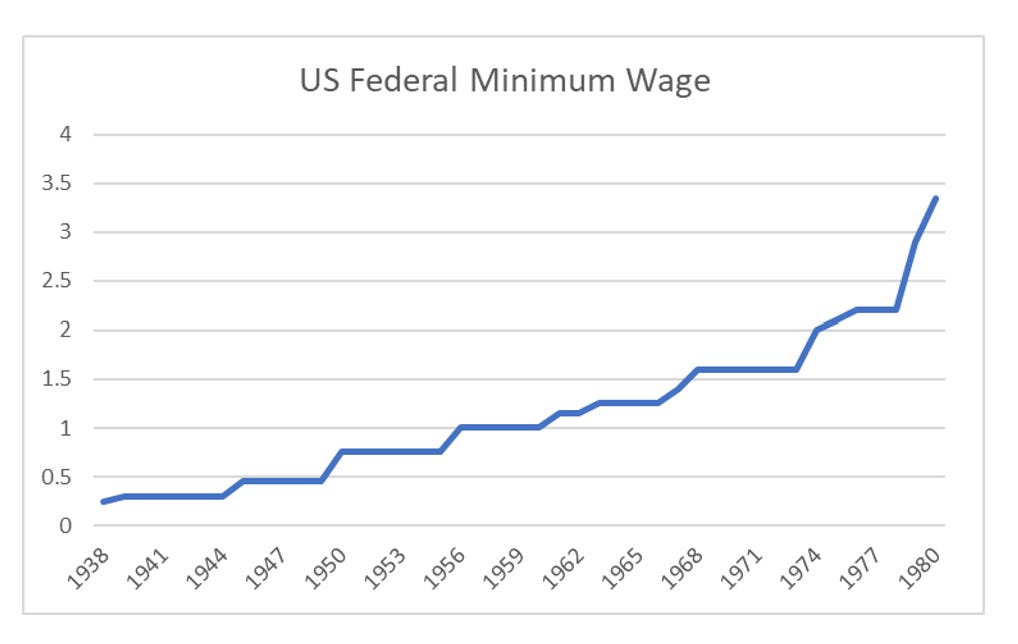

Is there some way we can square this circle? If we add a layer of political analysis, we can solve the Japanese conundrum, and also tease out a much subtler and important relationship. The Great Depression in the 1930s destroyed the political support of free market capitalism, and voters wanted something different. They voted in FDR in 1932, a good 7 years before R1 dates the start of the leftward shift, and 13 years before the election of Clement Atlee. FDR tried many different policies, but for me FDR finally produced a growth policy that was focused on wage led growth. The signature policy was the introduction of a minimum wage, that was rapidly increased.

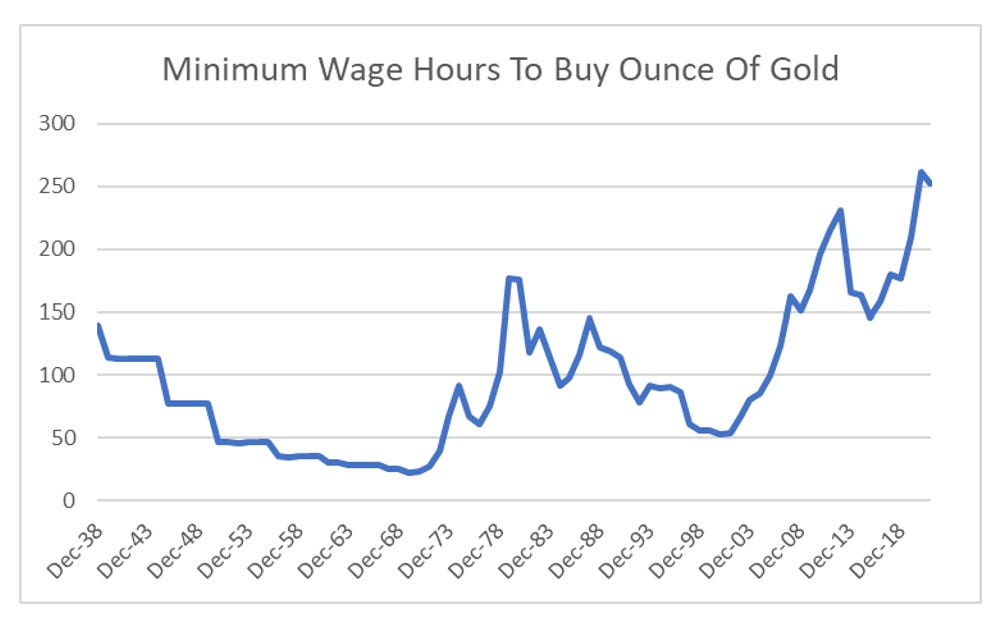

That is government policy was focused on full employment and rising wages. For corporates this provided growth, as they knew wage earners would be earning more every year. The interesting part of growing “real wages” is that a government will then want to keep the value of the currency strong so that the wage increases were “real”. FDR onwards saw minimum wages rises in gold terms. Until we got to Nixon. Nixon leaving the gold standard was in fact a pro capital policy, as it caused real wages to fall. This then dates the beginning of the pro capital shift back to 1971. It is no surprise that in 2022, minimum wage is at all-time lows in gold terms.

So how does this solve the Japanese conundrum of low inflation? In Europe and the United States, populist politicians have been making huge strides and forcing the debate for change for years. The free-market Conservatives were forced to change by UKIP, the Republicans by Donald Trump, and Europe by a whole range of politicians. In Asia pro-labour politicians include Xi in China and even South Korea has seen former President Moon force through substantial increases in the minimum wage. But who is the Japanese Donald Trump? Has the Japanese political opposition made any triumphant wins lately? Japan almost uniquely is still following the pro-capital policies, of weak currency, falling real wages and promoting the interests of corporates over workers. Without rising real wages, how can Japan ever have meaningful inflation? Also understanding the shift in policy in the rest of the world also suddenly explains why the Yen is now breaking down to 30-year lows. Japan has wanted a weak currency ever since the bubble economy burst in 1990, but failed for many years. Suddenly yen is falling (collapsing) because everyone else has moved away from weak currency (pro capital policies) to strong currencies (pro-labour policies)!

R1 predicts a capex boom. I am not sure about that but it’s probably correct, but I do predict a wage boom, with growth being very strong in the west as real wages start rising quickly. Like R1, I also think bonds and most financial assets do badly, certainly in real terms.

This analysis suggests gold prices have already prices in strong wage growth. Assuming a flat gold price, and a return to the ratio we saw in 2000, would imply a minimum wage in the US of 33 USD, or if we have the ratio, we saw in 1969, 55 USD an hour (from 7.25 today)

One surprisingly prediction this line of thinking produces is that unless Japan reverses its weak yen policy, countries will start talking about placing tariffs on Japanese imports. Why should you allow another country to put downward pressure on your country’s workers? It’s the sort of bold and beautiful prediction that I like - and very subtly different. R1 thinks debt drive political change - I (R2) think voters drive political change. And voters are tired of pro-capital policies.